Highlights:

The recent acquisition of pharma company Sharon Bio and capacity expansion in Jammu provide access to new markets and a volume growth visibility, respectively.

That said, limited pricing power and rich valuation keep us on the sideline.

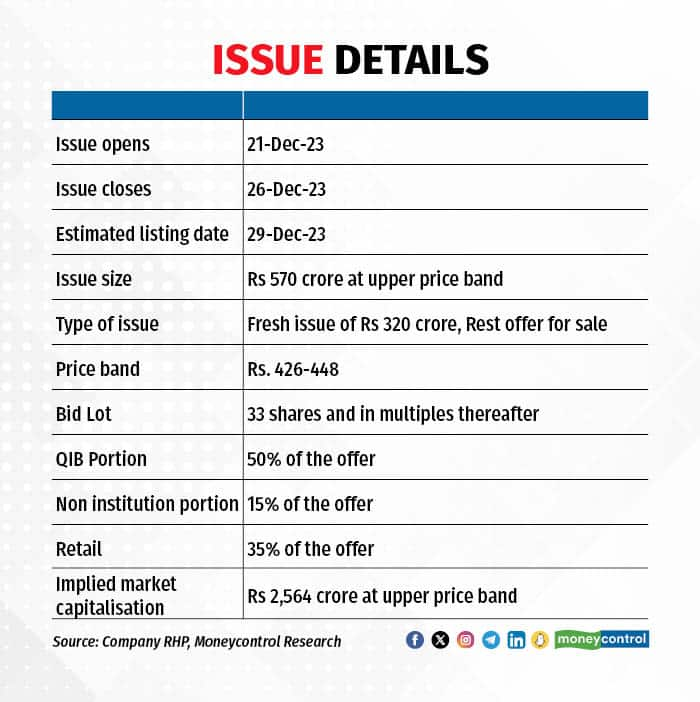

IPO details

After listing, the promoter group shareholding will come down to 51.6 percent from the current 66.8 percent.

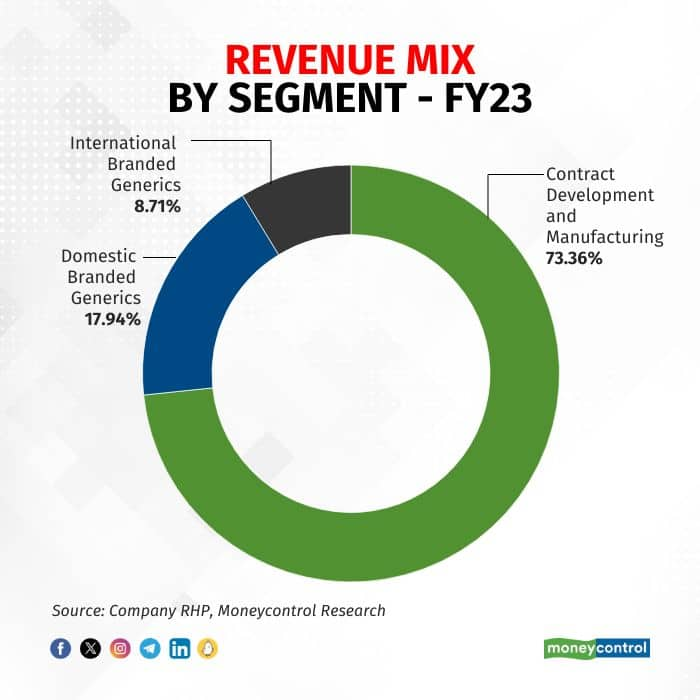

Innova Captab: chiefly a contract manufacturer

Founded in 2005, Innova Captab operates through its plants in Baddi, Himachal Pradesh, and serves three business segments -- contract development and manufacturing (CDMO) services for Indian pharma companies, domestic branded generics business and international branded generics business.

On the CDMO front, Cipla, Glenmark, Lupin, Mankind Pharma, and Wockhardt are a few of its key customers.

