Highlights

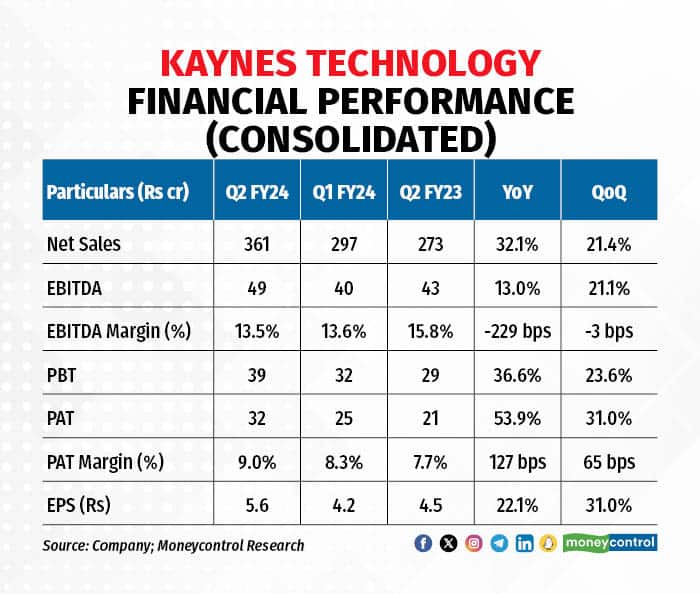

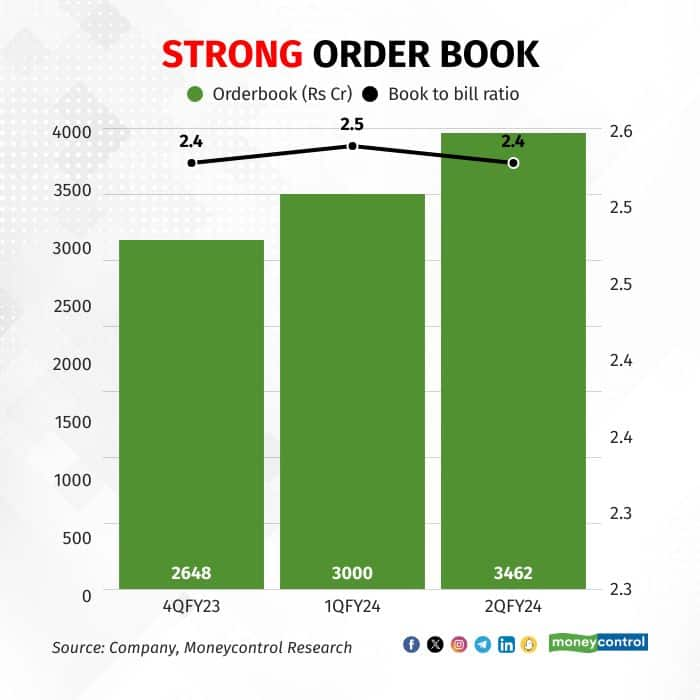

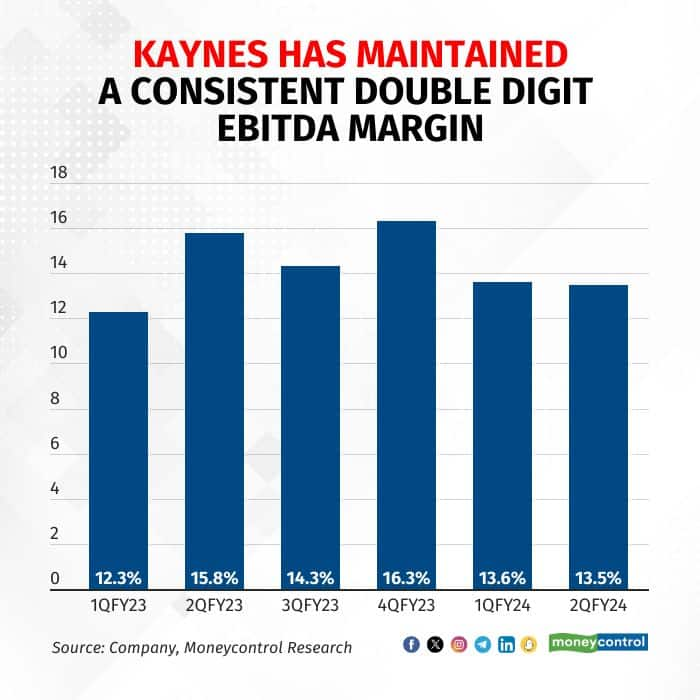

Revenues in Q2 jumped 32 percent year on year (YoY) and 21.4 percent sequentially, led by industrial, automotive, aerospace, and defence verticals. The EBITDA (earnings before interest, tax, depreciation, and amortisation) margin came down marginally to 13.5 percent. The order book, however, improved to Rs 3,462 crore, indicating a strong show in the second half of the year.

