Highlights

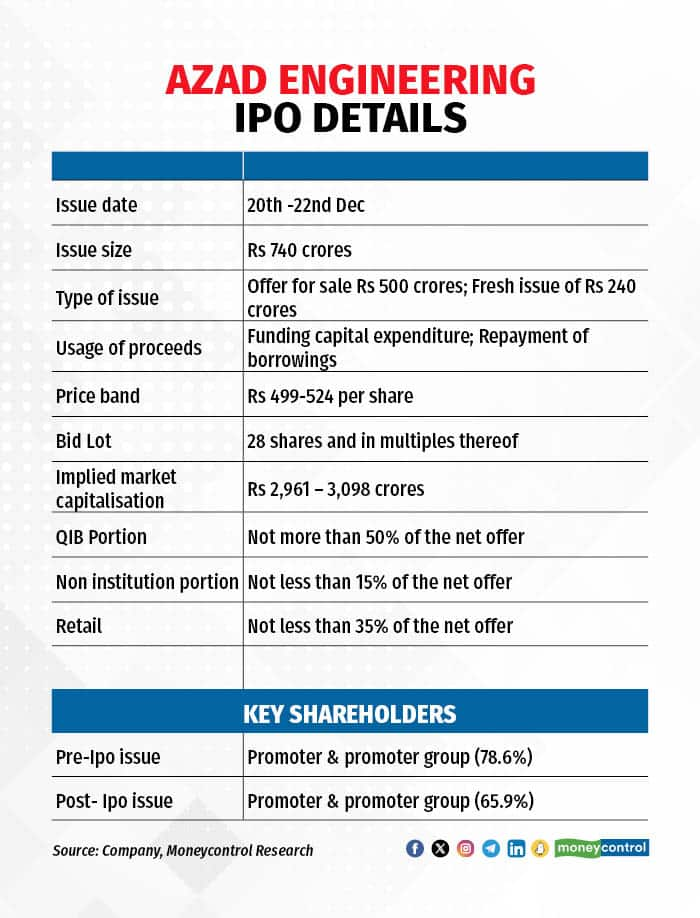

Amid this boom, Azad Engineering — a manufacturer of aerospace and turbines components — is launching its IPO on Wednesday (December 20, 2023). The total issue size is pegged at Rs 740 crore and the company is being valued at nearly Rs 3,100 crore based on the upper end of the price band.

Although the business outlook may seem promising, there are several factors that warrant attention while subscribing to this IPO.

About the business

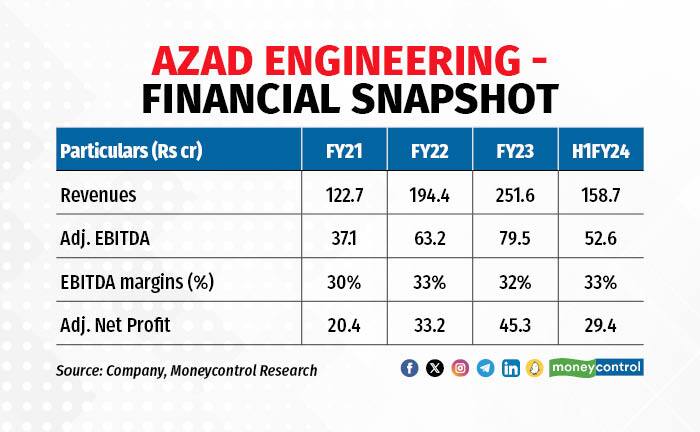

Azad Engineering specialises in the production of niche and customised products for global original equipment manufacturers (OEMs) in the energy, aerospace & defence, and oil & gas sectors. The company enjoys superior operating margins in the range of 30-33 percent as it manufactures complex and highly engineered precision components.

Within the energy turbine industry, airfoils contribute to majority of the sales for the company. As of September 30, 2023, Azad generated a revenue of Rs 114 crore from the sale of airfoils/blades for the energy industry, which comprised 72 percent of its revenue. Its aerospace and defence products are largely used in commercial and defence aircraft to provide propulsion, actuation, hydraulics, and flight control.

