Even as markets take off into uncharted territory and there is optimism in the air after BJP’s win in three states, where should investors place their faith in beating the market over the next year?

The general perception is consumption stocks do well in election year given accelerated spending by governments ahead of elections, but this time around, analysts suggest, industrials may be a better bet than consumption stocks despite a slow private capex growth.

While muted demand, high raw material prices are likely to hurt stocks in consumer staples, consumer discretionary are expected to fare better faring due to the premiumisation trend. Yet, it is stocks in the industrial space that may be the big winners.

Amnish Aggarwal, Head of Research at Prabhudas Lilladher says “Industrials are expected to do well because the continued government investments in the infrastructure segment are expected to benefit the sector. The state election results calm down the uncertainty regarding the current government’s comeback. Hence the continuity towards those policies is expected.”

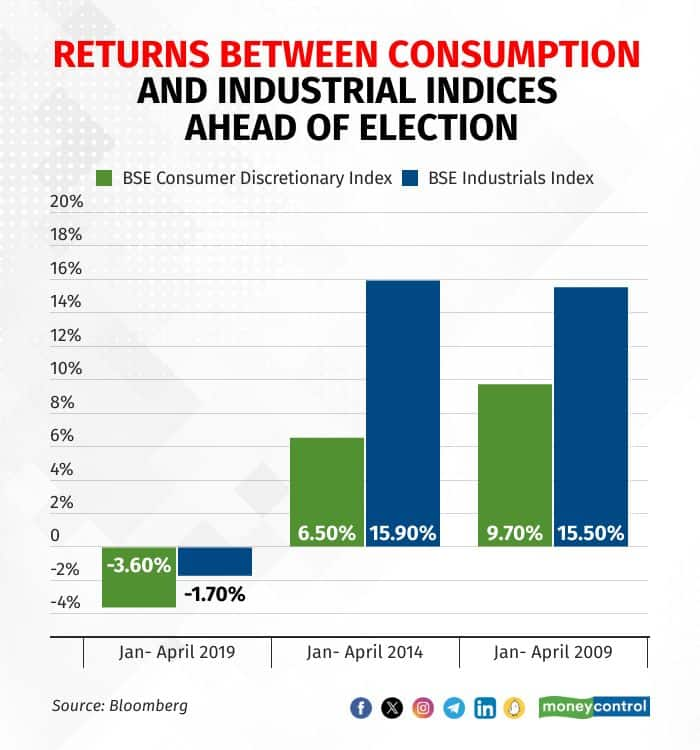

Even during the previous run-ups towards the election, industrials have fared better than consumption stocks. According to Bloomberg data, the BSE Industrial index has given above 15 percent returns during the January to April months during 2009 and 2014.

Returns between Consumption and Industrial Indices during election years.

Returns between Consumption and Industrial Indices during election years.

Also Read: Eye on elections: PSU bank stocks may continue to race ahead as BJP prospects instill confidence

The show will go on, despite high valuations

Analysts are positive on industrials stocks to continue their strong performance, despite expensive valuations. Stocks like L&T, Bharat Electronics, Hindustan Aeronautics, Suzlon Energy have rallied between 60-200 percent over the past one year.

Kranthi Bathini, director of equity strategies, at WealthMill Securities said, "Given the kind of public sector capex and the slowly increasing focus of the private sector capex, industrials are expected to outperform relatively in the medium to short term. The main advantage for them is the stable metal prices. As industrial companies are the highest buyers of metals like iron and steel, the stable commodity prices will benefit them,” Bathini said.

Also Read: In Charts: What Jefferies, foreign investors say about power and energy stocks

Nirav Karkera, Head of Research at Fisdom concurs. “The rally is expected to continue due to the long gestation periods of the sector. Structurally, it is in a better position to capitalise on the continued investments and better macro conditions.”

The industrial sector has also seen a growth in order intake during FY22- 23. According to Antique Broking, this comes after a period of stagnation from FY2012- 2023. Over the last two years, the sector has reported 25 percent (FY22) and 17 percent (FY23) growth in order intake.

Rural demand dampener for consumption stocks

Normally there is a pick-up in rural demand before elections as a result of government spending and populist schemes. Amnish Aggarwal says that hasn’t happened this time.

“Due to inflation and poor monsoons, demand has not picked up. There is not much-expected upside among consumer staples. The rural demand remains tepid. Hence, staples aren’t expected to provide much value at the current juncture," he said.

Also Read: Analyst Call Tracker: Capex cycle, order book drive upside for L&T

However, he expects discretionary names like Titan to do well as the population purchasing high-end jewellery remains unfazed by persistent inflation.

Stocks to watch out for

Among industrials, analysts expect L&T, Siemens, and ABB to do well. “L&T is the best infra and engineering play in the country. It has a lot of exposure to Gulf countries and their economies are reviving. It has a robust orderbook and the overall outlook for the company is bright”, said an analyst who didn’t want to be named.

L&T's total consolidated order book now stands at Rs 4.5 lakh crore, of which, 35 percent come from international orders.

Analysts are optimistic about ABB also on the back of a strong order book. Due to project wins in the railway segment which also led to expansion in other sectors like traction motor and propulsion systems capacity, Dalal Broacha said in their report.

When it comes to defense and railway stocks, the story is in the long-term 'Make in India' theme. Titagarh Wagons, RVNL have bagged multiple railway and metro projects this year meanwhile HAL, BHEL, and BEL have secured order wins from the Indian Army. While some fund managers believe valuations have turned frothy, the rest are of the view that strong, structural triggers demand such high valuation.

In the power sector, the growing focus on renewables is the main reason behind the stocks' rally. Power capex in India, according to Jefferies, should rise at 9x CAGR in FY24E-26E vs FY10-20, and stocks like Power Grid, Thermax, NTPC and JSW Energy are expected to reap gains.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!