There is an emerging trend of millennials believing in funding their weddings, taking the burden off the shoulders of their parents. While this is good for those who have adequate savings or financial resources to foot the wedding bill, those who do not have enough savings end up borrowing. According to the IndiaLends Wedding Spends Report 2.0, of brides and grooms who plan to self-fund their weddings, 41 percent plan to use their savings, 26 percent will consider personal loans, and the remaining 33 percent are undecided. Of those considering borrowing, 68 percent plan to borrow between Rs 1 lakh and Rs 5 lakh. The survey was conducted in October–November 2023, in which 1,200 millennials took part.

Gaurav Chopra, founder and Chief Executive Officer (CEO) of IndiaLends, a fintech lender, said, “The trend of self-funding weddings highlights a sense of financial independence and conscious decision-making. Moreover, it's worth noting that 26 percent of these individuals choose the option of loans, challenging the long-standing taboo associated with wedding financing.”

Besides loans for weddings, 'Marry now, pay later (MNPL)' schemes have also entered the wedding space. The MNPL scheme, launched by SanKash, a fintech lending platform, partners with hotels across cities. “We received an overwhelming response to the scheme. Within a week of its launch in March this year, we received over 100 queries worth Rs 8 crore from Delhi’s National Capital Region (NCR) for services, including food, venue, decoration, and trousseau,” said Akash Dahiya, CEO and Co-Founder, SanKash.

Wedding loan vs MNPL scheme

While the terms 'wedding loan' and 'Marry Now, Pay Later' schemes are often used interchangeably, they represent distinct financial products.

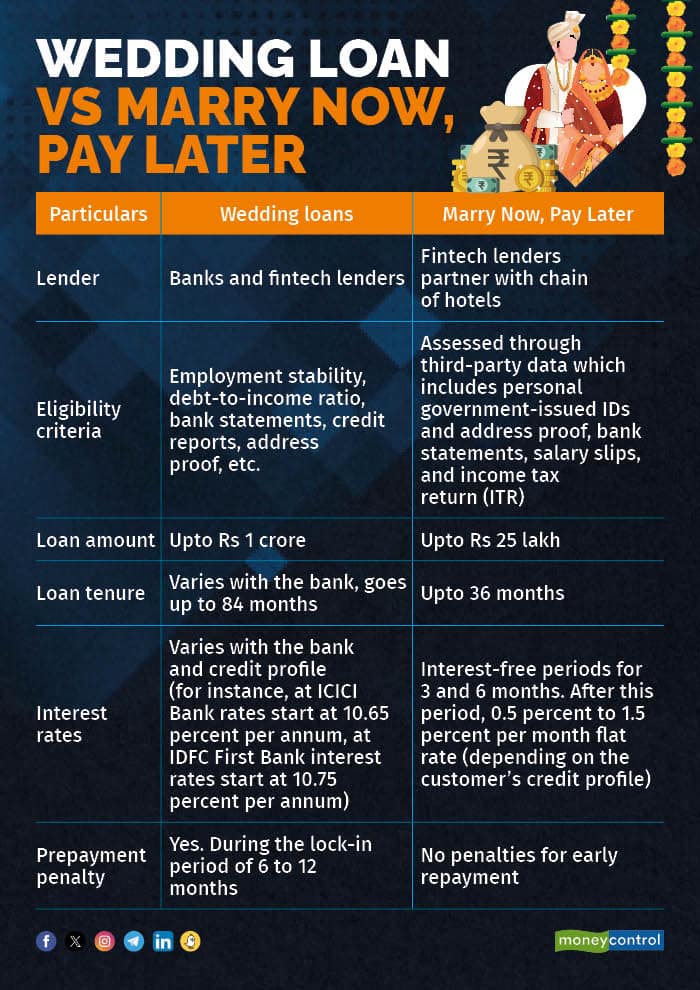

“Wedding loans are typically traditional personal loans designed explicitly for wedding expenses, with borrowers receiving a lump sum upfront and repaying it through fixed monthly instalments. These are offered by banks and fintech lenders,” said Yashoraj Tyagi, CEO, CASHe, a fintech lender. So, banks including Axis Bank, ICICI Bank, IDFC First Bank, and HDFC Bank, as well as fintech platforms such as CASHe and IndiaLends, offer personal loans for weddings. Eligibility for a wedding loan depends on factors like income, employment stability, debt-to-income ratio, age, and residency. Tyagi said, “Employment verification, recent bank statements, and credit reports are also commonly requested to assess financial stability and creditworthiness.”