Source: Company data

Operational performance

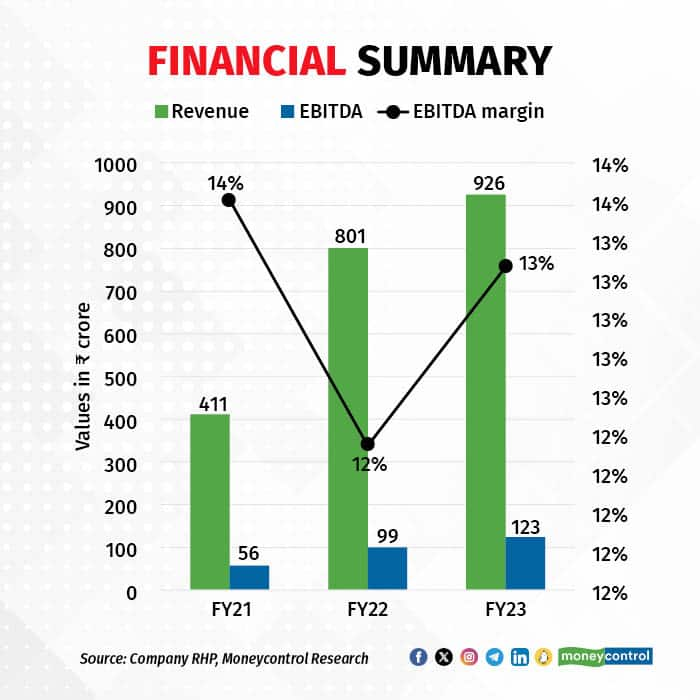

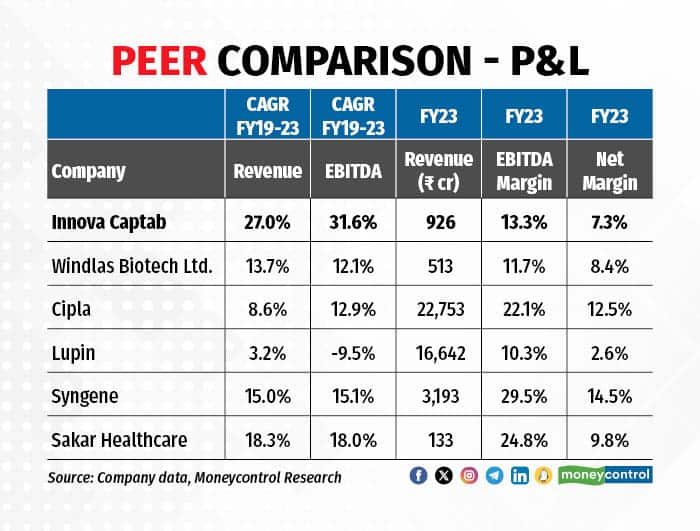

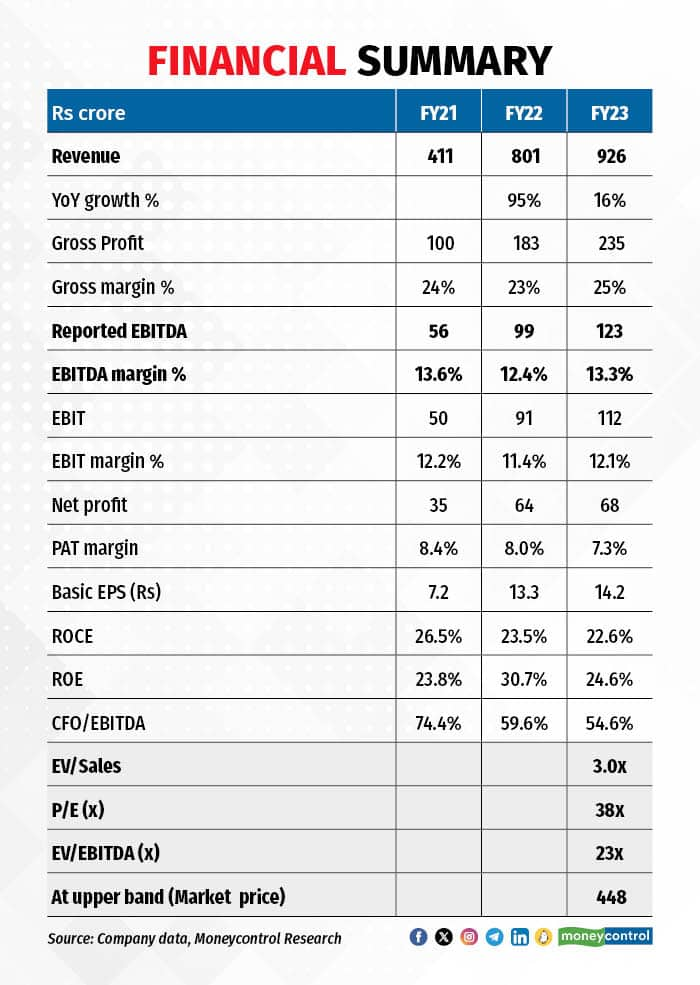

The company’s operating revenue has grown at a compounded annual growth rate (CAGR) of 27 percent over FY19-FY23 and its EBITDA CAGR has also been equally strong at 32 percent over the same period.

Both revenue and EBITDA growth have been stronger than its peer average growth of ~12 percent and 10 percent, respectively.

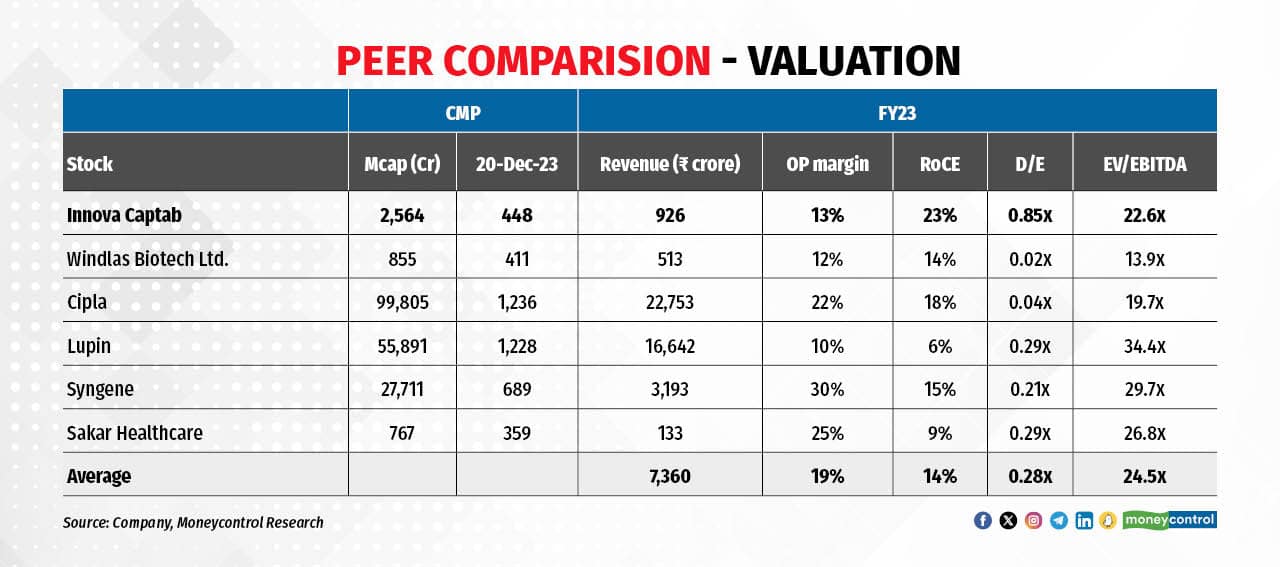

Innova Captab operates at an average operating margin range of 12-14 percent, which is line with its closest peer Windlas Biotech, but remains lower, compared to its entire peer universe, which operates at ~20 percent margin.

However, the company’s return on capital employed (RoCE) of over 20 percent has consistently remained higher than the industry performance.

Sharon Bio acquisition

The company acquired Sharon Bio, pursuant to CIRP (Corporate Insolvency Resolution Process) and infused Rs 195 crore into it in June 2023.

