IDFC FIRST Bank, along with LIC Cards and Mastercard, recently launched a co-branded card — LIC IDFC FIRST credit card. The card comes in two variants — LIC Classic and LIC Select — and will give cardholders the benefit of earning reward points at an accelerated rate on their LIC premium payments.

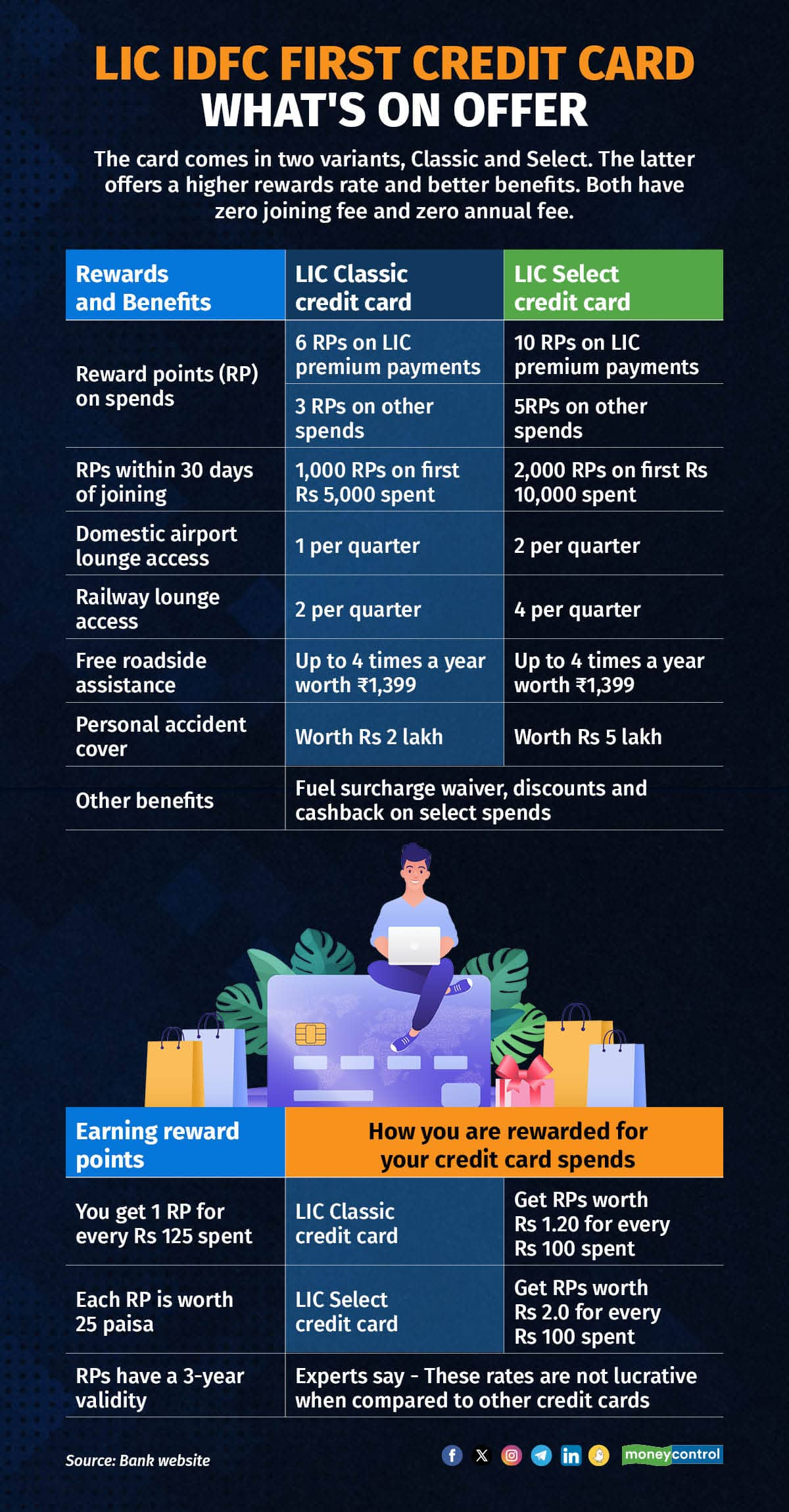

Apart from that, the card offers reward points on other spends, offers joining benefits, airport and railway lounge access, complimentary roadside assistance, and personal accident insurance cover. (see graphic for details).