Fintech lenders who partner with hotel chains in various cities offer MNPL schemes. For instance, SanKash has partnered with multiple hotels across Agra, Delhi, Gurugram, Nathdwara, Jaipur, Chandigarh, and Pune, among others.

“If a customer opts for MNPL at a partnered hotel, SanKash comes in and evaluates the customer’s credit profile and employment background. When the loan is approved, we pay the hotel on behalf of the customer. And the customer starts paying equated monthly instalments (EMIs) to SanKash's non-banking financial company (NBFC) partners for the tenure they have selected,” Dahiya explained.

Also read | Made in heaven: How to choose a wedding planner

Loan tenure and charges

ICICI Bank offers wedding loans ranging from Rs 50,000 to Rs 50 lakh. The interest rates start at 10.65 percent per annum. The tenure of the loan is 12-72 months. Similarly, IDFC First Bank offers personal loans up to Rs 1 crore for weddings, with interest rates starting at 10.75 percent per annum and a flexible tenure of up to 84 months. For wedding loans, there is no need for a guarantor. The terms and conditions for wedding loans vary from bank to bank.

In MNPL schemes, the maximum amount of funds a customer can avail of is Rs 25 lakh. “The customer is assessed through third-party data, which includes personal government-issued IDs and address proof, bank statements, salary slips, and income tax returns (ITR),” said Dahiya.

To sweeten the deal, the fintech firm could throw in a three-to-six-month interest-free period for the borrower. This, however, depends on the former's tie-up terms with the hotel, said Dahiya. At the end of this honeymoon period, interest at a flat rate of 0.5 percent to 1.5 percent per month (depending on the customer’s credit profile) kicks in. The repayment tenure varies from three months to 36 months. There are no penalties for early repayment.

“Depending on the amount borrowed, you might need to go for a loan against your mutual fund investment. But in most cases, it's collateral-free borrowing,” Dahiya said.

Key terms to know

Before taking out a wedding loan, or MNPL, borrowers must understand key terms such as interest rate, loan amount, and repayment schedule. “Borrowers should be aware of total repayment amounts (principal and interest), fees, and any prepayment penalties that might apply,” said Tyagi.

“It’s recommended that annual percentage rates from different lenders be compared to get the best deal,” said Shavir Bansal, founder and CEO of Kifaayat, a fintech start-up.

Some banks have a lock-in period of six to 12 months. “During this period, you might have to pay a prepayment penalty,” said Bansal. It's important to know the details of this period, especially if you plan to pay off the loan ahead of schedule.

These schemes have some drawbacks if not used wisely. “In case the EMIs are not paid on time, it may invite penalties and even hurt your credit scores,” Dahiya cautioned.

Also read | Managing money as a couple: Should it be done jointly or separately?

Should you apply?

Taking out a loan to fund your wedding is not a wise financial move. Weddings are already expensive affairs.

“Taking a wedding loan for marriage isn’t advisable. It is best avoided,” said Dev Ashish, a Securities and Exchange Board of India (SEBI)-registered investment advisor (RIA) and founder, StableInvestor. "If your savings aren’t enough for the budget of your dream wedding, then consider reducing the budget and bringing your expenses within your budget instead of borrowing."

According to Bansal, it is best not to burden the period immediately after marriage with a loan repayment. “That’s a joyous and stress-free period of life; let it remain so,” said Bansal. Also, starting a married life with wedding loans can limit your financial flexibility to start investing jointly for your joint financial goals.

“Couples should assess their financial situation, establish a realistic budget aligned with their long-term goals, and openly communicate about their priorities,” Tyagi said. By weighing the potential impact on their financial well-being and considering alternatives, couples can make choices that align with their values and ensure a more stable start to their married life.

“MNPL works best for those couples or sets of individuals who do not wish to make their wedding a financial burden on their families and wish to finance the same by themselves,” Dahiya said.

Just because you are easily able to get a loan for the wedding doesn’t mean you should take one. And even if you need to borrow, don’t borrow more than is necessary. “Borrow just for the basics and not for the showbiz part of a big fat Indian wedding,” said Ashish.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!