Highlights

Business model

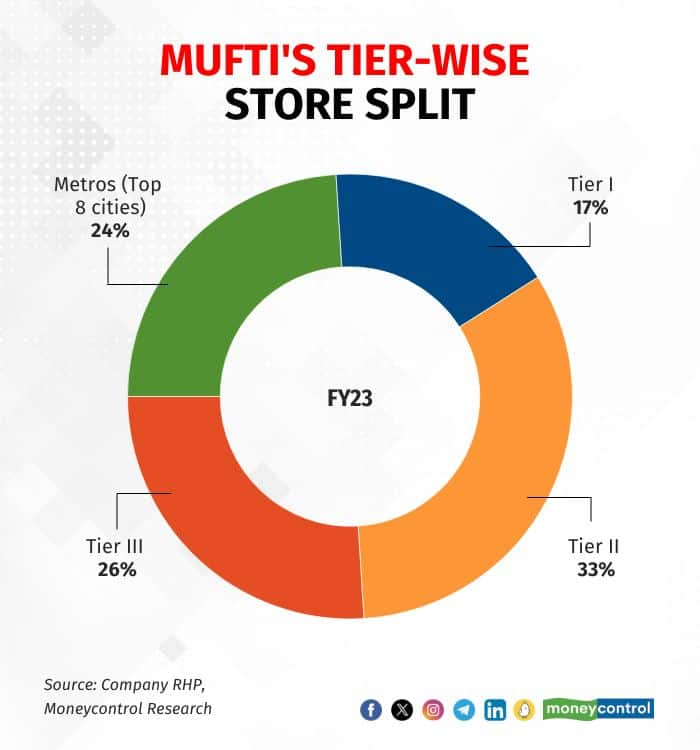

Credo is a homegrown brand for men’s western apparel in India. Mufti, its flagship brand, was launched in 1998 and offers a wide range of products for various occasions, focusing prominently on casual wear. Being a mid-premium to premium player, Mufti is focused on Tier 2 and Tier 3 towns for expansion.

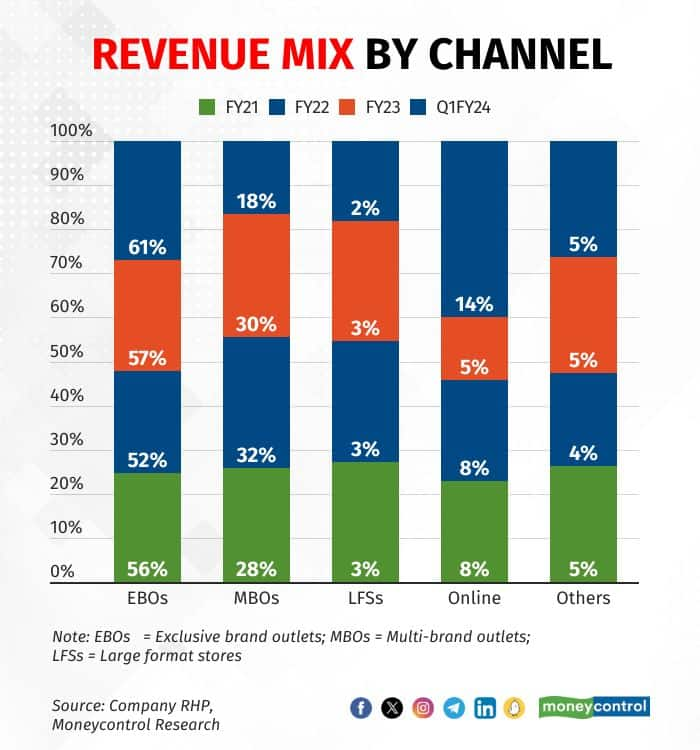

Mufti sells its products through a multi-channel distribution network of EBOs, LFSs, MBOs, as well as online — through its website and other third-party e-commerce marketplaces. EBOs are the primary distribution channel and account for more than 50 percent of its revenues.

It operates on an asset-light model where product manufacturing is outsourced to various partners, while the company focuses on design.