Capacity constraints to limit growth

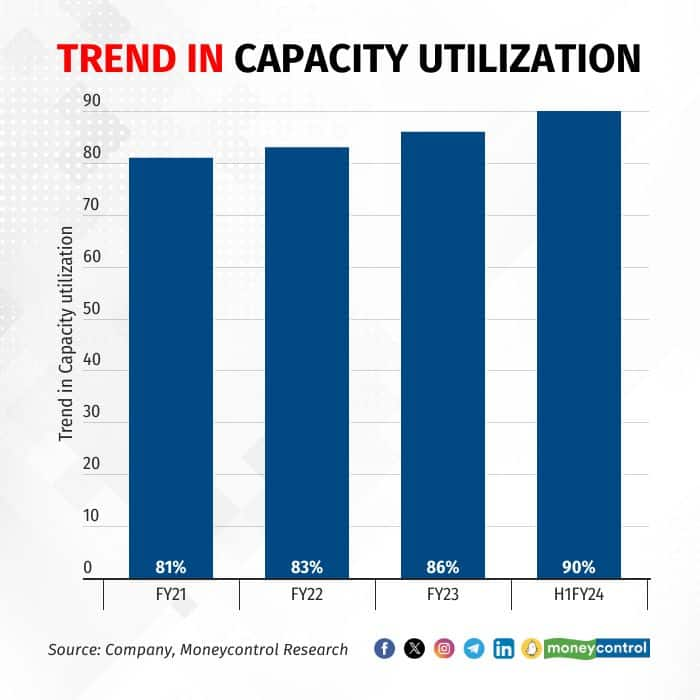

The company has four manufacturing facilities in Hyderabad (Telangana) spread across 20,000 sq. m, with a capacity utilisation of 85-90 percent across all units. The company plans to invest Rs 60 crore from the IPO proceeds to develop two new facilities. As the existing plants are running near optimum levels, capacity constraints will continue to pose challenges till the new capacity comes on stream in FY25.

The company has four manufacturing facilities in Hyderabad (Telangana) spread across 20,000 sq. m, with a capacity utilisation of 85-90 percent across all units. The company plans to invest Rs 60 crore from the IPO proceeds to develop two new facilities. As the existing plants are running near optimum levels, capacity constraints will continue to pose challenges till the new capacity comes on stream in FY25.

Poor cash conversion

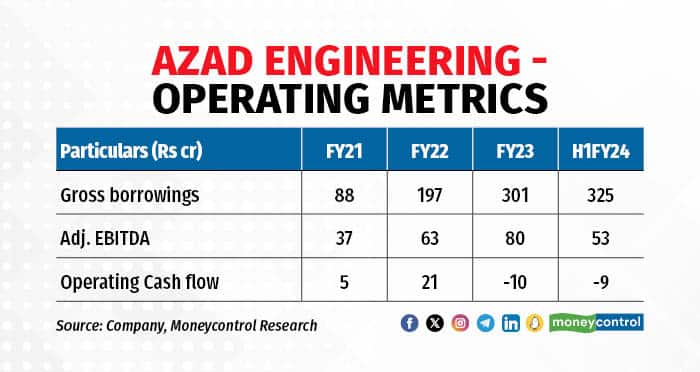

The company has experienced a surge in gross debt levels, increasing from Rs 88 crore in FY21 to Rs 325 crore in H1FY24, coinciding with the ongoing challenges in generating positive operating cash flow. Despite stellar operating margins, the return ratios remain very mediocre on account of stretched working capital cycles. Since FY20, Azad has generated an aggregate operating cash flow of just Rs 7 crore in comparison to an aggregate adjusted EBITDA of Rs 232 crore.

The company has experienced a surge in gross debt levels, increasing from Rs 88 crore in FY21 to Rs 325 crore in H1FY24, coinciding with the ongoing challenges in generating positive operating cash flow. Despite stellar operating margins, the return ratios remain very mediocre on account of stretched working capital cycles. Since FY20, Azad has generated an aggregate operating cash flow of just Rs 7 crore in comparison to an aggregate adjusted EBITDA of Rs 232 crore.

Conversion of Piramal’s debt to equity (Rs 160 crores investment by Piramal Structured Credit Fund via Compulsorily conversion debentures has been converted to equity just ahead of the IPO) and the repayment of debt from the IPO proceeds will improve its balance sheet. However, failure to achieve positive cash flows in the future is likely to diminish overall profitability over the medium term.

