Highlights:

Despite headwinds in the short term, CRIL has maintained healthy store addition in the medium to long run. The entry into the footwear and athleisure segment will help to build up the growth momentum, while the increasing share of women and kids segments will broaden the customer base and strengthen CRIL’s position as a one-stop shop for all family needs.

We are bullish on the long-term growth prospects for CRIL. Robust return ratios as well as reasonable valuations make it an apt bet in the apparel space.

Demand muted in near term; expect growth to resume from FY25

The apparel industry has been facing muted demand over the past few quarters due to a slowdown in consumer discretionary spending because of high inflation. Demand in non-metro regions (CRIL derives about 75 percent revenues from non-metros) has been relatively more affected due to the slowdown. Moreover, a high base in FY23 (FY23 was the first normal year post COVID-19) is dragging the demand growth in the current fiscal.

The festive season has failed to lift demand in Q3FY24 so far. CRIL expects flattish SSSG (same-store sales growth) in H2FY24. With an improvement in consumer sentiment on the back of receding inflationary pressures and a favourable base in FY24, CRIL expects SSSG to resume from FY2025.

Aggressive store expansion on track; enters footwear and athleisure space

CRIL is on track for aggressive network expansion. CRIL aims to open 75-80 new stores every fiscal, implying about 16 percent CAGR. CRIL will deepen presence in existing locations as well as in new cities where it has recently entered. As per CRIL, stores in newly entered locations such as Rajasthan, Odisha, Madhya Pradesh, and Assam have received encouraging response, giving confidence to CRIL to expand aggressively.

In November 2023, CRIL announced the entry into the footwear and athleisure space by opening its first exclusive store in Hapur, Uttar Pradesh. Initially, CRIL plans to open 5 such stores (average store size of 2,000-2,500 sq feet) and has invested Rs 5 crore in this business. Like the apparel segment, footwear and athleisure will be sold under the Cantabil brand but manufacturing will be outsourced. CRIL will position the new categories in the mid-premium range as well.

Increasing share of women, kids & accessories; enhancing online business

The men’s segment is the largest for CRIL, contributing about 81 percent of revenues. In order to diversify and broaden the customer base, CRIL is enhancing the share of the women and kids wear segment. CRIL is opening exclusive family stores (offerings for entire family) as well as exclusive women and kids stores. It aims to increase the share of the women and kids segment from 13 percent now to about 17-18 percent over the medium term. CRIL is also focusing on enhancing the accessories business — belts, socks, ties and handkerchiefs.

With increased consumer preference for online shopping, CRIL is scaling up the online business and selling products via its own website cantabilinternational.com as well as leading third-party platforms such as Amazon, Flipkart, and Myntra. CRIL aims to increase the share of the online business from the current 2.5-3 percent to 8-10 percent over the next two to three years.

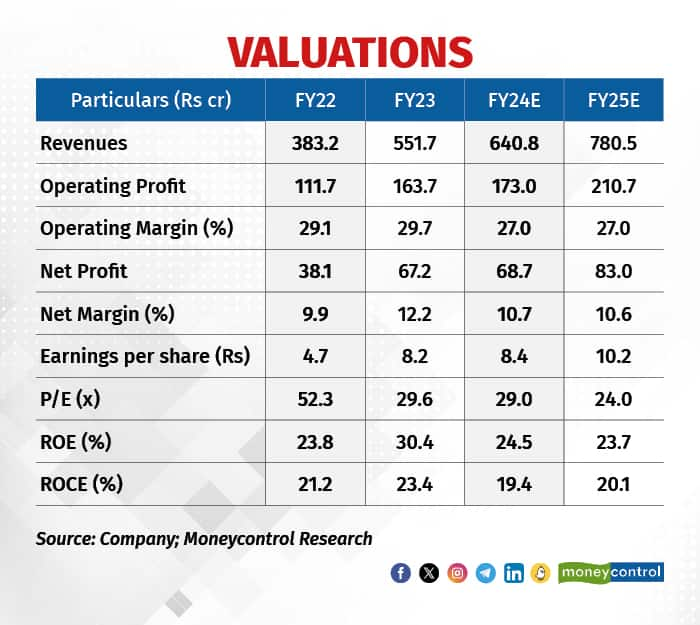

Valuations

At the CMP, the stock is trading at a P/E of 24 times FY25 projected earnings. CRIL has strong growth prospects as well as robust return ratios. Hence, we advise investors to add the stock to the portfolio.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now