The focus of discussions on the market nowadays is oriented around the current valuation levels and the great growth story of our economy. It has been discussed on various platforms that a long investment horizon is required from now on. That is very much the case. Now let us look at it through the perspective of data which will give you the rationale, why a long horizon is required, particularly when valuation levels are not cheap.

Data

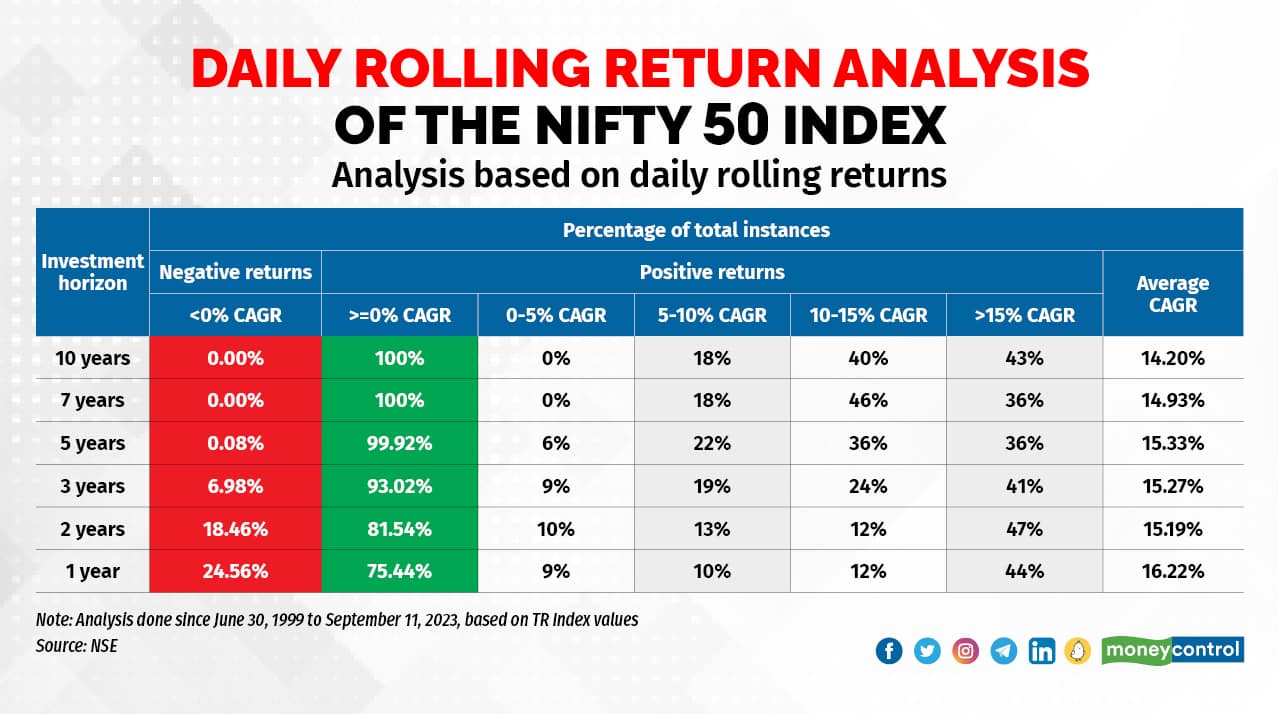

We have data on Nifty50 over a long period of time - from June 30,1999 to September 11, 2023. The analysis is done on a daily rolling basis i.e. every day’s index value over the previous day’s index value. Returns are on the total return index (TRI) which adds the dividends distributed by the companies, to the price returns. The output of the analysis is bucketed into various investment horizons, from one year to 10 years. That is, over the period from June 30, 1999 to September 11, 2023, it is the average of daily rolling returns on investment horizons of one year to 10 years.

Also read | This debt fund is a winner, and not just when interest rates start to fall. Here’s why

Observations

On a one-year investment horizon, the average CAGR (compound annual growth rate) has been 16.2 percent, and returns have been positive 75.4 percent of the time. The implication is, though average CAGR has been 16.2 percent, 24.6 percent of the times, returns have been negative.

On a two-year investment horizon, average return is marginally lower at 15.2 percent, but returns have been positive 81.5 percent of the time. That is, the number of negative incidences drop from 24.6 percent of the time to 18.5 percent of the time.

On a three-year investment horizon, average CAGR is similar at 15.3 percent and returns are positive 93 percent times. Negative incidences drop further to 7 percent. This is the advantage of enhancing your horizon.

On a five-year investment horizon, average return is similar at 15.3 percent, and positive returns are earned 99.9 percent of the time. Your probability of earning a negative return, going by history, drops to only 0.1 percent.

When we extend the investment horizon to seven years over the data period, average return earned is just under 15 percent and returns are positive 100 percent of the time. Going by history, if you have a seven-year horizon, you do not go home with negative returns.

Finally, the 10-year horizon average of daily rolling returns. Average CAGR is 14.2 percent. You earn positive returns on all the 10-year horizons over the data period. Another observation is that on the investment horizon of one to five years, there are certain incidences of returns in the range of zero to five percent. This is positive but muted returns. On the horizon of seven and 10 years, returns are always more than 5 percent.

Takeaways

Markets go through cycles. When you are giving it adequate time, cycles go up and down, you ride it, and eventually go home with adequate returns. There is a saying, “market can remain irrational longer than you can remain solvent”. But over an adequate horizon, fundamentals of companies take over, from short-term irrational market movements.

Also read | Behind the barrier: Understanding the regulations impacting mutual fund investments for NRIs

Conclusion

Over a long period of time, returns are somewhere equal to the nominal GDP growth of the economy. The top line growth of companies will be near-about the real GDP growth of the country, plus inflation. The bottom-line growth and hence the EPS growth of companies is expected to be somewhere equal to the top-line growth. Though there will be differences due to industries, segments, management quality etc., the indices are calculated on a free-float basis and are re-balanced every six months. Companies that are doing well, or not doing well, are priced accordingly by the market participants. These companies will be added to, or deleted from, the index. There are short-term exuberances, but over a long term, market behaviour is more rational. You just have to ride over it.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now