Highlights

Fermion opportunity from Q4 FY24

The CDMO contract with Fermion includes supplying multiple intermediates for the API – Darolutamide. Fermion and its parent company Orion and Bayer have the approval from various regulatory agencies for this molecule – Darolutamide, a key oncology drug for prostate cancer. Fermion manufactures the relevant API and Orion manufactures the related drug products. Under the recent agreement, Ami Organics will be manufacturing two additional advanced pharmaceutical intermediates which will be used for the manufacture of the earlier contracted advanced pharmaceutical intermediates.

In a follow-up, the company’s new pharma intermediates facility in Ankleshwar is getting commissioned in phases. A new production block got ready in Dec’23 which will be used to execute the contract with Fermion from Q4 FY24 onwards.

In addition, the Ankleshwar facility is envisaged to have 436 KL capacity -- nearly three times the existing facility in Sachin. Hence, it is expected to take care of medium-term opportunities.

Electrolyte additives business taking shape

In another recent development, the company has signed an MoU with a global client to manufacture electrolytes for battery cells. The company will also be investing about Rs 300 crore to set up a dedicated manufacturing facility in Gujarat for the electrolytes business.

The opportunity in this space is backed by a change in the supply-chain policies of the US and European countries. We believe the supply-chain shift from China is benefiting Indian companies which have the technical capability and capacity.

High-margin photo-resistant chemicals adds to the quality of earnings

Another medium- to long-term factor to be watched is the traction for the products from subsidiary Baba Fine Chemicals, as it deals with high entry-barrier products (photo-resistant chemicals), having applications in the semiconductor industry.

In the first half of FY24, net profit of Baba Fine Chemicals was Rs 14 crore, translating into a 70 percent net profit margin.

Outlook

Ami Organics is anticipated to bounce back in FY25, backed by a ramp-up in the Ankleshwar facility, a pick-up in supplies for Fermion, and a foray into the electrolyte additive business.

We maintain that as the company moves into multiple frontiers it may require growth capital other than the outlay assigned for the Ankleshwar plant (Rs 200 crore) and the initial investment in the electrolyte business. As the company’s balance sheet is strong (Debt/Equity: 0.16x), it certainly has room to raise funds for the same.

The stock appears to be coming out of the recent consolidation and trading at 23x EV/EBITDA for FY25e. We believe this valuation is reasonable, given the expectation that it will go back to the top-line CAGR trend of close to 25 percent. Overall, we see the business as a good proxy for China- and Europe-plus trends.

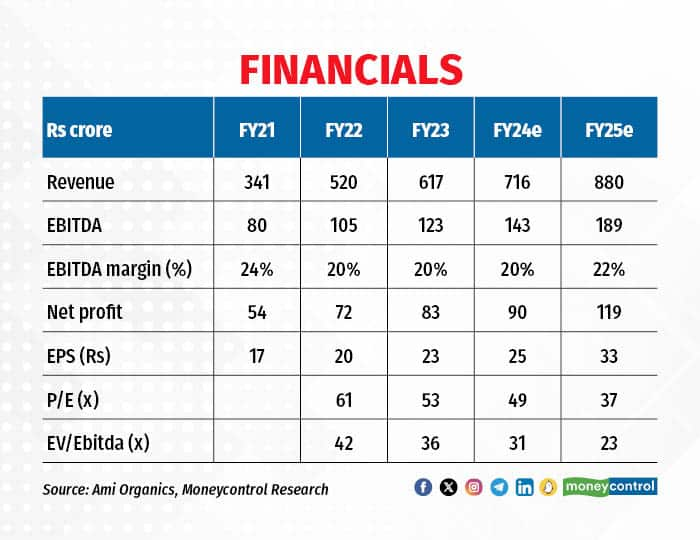

Financials

The key risk to watch is the project execution of new products and the longer-than-expected pricing pressure due to China.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now