The LIC Select variant offers a higher reward rate and certain better benefits than the LIC Classic variant. Only those with a good credit profile (high credit score) are likely to be eligible for the former.

What you get

You get 3 and 5 reward points (RPs) for every Rs 125 spent on the LIC Classic and LIC Select credit card, respectively, for most categories such as groceries, utility bills, government payments.

LIC insurance premium payments can, however, fetch you RPs at a higher rate – 6 RPs on the Classic variant and 10 RPs on the Select variant for every Rs 125 spent (see graphic for details).

Note that each RP is worth 25 paise only. As with most other credit cards, the RPs can be redeemed / spent on gift vouchers, payment for online transactions, conversion into travel miles, etc.

Both the variants come with zero joining fee and zero annual fee. Also, the interest rate on the credit card (applicable on card dues) ranges from 0.75 to 3.5 percent per month (9 to 42 percent per annum).

You do not need to be an LIC policyholder to be eligible for this credit card.

Also read: The charges lurking in your credit card you didn’t know about

Not a very rewarding rewards rate

Credit card experts we spoke to say that the card has an ordinary (not lucrative) rewards rate and it offers only regular benefits.

According to Sumanta Mandal, Founder, TechnoFino, a digital platform that reviews credit cards, compared to industry standards, the Classic and the Select variants of the LIC IDFC FIRST credit card offer a low value-back rate of 1.2 percent and 2 percent, respectively. The value-back rate tells you the total rupee value of RPs earned for every Rs 100 spent on a card.

This metric can be useful for comparing credit cards.

Here’s how the value-back rate is calculated. Take for instance, the LIC Select credit card that offers 10 RPs for every Rs 125 spent. If you assume proration, this would mean you get 8 RPs for every Rs 100 spent. At the rate of 25 paise per RP, these points are worth Rs 2 in total, or a 2 percent value back rate. Note that this calculation assumes the highest reward point earn rate that is applicable for LIC premium payments.

Ankur Mittal, Co-Founder and CTO, Card Insider, a credit card comparison and review platform, offers a slightly different view. “Those with high-value LIC insurance premium payments, say upwards of Rs 1 lakh a year, can get some benefit from this card for no charge. Otherwise, it’s an entry-level card. There are many better credit cards to choose from such as Amazon Pay ICICI Bank credit card, AU Small Finance Bank’s LIT credit card etc,” he said.

According to another credit card expert who did not wish to be named, IDFC FIRST Bank’s core credit cards (not the co-branded cards) can be considered better than the bank’s latest co-branded card with LIC Cards.

Also read: Fallen into a credit card debt trap? Here are strategies to pay off your debt

Not-so-special benefits

In terms of benefits too, the LIC IDFC FIRST credit card is not a stand-out card. Benefits such as complementary airport lounge, fuel surcharge waiver, cashback on certain spends, discounts etc., are not unique.

Furthermore, while the interest rate charged on credit card dues starts from as low as 9 percent per annum (significantly lower than what most credit cards charge), not every card holder will be eligible for such a rate. A person with intermittent / uncertain cash flows, who is most likely to make delayed credit card bill payments may, in fact, not even be granted this favourable rate.

Having said that, the card has two positives.

Mandal says, “The complementary railway lounge access offered by the card is a useful feature. Several credit cards offer airport lounge access but only a few offer railway lounge access.” He also finds the complimentary roadside assistance of Rs 1,399 beneficial. “During the warranty period, your car company will provide you free road-side assistance. Once that period is over, you can utilise this benefit. You will have to call the bank’s dedicated helpline to book this service.”

The bottom line

While the LIC IDFC FIRST credit card comes free of charge, it does not offer a very compelling proposition for most credit card customers.

Those spending substantial sums on LIC insurance premiums could perhaps consider signing up for the card. But even for such customers, this may not be the best option. According to Mandal, the Standard Chartered Ultimate and HDFC Bank Infinia credit cards offer higher value back rates of 2 percent and 3.33 percent, respectively, on premium payments to any insurance company.

And, given that the best rewards rate offered by this credit card is on premium payments to LIC, the card offers even less value to those who are not LIC policyholders.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!