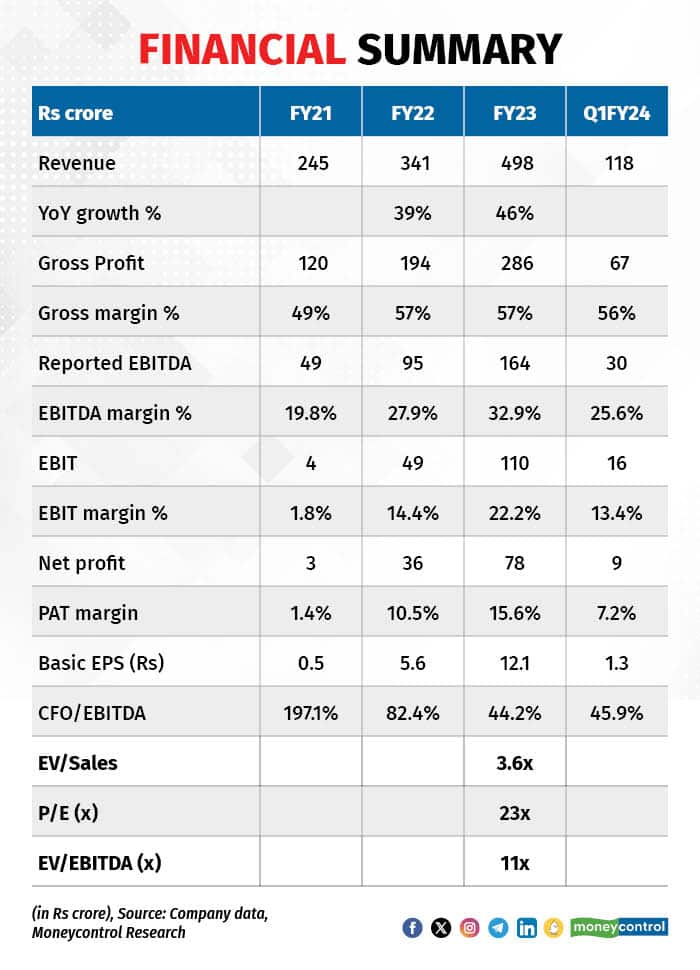

Top line is uninspiring but profitability is impressive

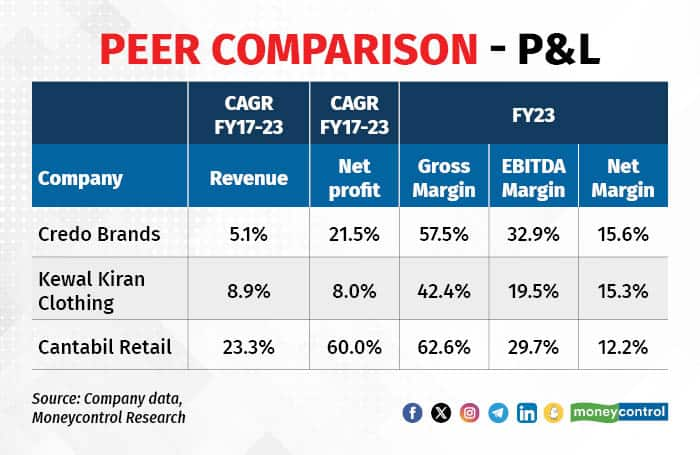

Mufti has seen its revenue grow at a CAGR of ~5 percent over FY17-FY23, which is below its peers’ average of ~16 percent and the industry average growth of ~8 percent.

However, its net profit has grown at a CAGR of 22 percent over the same period with net margin rising from 6 percent in FY17 to 16 percent in FY23 and now stands better than its industry peers.

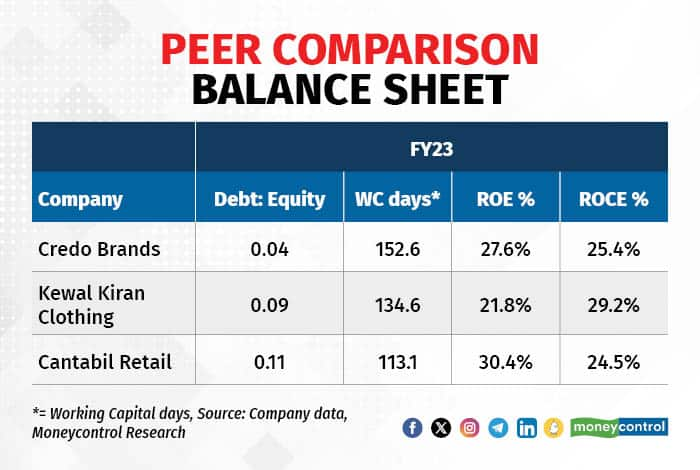

Balance sheet strength on a par with the industry

The company’s working capital cycle of 152 days is slightly higher than its peers. However, its Debt/Equity ratio of 0.04x and the return ratios remain on a par with its peers.

Revenue scale-up key to maintaining industry-leading profitability

Despite a mediocre top-line growth, Mufti has managed to show impressive growth in profitability by managing its operating costs. Its selling and distribution (S&D) cost has come down from an historical average of ~20 percent of sales to now at ~ 6 percent of sales.

The revenue scale-up for Mufti remains a key factor to be watched. Enhancing the distribution reach as well as entry into the accessories business — belts, socks, and wallets — as done by the peers could be the key growth driver. With Mufti’s margins being better than peers, revenue growth is key to maintain margins and earnings momentum.

Industry consumption to support branded retail players

Mufti is one among the many compelling apparel brands in the men fashion domain. This segment has come a long way to add a lot of elements for every occasion just like women fashion. The trend of fast fashion – where new design/style move around in the market rapidly – is also leading to higher consumption in this segment.

