The Indian stock market is about to bid adieu to 2023 on a cheerful note after climbing walls of worries. Albeit the positive undertone, markets are seldom a one-way street, and 2024 is set to be another volatile year, marked by several important events like elections in India and the US, likely reversal of monetary stance by central banks, slowdown in China and continuation of geopolitical tensions.

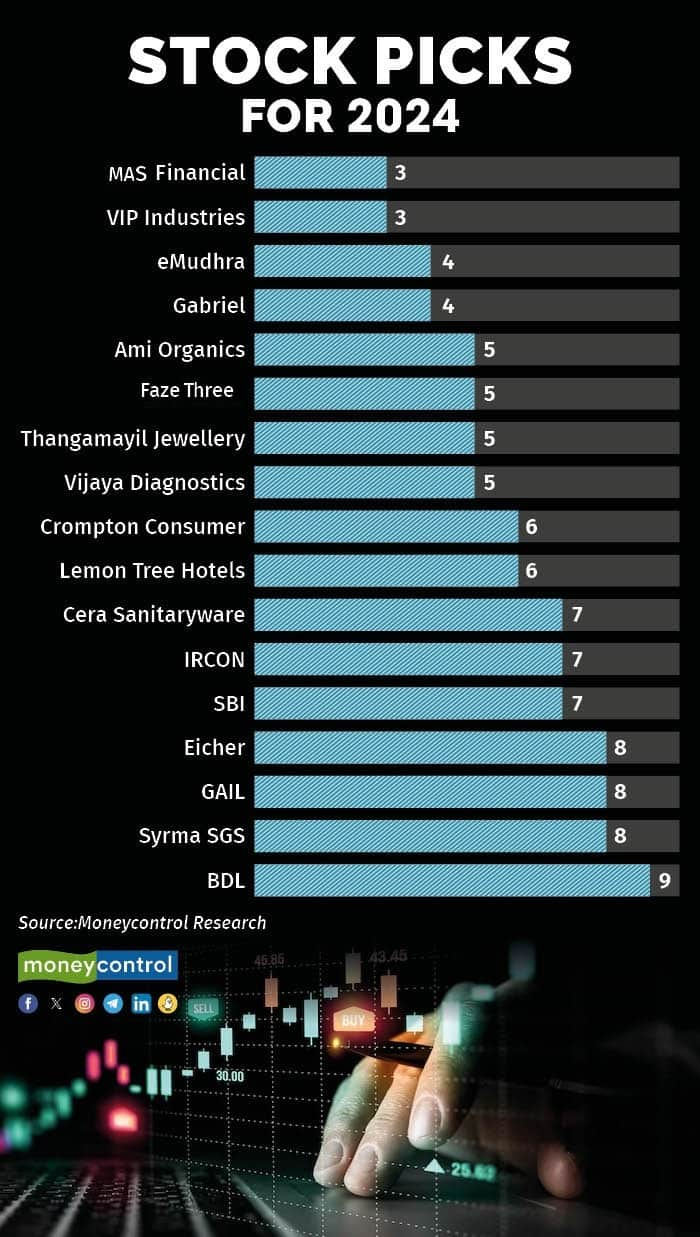

Here’s a 17-stock portfolio that can turn out to be profitable in 2024. Wishing all our readers a very Happy New Year and a rewarding year of investing with MC Pro.

The following are the 17 stocks with the weights (table at the end) that ought to find a place in your portfolio.