Recent Financial Performance

Entry into OSAT and high-end PCB manufacturing

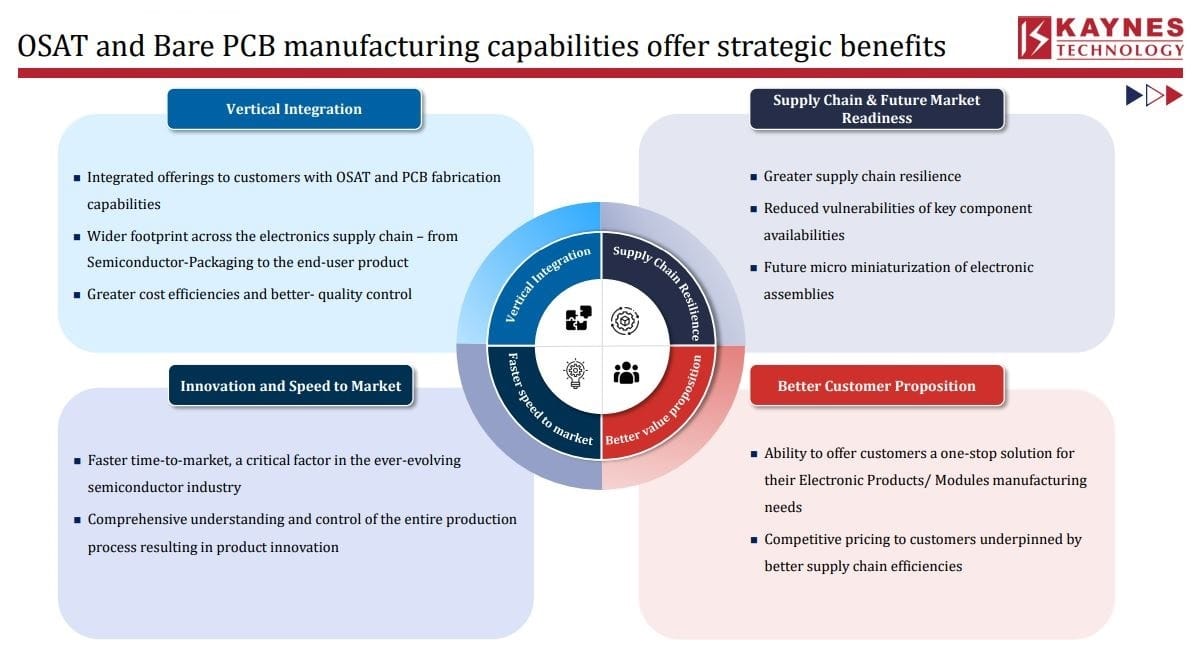

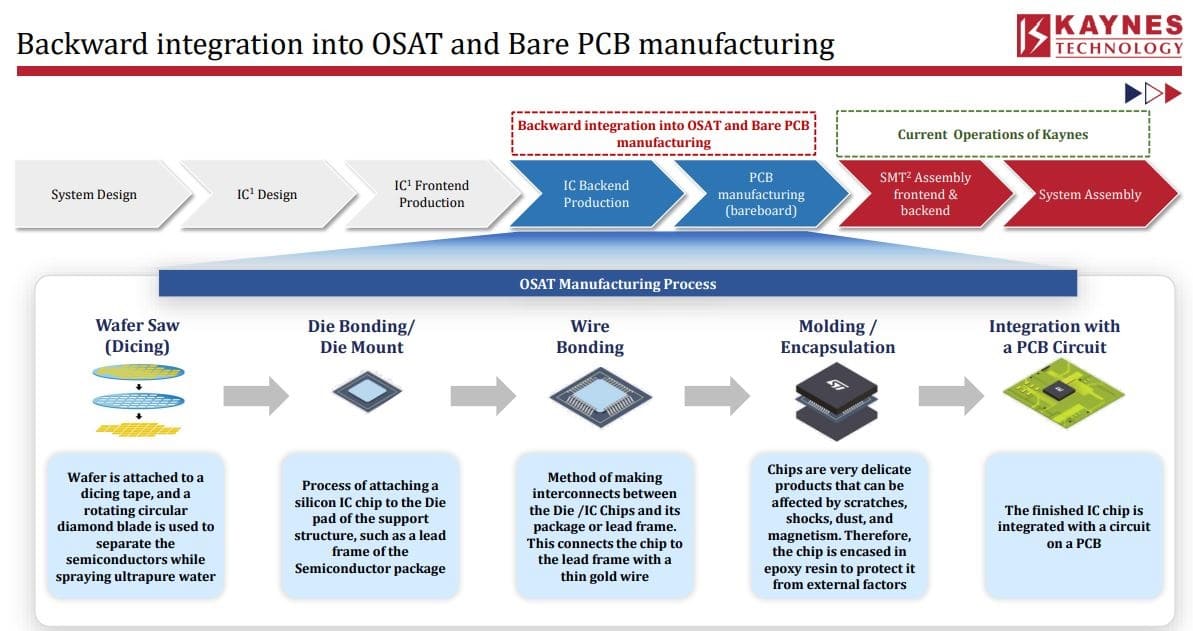

Kaynes is setting up an OSAT facility and undertaking a PCB expansion project.

The OSAT facility is being set up at an investment of Rs 2,850 crore in Telangana, to be operational by FY25. Kaynes has partnered with Globetronics Technology, a major OSAT company, to help with technology know-how and distribution.

Kaynes is the first Indian EMS player entering the semiconductor manufacturing supply chain. This would mean that as the domestic semiconductor industry evolves, Kaynes will be ready to reap the benefits at the right time.

For the PCB (printed circuit board) business, the expansion at the high-end PCB manufacturing facility in Mysore, Karnataka for Rs 1,396 crore will help Kaynes to cater to the growing electronics markets, especially in the consumer, medical, and defence industries. This backward integration will aid margin expansion while offering comprehensive solutions to its customers and potentially eliminating some of the supply-chain issues.

Outlook

Kaynes enjoys a well-diversified product and customer profile with a presence in all the growing verticals, including automotive, defence, railways, and IT. It enjoys the highest EBITDA margin among its peers and is the only player that has maintained a double-digit margin in FY24.

