Soon, policyholders terminating their life insurance policies before completing the original tenure may have to pay lower surrender charges, thus taking home more of the premiums paid until then. Surrender charges mean penal charges for making an early exit, in insurance parlance.

The Insurance Regulatory and Development Authority of India (IRDAI) recently proposed a new set of product regulations across categories: unit-linked insurance policies (Ulip), traditional endowment policies (guaranteed and with-profit plans), pension policies, micro-insurance covers as also health plans.

The traditional endowment category could see the most impactful change. We look at what all this means for you, if the proposal goes through.

Also read: Why traditional life insurance policies aren't great long-term investments

How does IRDAI intend to change the surrender rules for traditional life insurance policies?

Changes in surrender rules will mean policyholders who let their policies lapse due to reasons such as unsuitability and inability to meet recurring premium paying commitments will now lose less of their premium that they had paid up until then, as a penalty. This is because the surrender charges—or the penalty for early exit—will be lower.

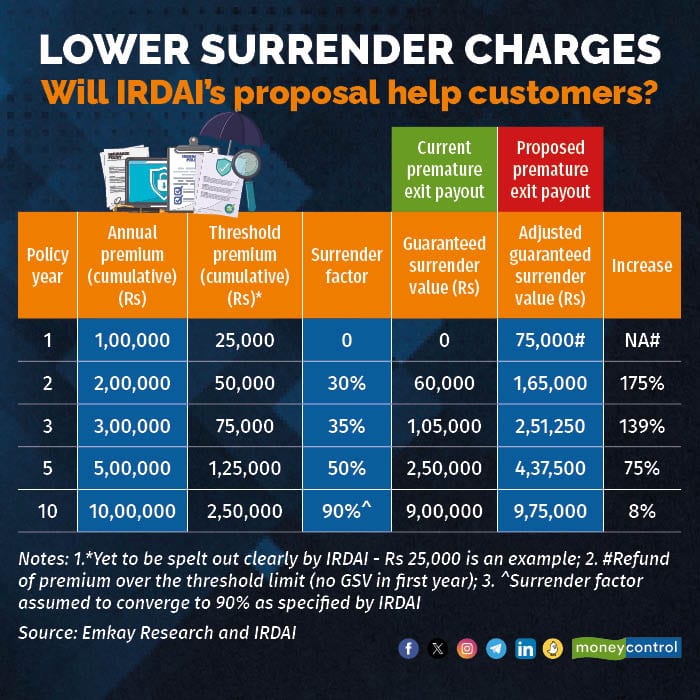

For example, at present, a policyholder surrendering her policy after paying the second-year premium is entitled to get just 30 percent of her premiums back. If the IRDAI’s draft is finalised, this ‘premium refund’ could go up, depending on the threshold premium—a concept introduced in the draft paper.

“There shall be a premium threshold defined for each product, wherein, there shall not be any surrender charges imposed on the balance of the premiums beyond such limits, irrespective of the timing of the surrender,” the IRDAI product proposal says.

Now, the IRDAI has not specified the threshold premium, though it has sought to explain the concept with examples.

Also read: Why LIC’s Jeevan Utsav is not for everyone

How will the new methodology for computing surrender value (amount that policyholder will receive upon a premature exit) work?

The IRDAI circular has assumed a threshold premium in the examples cited to illustrate the workings of the new methodology. So, for a traditional savings insurance policy with an annualised premium of Rs 1 lakh, with a policy term of 20 years, the assumed limit is Rs 25,000. Under current rules, she is entitled to receive a surrender value of Rs 35,000 (35 percent of Rs 1 lakh) if she surrenders the policy after paying the third-year annual premium.

However, if the draft is finalised, she will receive the ‘adjusted guaranteed surrender value’. This will be the sum of the guaranteed surrender value for threshold premium paid until then (Rs 25,000 x 3 x 35 percent = Rs 26,250) and the premium refund beyond the threshold limit [(Rs 1,00,000 – 25,000) x 3 = Rs 2,25,000]; so the adjusted guaranteed surrender value will be Rs 2,51,250 (Rs 26,250 + Rs 2,25,000). Finally, if the special surrender value that such policies declare is higher than this adjusted guaranteed surrender value, then the former will be paid out.

As per Emkay Global Research’s calculations, for a policy with an annual premium of Rs 1 lakh, the threshold limit of Rs 25,000 and exit in the second policy year, the surrender value will be Rs 1.65 lakh versus Rs 60,000 under the current rules, an increase of 175 percent.