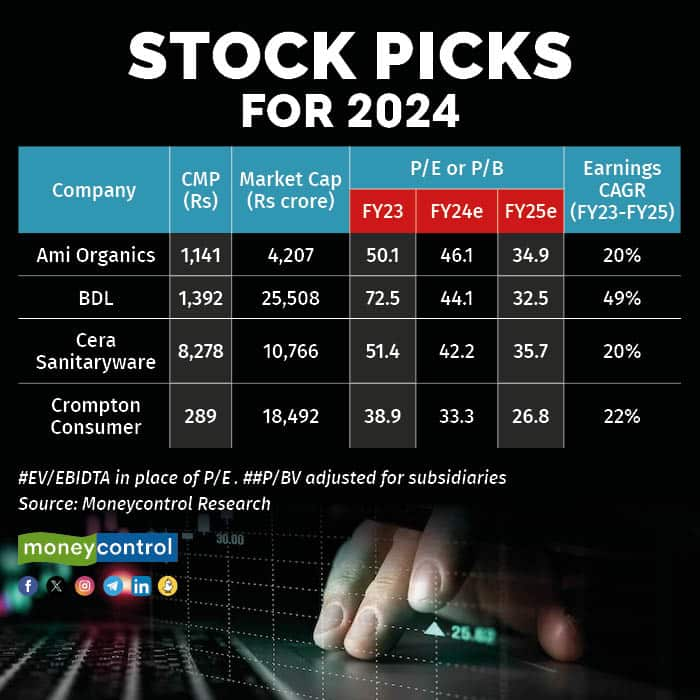

Ami Organics, a fast-growing pharma intermediates company, benefits from the China and Europe-plus trends. The near-term triggers include the start of the CDMO (contract development and manufacturing organisation) project for Fermion as the new capacity at Ankleshwar gets ready. A foray into the electrolyte additive business used for lithium-ion batteries and photo-resistant chemicals (through subsidiary), which have applications in the semiconductor industry, can be key earnings catalysts.

Also Read | Crystal ball gazing: The winning investment themes for 2024

Bharat Dynamics, a defence PSU, is benefitting from the government’s missile programmes. The company is sitting on an order book of close to Rs 20,000 crore – about 8 times its revenue. The company’s execution is going to be better and it has guided close to 28 percent growth in revenue for fiscal 2024, which will keep its stock in the limelight.

Cera Sanitaryware, a leader in sanitaryware and faucets, is a prime beneficiary of an upswing in the real-estate market and secular home improvement trends.

The recent capacity augmentation in faucetware and greenfield facility for sanitaryware create headroom for market share gains. Cera has set a revenue target of Rs 2,900-3,000 crore for the next three years -- nearly 1.5 times its current revenue run rate.

Crompton Consumer, a dominant player in the consumer durables industry, currently trades at reasonable valuations of 27x FY25 estimated earnings. The company is undergoing a transition, and earnings could surprise on the upside in 2024, thanks to a realignment of business strategy (following the appointment of a new CEO), deleveraging of balance sheet, integration benefits and synergies from the Butterfly Gandhimathi acquisition and a revival in retail consumption.

Eicher Motors is a pure play on the structural change towards premium motorbikes. A leadership position in >125cc bikes, strong demand for premium bikes, a slew of launches, and a healthy order book, coupled with strong traction in the international markets, make this company a must in the portfolio.

eMudhra is a technology solution provider, benefiting from the secular growth in digitisation and cybersecurity in India and abroad. The addressable market is growing at 20-25 percent plus CAGR and it maintains an EBITDA (earnings before interest, tax, depreciation and amortisation) margin of 30 percent. The company is currently trading at a reasonable valuation despite being the only player offering a variety of solutions in trust services and cybersecurity and a solid earnings trajectory.

Faze Three is a play on the China-plus-one theme. The company manufactures technical and home textile products, with direct exports to large retailers in the US, the UK and European region. It has completed a large capex and another capex comletion is expected by June 2024. Higher capacity utilisation, operating leverage, cash flows, and zero long-term debts should support higher earnings growth.

A significant recovery in two-wheeler demand, entry into the premium car component through sunroof and easing of raw material prices make the auto component player, Gabriel, a good bet. A strong order book, focus on electric vehicles and foray into premium component segment can act as growth catalysts for the company.