Revenue in the first half grew rapidly with commensurate growth in the order book, providing visibility for the next 12 months. The management's FY24 guidance of Rs 1,700-1,800 crore revenue, with more than 15 percent EBITDA margin, is broadly achievable.

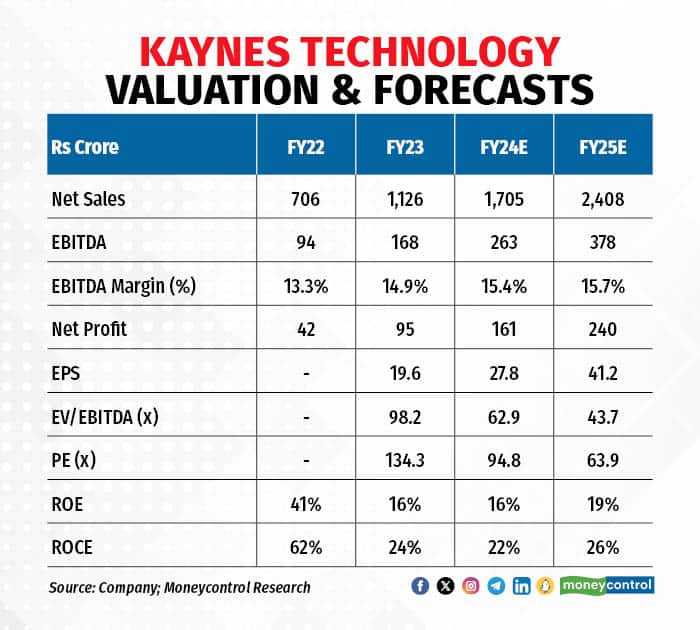

Its entry into OSAT could do wonders in the long term for revenue growth as well as margins. Kaynes didn’t receive the approval for IT PLI 2.0 and may miss a place in the highest-growth category in the Indian EMS market as compared to peers such as Syrma and Dixon. Nonetheless, the company is on a very strong growth trajectory and is likely to remain one of the leaders in the Indian EMS story. We are revising upwards our estimates for revenue, margin, and EPS and now forecasting a revenue CAGR of 46.2 percent and an EPS CAGR of 45 percent over FY23-25.

Valuation

Kaynes' stock price has moved sideways in the last two months after a very strong run earlier in 2023. At the CMP of Rs 2,633.15, the stock is trading at an FY25 PE of 63.9 times, which, adjusted for growth, translates into a PEG of 1.4x. This appears steep and we retain an equal-weight rating and reiterate that investors wait before making a fresh investment.

Risks

A slowdown in growth due to competition, delay in execution, margin dilution, and a longer working capital cycle

Nitin Sharma can be reached on Twitter at @nsharma_01. For more research articles, visit our Moneycontrol Research page.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now