Do policyholders stand to benefit from this change in rules?

Those who are stuck with a policy that is a drain on their resources stand to gain, as they will lose less if they let go of such plans.

“The current surrender charges, paid especially during the initial years, dissuaded many from opting for long-term non-linked plans. The new proposed changes are a highly customer-friendly measure by the IRDAI to make non-linked plans more attractive among customers considering the fact that a significant proportion of policies lapse or get surrendered before the policy term,” says Sabyasachi Sarkar, Appointed Actuary, Go Digit Life Insurance.

Given that the majority of traditional life insurance customers let their policies lapse by the fifth policy year, a large number of policyholders are likely to get more of their money back. For example, the Life Insurance Corporation of India’s (LIC) persistency ratio by policy count and premiums paid is 42.45 percent and 55.17 percent, respectively. The lower the persistency, the higher the lapsation rate. The draft higher surrender value rules will benefit policies with premiums higher than the threshold premium.

But will it encourage policyholders to surrender their policies sooner? “The lapse or surrender typically happens due to unaffordability or some other compulsion at the customers’ end. The exposure draft will not make the customers profit more from surrender than maturity, but the loss to customers on surrender will definitely reduce to a huge extent,” says Sarkar.

However, this could mean lower returns for those who persist—stay on for longer—and complete the term. “If the lapsing customers get more (of their premiums paid), there is bound to be some impact on the persistent customers. At the end of day, the money has to be distributed among the stakeholders, including the shareholders, policyholders and intermediaries,” says Avinash Singh, Senior Research Analyst, Emkay Global.

According to Professor Manoj K Pandey, faculty member at Birla Institute of Management Technology (BIMTECH) and a former life insurance industry professional, this may encourage more people to go in for life insurance. “Earlier many did not opt for it because they knew they would lose a big chunk of money if they needed to surrender the policy.”

Will this incentivise agents to encourage their customers to stay put instead of prompting them to churn their insurance portfolios, as is the case now?

Not really. In fact, insurers and independent experts fear the reverse. “This could push up lapsation. Distributors could induce people to surrender existing policies and switch to newer policies, promising better benefits,” says the CEO of a private life insurance company, who spoke on condition of anonymity.

This is the case even now, but the new rules could make it easier for the agents to carry on. “Now, the customer has more to lose, so she can push back, which won’t be the case if the proposal is accepted,” he adds.

Will insurance companies have to look at revising commission payout structures?

IRDAI has floated the proposal and sought comments from stakeholders. It will go through several changes before it is finalised. But if it goes through no modifications, then insurers might have to look at altering the current commissions structure.

They could pay more on renewals to incentivise distributors to encourage their customers to stay put. “So, for high-value policies, insurers could introduce a back-ended commission structure (staggered through the term, higher than now at renewals). Today, it is front-loaded (higher commissions in the first year of sale), from 35 percent in the first year, it drops to 5 percent in later years. Companies could perhaps look at two slabs: commissions for premiums below and above the specified threshold. For policies with premiums above the specified threshold, the commissions could be back-ended,” says Singh.

How will the move, if implemented, impact life insurance companies?

It will exert pressure on their margins. “It is not good news for insurers. The immediate impact would be narrower margins and we will have to ensure more reserves to take care of the surrenders. It will adversely affect insurers’ profitability,” says a life insurance CEO who did not wish to be named.

However, there could be an upside for the industry. “A sizeable proportion of people surrender because they were sold the wrong policy. Now, if they get a higher surrender value, the policyholder will feel less short-changed. To that extent, this proposal could improve the overall perception about insurance,” says Sumit Ramani, Actuary and Co-founder of ProtectMeWell.com, a financial planning engine focussed on insurance.

What are the key changes proposed on the health insurance front?

At present, the maximum entry age limit for health insurance policies is 65 years. The insurance regulator has proposed to eliminate this restriction. Currently, the maximum waiting period for pre-existing diseases (PED) is four years. IRDAI has mooted a PED waiting period of three years or less.

“The draft says insurers shall cover pre-existing diseases either disclosed or undisclosed by the persons to be insured, immediately after the expiry of the 36 months waiting period or such lower period as stipulated in the product. This proposed move will improve accessibility of health products to customers with pre-existing ailments,” says Shanai Ghosh, MD and CEO, Zuno General Insurance.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now