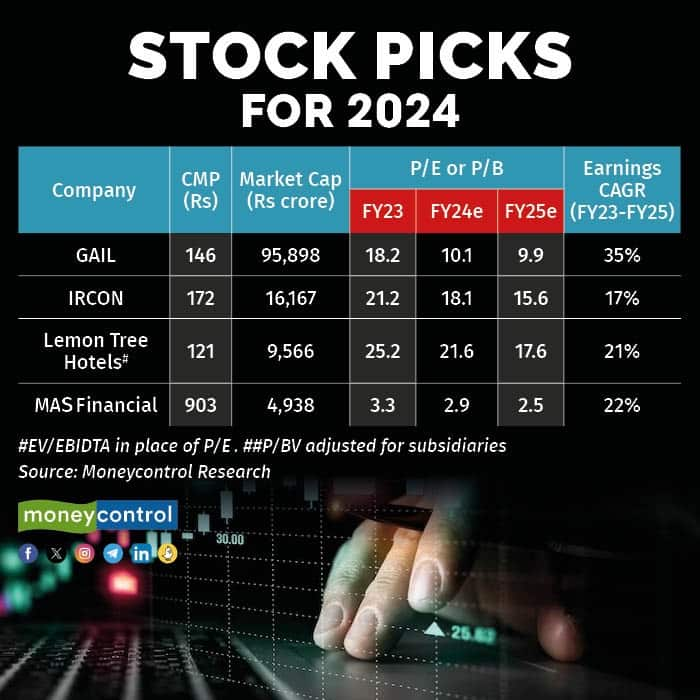

The macro-environment for the gas sector has been improving with government policy support and rising gas consumption. GAIL is best placed among gas companies. With its indispensable position in the Indian gas grid, we expect GAIL to see a 35 percent earnings growth in the next two years, and the current valuation is yet to reflect the same.

On the back of a strong order book and orders pipeline, IRCON International should continue to deliver higher returns. Higher execution, improved earnings visibility, stability in margins and valuations rerating should offer an upside in 2024. The management expects a 10-15 percent growth, going ahead.

Lemon Tree Hotels, a leading hotelier in the mid-market segment, is expected to be a key beneficiary of the industry upcycle over the next few years. Lemon Tree has industry leading expansion plans via the asset-light management contract route. With the recent opening of an owned Mumbai property, Lemon Tree’s capex cycle is over and the company would reduce its debt, leading to a re-rating of valuation multiples.

MAS Financial, a Gujarat-based NBFC, lending mainly for livelihood activities at the bottom-of-the-pyramid, has a consistent track record of growth without compromising on asset quality. It is diversifying into consumption loans and sees affordable housing as a future growth driver. With a large opportunity size, a 20 percent plus growth with a handsome RoA (return on assets) of close to 3 percent isn’t a challenge.

SBI continues to hold the fort at a time when public sector banks are losing market share to private peers. In the last quarter (Q2FY24), SBI posted strong quarterly profit with RoA above 1 percent. The bank is a key beneficiary of buoyant economic conditions and a healthy credit demand. Given its leading market share, improved return ratios, favourable asset quality cycle and sector tailwinds, SBI should command a better valuation.

Syrma SGS is a key beneficiary of the Indian EMS (electronics manufacturing services) story with its well-diversified business model and high growth. A strong order book, presence across key industries and PLI (production-linked incentive) scheme approvals attest to its potential as a winner. As the EMS sector growth accelerates, revenue growth and margin improvement should come for Syrma though client wallet share gain as well as new opportunities such as lucrative IT hardware manufacturing.

Thangamayil Jewellery: This regional jewellery player is set to strengthen its presence in the largest jewellery market of India -- Tamil Nadu -- by not only expanding to Tier 2 and 3 cities but also entering bigger cities. Hallmarking regulations would further aid market share gains. Margin improvement, owing to increased share of non-gold jewellery and operating leverage, would also drive earnings growth.

.

.

Vijaya Diagnostics commands a leadership position in south India and its radiology offering remains a key benefactor.

The market dynamics are turning favourable as test volumes continue to see a gradual uptick and the pricing environment appears to be holding up, in an otherwise competitive industry. The company’s plan to replicate similar brand positioning in the new market of West Bengal places it on a concrete growth path in the coming years.

VIP Industries has been going through a rough patch with leadership changes and steady loss in market share. However, it has created a formidable manufacturing capacity that structurally stands to support margin. The promoters are open to monetising, and the current market cap is lower than its smaller competitor, thereby protecting the downside in the stock.

For more research articles, visit our Moneycontrol Research page

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now