The integration of Sharon helps the company to access regulated markets like Canada, the UK, Australia, etc., and adds the new revenue stream of APIs and research services (toxicology business). As the acquired company has better gross margins, the company’s RoCE improves from 22.6 percent to 24 percent at the consolidated level. On a proforma basis, Sharon accounts for 17 percent of consolidated sales. CDMO services account for about 60 percent and branded generics form the rest.

Outlook

The company’s CDMO business largely constitutes large-scale manufacturing of generic products for Indian pharmaceutical companies. The prime driver of growth here is the higher fixed asset turnover (~5x), wherein volume visibility comes from the contract duration, which typically ranges 2-5 years.

Branded generics business focuses on emerging and semi-regulated markets like those of Ethiopia and Uganda. As these markets are competitive, the operating margin profile is not much different from the CDMO business.

That said, the acquisition of Sharon Bio helps in lifting the margin profile as it provides access to regulated markets. As restructuring/legal cost would wane off for the acquired company in times to come, it would also help.

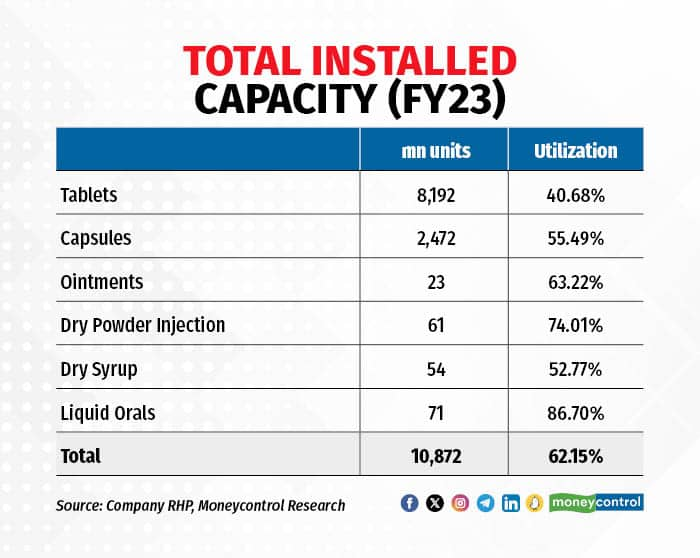

The chief growth trigger for the company, however, includes a capacity ramp-up of its existing plants, wherein the current utilisation levels are in the vicinity of 50-60 percent. Further, the company’s new plant (project cost: Rs 355 crore) at Jammu is expected to be commissioned in FY25. The first production block is dedicated for cephalosporins. Existing fixed asset turnover suggests that the potential sales from this plant could be about Rs 1,500 crore.

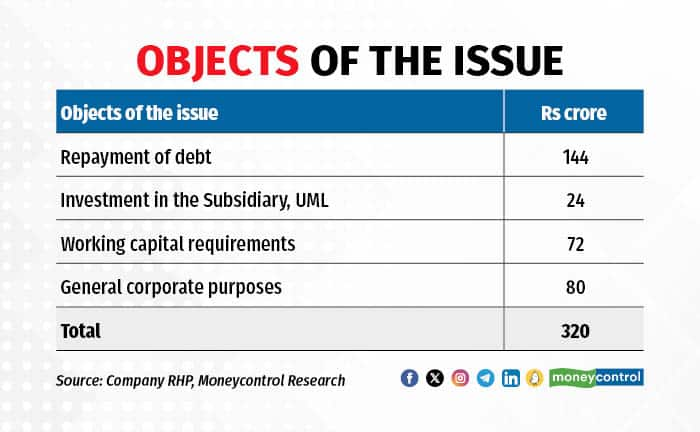

In terms of balance sheet, due to the partial repayment of debt from the IPO proceeds, the company would have headroom for more investments for backward integration and it would help explore new opportunities from Sharon Bio.

However, what makes us less enthusiastic about the business is the weak pricing power (unlike domestic branded generics players such as Cipla) and the absence of higher value-added services within CDMO ( vs. Syngene, Neuland labs). In light of this, valuation (23x EV/Ebitda) is demanding, and, hence, investors can revisit this business, post listing at better levels.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now