Highlights:

Fiem Industries (CMP: Rs 2,105; M Cap: Rs 2,770 crore; Rating: Overweight), a comprehensive provider of lighting solutions for 2Ws, has shown resilience despite the challenges in the two-wheeler (2W) industry.

With the recent upturn in 2W demand, the company is poised for a substantial improvement in its financial performance. The increasing market share of LED lights, acquisition of new clients, expansion of business with existing clients, and wider acceptance of EVs make it an attractive long-term investment opportunity.

There are multiple factors that make us upbeat about the company.

A big opportunity from the sunrise EV segment

Like any other auto ancillary company, Fiem is also focusing aggressively on the opportunities that electric vehicles (EVs) offer.

Fiem currently works with all major EV OEMs such as Ola, Okinawa, Bounce, Hero Electric, and several others and supplies to them. Fiem expects to grow significantly in this segment during FY24. In fact, EV sales now account for 6 percent of the company’s total revenue.

Additionally, to diversify its portfolio of EV components, Fiem's strategic collaboration with Gogoro positions it strategically in the evolving EV landscape, introducing a new source of revenue. The Memorandum of Understanding (MoU) encompasses the manufacturing and assembly of essential EV components, such as Hub Motor Assembly, Electric Control Unit (ECU), and Motor Control Unit (MCU). This partnership, combined with Fiem's provision of lighting and mirror solutions for Gogoro's domestic and export markets, solidifies the company's position as a significant player in the emerging EV revolution.

The company’s focus in this segment could drive its growth over the next few years as EV penetration increases.

Adoption of LEDs continues to be a key growth catalyst

A significant driver of the company's growth is the increasing adoption of light-emitting diode (LED) lights, which offer substantial value and high-profit margins. In the latest quarter i.e., Q2FY24, LED lights contributed to 47 percent of Fiem's sales.

With a pipeline of new products, the share of revenue generated by LED lights in Fiem's overall earnings is expected to increase.

Robust order inflow

Benefitting from a robust product portfolio, a solid client base, and anticipated recovery in 2W demand, the company boasts a strong project pipeline.

Collaborating closely with Yamaha, Fiem is actively involved in the launch of the premium Aerox 155 scooter, catering to both the domestic and export markets. Additionally, in partnership with TVS, Fiem has initiated the supply for the Jupiter 125 scooter model and a new three-wheeler model, King Duramax.

In the EV segment, the company has secured contracts with several new customers, including notable names like Raptee, Polaris, and Numerus. As we enter the second half of the year, Fiem is well-positioned and maintains an optimistic outlook for future growth.

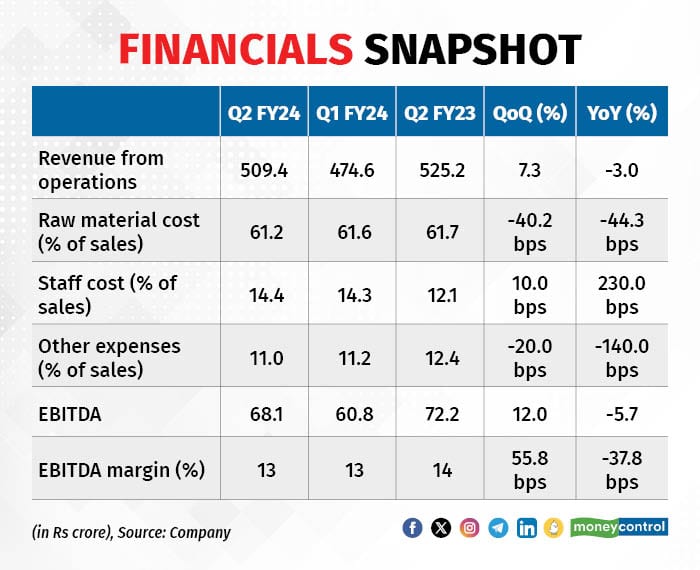

Q2FY24 highlights

.

.

Valuation remains attractive

Fiem currently trades at a valuation of 13.5 times FY25 projected earnings, which is very reasonable. We advise investors to buy this stock with a long-term perspective.

Risks

Any slowdown in demand could hurt financials. Moreover, adverse commodity prices could increase raw material costs and impact operating profitability.

For more research articles, visit our Moneycontrol Research page.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now