Note to readers: Mutual funds’ chief executive officers are of broadly two types. One group typically rises from fund management. The second group rises from sales and marketing background. Who is better at heading a mutual fund house? The jury is still out. In this series of CEO profiles, we look at the successful fund managers who went on to head fund houses, later in their careers.

Mutual fund industry veteran A Balasubramanian could have been an agriculturist, banker, or software engineer, but as fate would have it, this village boy became head of one of India’s biggest asset management companies (AMCs).

In his career spanning more than 30 years in the asset management sector, Balasubramanian has been a trader, dealer, portfolio manager, and chief investment officer (CIO). He has also been on both sides of the market – fixed income and equity.

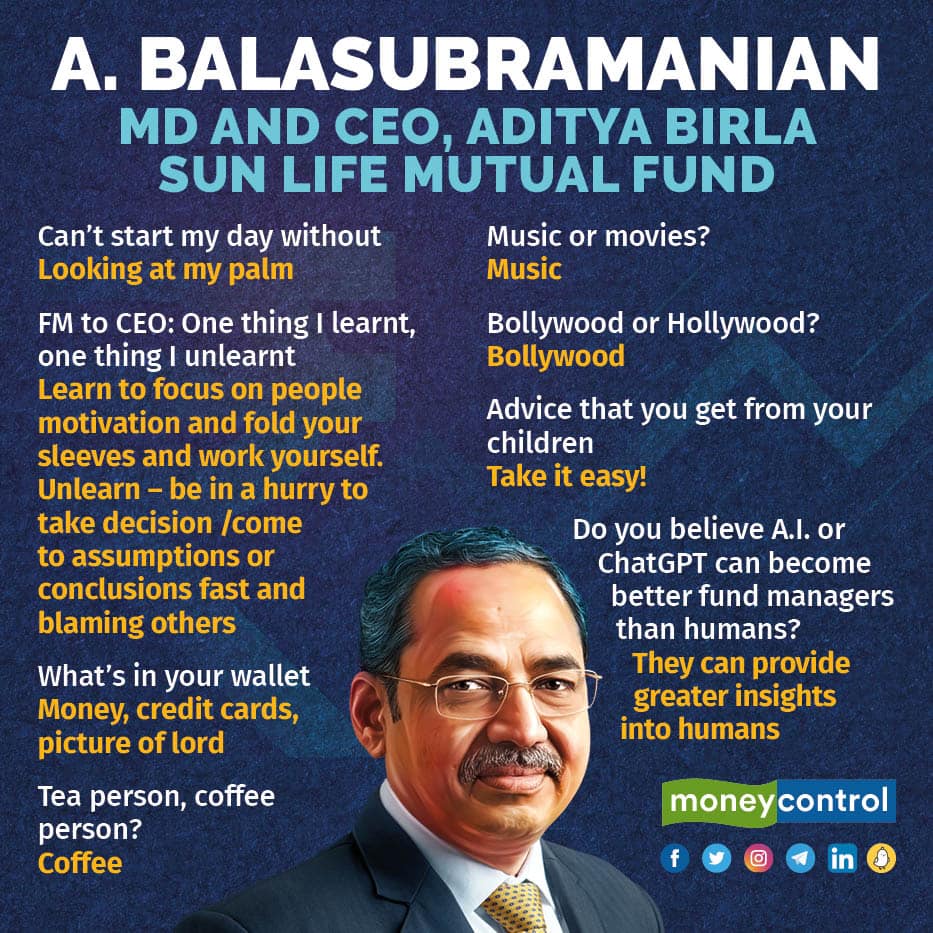

Balasubramanian is today the Managing Director (MD) and Chief Executive Officer (CEO) of Aditya Birla Sun Life Mutual Fund, which has assets under management (AUM) of around Rs 3 trillion. Here is his life journey.

From Melattur to Mumbai

Born in a small village named Melattur in Tamil Nadu’s Tanjore district, Balasubramanian studied in the village till Class 10 and then got admission to the nearby school for higher education.

Also read | Win for the unitholder is a win for the shareholder: Navneet Munot of HDFC MF

After passing out of Class 12, Balasubramanian wanted to pursue engineering, especially computer science, but he couldn’t get admission as the fees were high. He then settled with Bachelor of Science for graduation and also learned computer programming languages COBOL and C+.