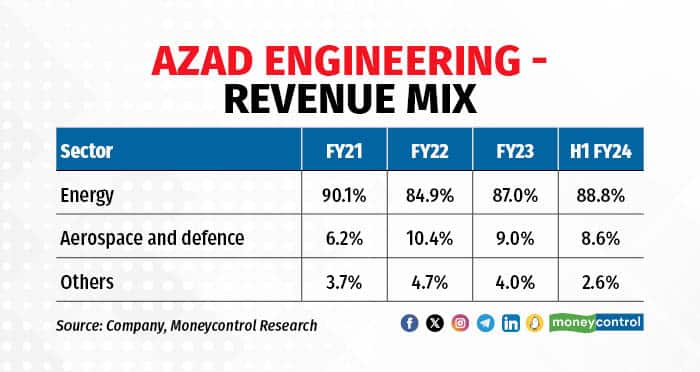

Concentrated revenue profile

The company is significantly reliant on specific key customers, with the top five contributors accounting for over 60 percent of revenues. Among its key clientele, Siemens Energy, the Spain-based turbine maker, has suffered a net loss of €4.5 billion during FY23. Siemens Energy has sought financial help from the government and its shares have crashed more than 50 percent since June 2023. This remains a key risk as the prevailing financial problems and restructuring at Siemens Energy could hinder Azad’s earnings trajectory in the near term.

The company is significantly reliant on specific key customers, with the top five contributors accounting for over 60 percent of revenues. Among its key clientele, Siemens Energy, the Spain-based turbine maker, has suffered a net loss of €4.5 billion during FY23. Siemens Energy has sought financial help from the government and its shares have crashed more than 50 percent since June 2023. This remains a key risk as the prevailing financial problems and restructuring at Siemens Energy could hinder Azad’s earnings trajectory in the near term.

Meanwhile, Azad is looking to leverage its existing technical expertise and manufacturing base to scale up its presence in aerospace and defence sectors. However, the revenue concentration risk in the energy sector will remain for the time being as the contribution of aerospace and defence verticals is very small. The scale-up will also take some time on account of the long gestation period of product development and lengthy qualification process mainly attributed to the criticality of their use.

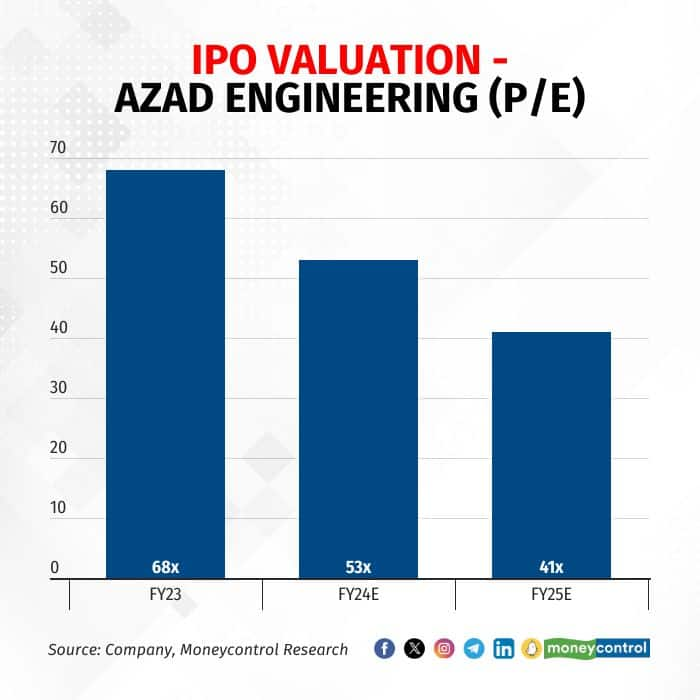

Steep valuation

Azad Engineering is a niche player in its segment and enjoys a very strong foothold in the market. The company is going public amid the bull market euphoria with a rich valuation (41 times FY25 estimated earnings). While Azad operates in an interesting domain, its valuations leave little room for safety. Hence, we advise investors to exercise caution.

Azad Engineering is a niche player in its segment and enjoys a very strong foothold in the market. The company is going public amid the bull market euphoria with a rich valuation (41 times FY25 estimated earnings). While Azad operates in an interesting domain, its valuations leave little room for safety. Hence, we advise investors to exercise caution.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now