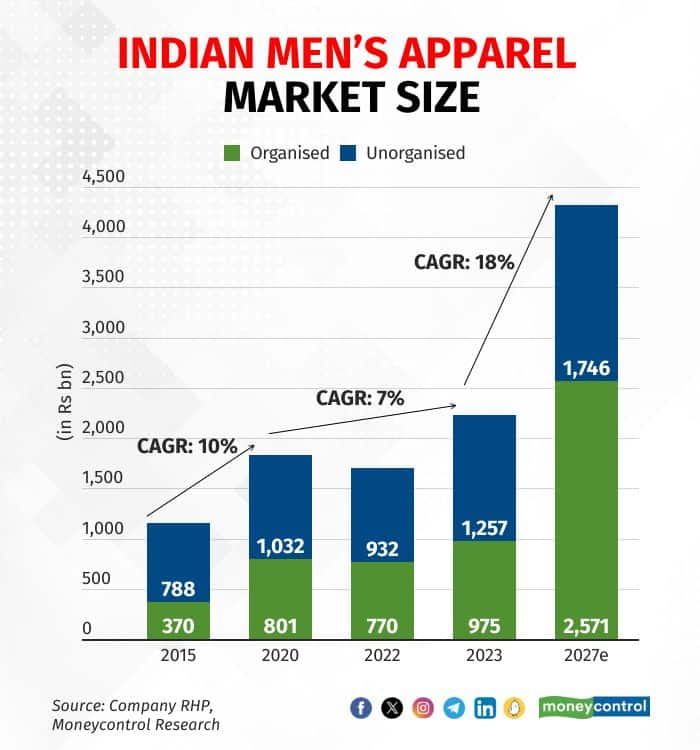

The Indian men’s apparel market is expected to grow at a CAGR of 18 percent over FY23-FY27 to reach about Rs 4,31,700 crore by FY27 from almost Rs 2,20,000 crore in FY23. Within the apparel segment, the organised market is estimated to grow much faster and account for ~60 percent of the men’s apparel market against ~44 percent now.

We believe, this trend will hold as, with increasing disposable income, the preference of Indian consumers is shifting towards branded options, which is likely to benefit players like Mufti and others.

Outlook and Valuation

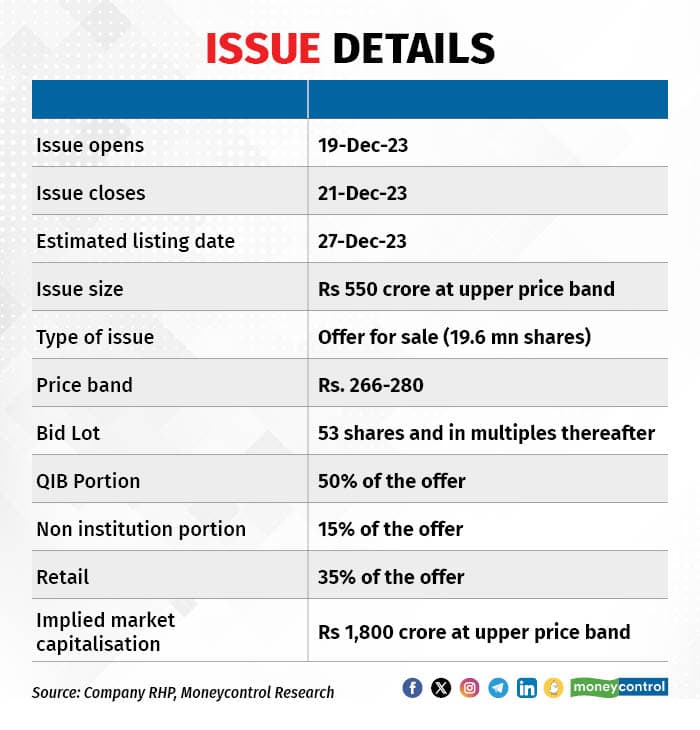

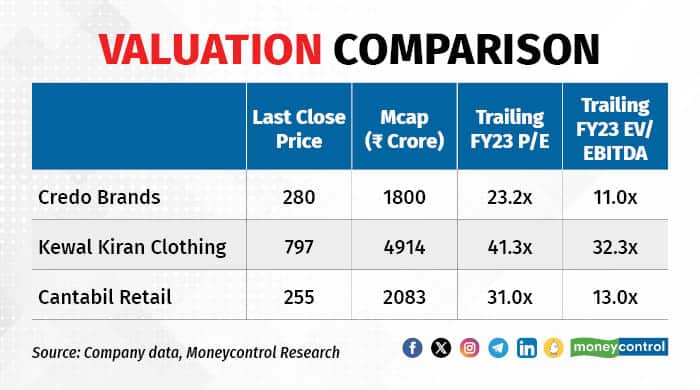

At the upper end of the offer price of Rs 280, Mufti is valued at ~23 times FY23 P/E, which, in our view, is quite attractive given the double-digit earnings track record and the growth potential of the addressable market.

However, Mufti’s top-line growth track record has significantly lagged peers in the past and remains a key factor going forward. In the event Mufti is unable to scale up revenues, profitability which is now greater than the comparable peers, could come under pressure.

Investors can subscribe to this issue for listing gains.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now