"Along with my education in my village, I continued to engage in agricultural activities. It was my parents who pushed me to move out and explore new opportunities. This push brought me to Bombay in 1988," he said.

With a dream to build his career in the information technology space, Balasubramanian worked for a few software companies. "But somehow destiny was different," he said.

Also read | Meet the CEO of a fund house that has worn the hats of a batsman, bowler and a coach

On the advice of one of his cousins, the mutual fund veteran joined the banking industry at CanBank Financial Services. Duty consciousness made him shine at the company as he simultaneously pursued his Master of Business Administration.

Balasubramanian considers joining GIC Mutual Fund as a dealer just after the Harshad Mehta scam in 1992 as a key turning point in his career.

"It gave me an opportunity to learn equity trading because, in those days, the stock market timing was for only two hours. The rest of the day you could do research or market intelligence, interact with people, focus on studies, and do bond market trading as well," he recalls.

Journey to the corner office

Balasubramanian has worked at Aditya Birla Sun Life Mutual Fund for close to 30 years now, but interestingly, the move almost didn’t happen.

With the job offer in hand, he was hesitant to move from a public sector entity (GIC MF) to the private sector. However, after being nudged by a friend, Balasubramanian joined the Aditya Birla Group as the job "fortunately" came back to him again after a gap of six months.

Also read | A fixed income market specialist who is now at the helm of a brand new fund house

At the fund house, he moved from a dealer’s role to portfolio manager, then to head of fixed income, deputy chief investment officer, and now head of the AMC.

He credits the fund house for his growth trajectory, as he says that it is the culture of the Birla Group to spend a lot of time building people’s careers.

Balasubramanian remembers that he cried the day he was promoted to portfolio manager from a dealer. "I thought dealing was more joyful than portfolio management. But still, you have to take up the responsibility when it is assigned to you."

Do debt fund managers become better CEOs?

Balasubramanian joined the investment industry at a time when the equity market became a household name in the country. However, it was the bond managers who were the heavyweights on Dalal Street.

He remembers that the early 1990s was the time when American Depository Receipts (ADR) /Global Depository Receipts (GDRs) were just being allowed to be issued overseas. Also, there used to be large bond issuances coming in from the likes of MTNL and NTPC. Most of the fundraising used to happen via the bond market route in those days.

In the mutual fund industry, many current MDs and CEOs such as Nilesh Shah, Rajiv Shastri, and Sandeep Bagla, were fixed-income managers in the past.

As per Balasubramanian, the bond market teaches the importance of a single basis point, which doesn’t happen much on the equity side.

"As I started building my equity capabilities, I started realising there's a greater correlation between equity and debt. In the debt market, you acquire a greater knowledge of credit, interest rates, durations, and basis points. In fact, when I became the head of investment, as the CIO, the first thing I said was that there should be a synergy between credit valuations and company valuations. Sometimes we go and meet the company for lending money, and you find that the company is good for equity investment," Balasubramanian said.

Management strategy

Balasubramanian, who moved into the CEO position at the fund house in August 2009, has always been impressed by the business approach of FMCG firms, especially Hindustan Unilever.

"I always tell my team that you must build retail branches like the Lever model. We should look at geographical footprint expansion and do a deep dive in terms of what kind of engagement a fund house should have. Another of my approaches was to build a knowledge-driven business rather than a sales-driven business," he said.

Having moved from the investment side to the management side, Balasubramanian liked the thrill of the investment process but also found satisfaction in building the business, which has a longer-term impact.

Also read | Aditya Birla Sunlife Mutual Fund to merge schemes investing overseas

As chairman of the industry body, the Association of Mutual Funds in India (AMFI), Balasubramanian is sometimes called upon to take decisions that may impact certain fund houses, including his own. But he says that the industry as a whole is the top priority, and then the question arises as to how to adjust your business model.

Back to the roots

While the thought of retirement hasn’t crossed Balasubramanian’s mind, he eventually plans to keep his village connection alive and again pursue his agricultural engagement.

His other plan is to enrol seven or eight students every year, engage with them, impart the knowledge and help build their careers.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!