Claims in health insurance come thick and fast. In SecureNow’s own portfolio we see that for every 100 people insured, five make a claim each year.

So, evaluating an insurer’s claim performance is essential when buying health insurance. There are four questions you must ask: How many of the claims made are settled; how much of the claim is settled; how long does it take to settle a claim and finally, how many claim grievances are there?

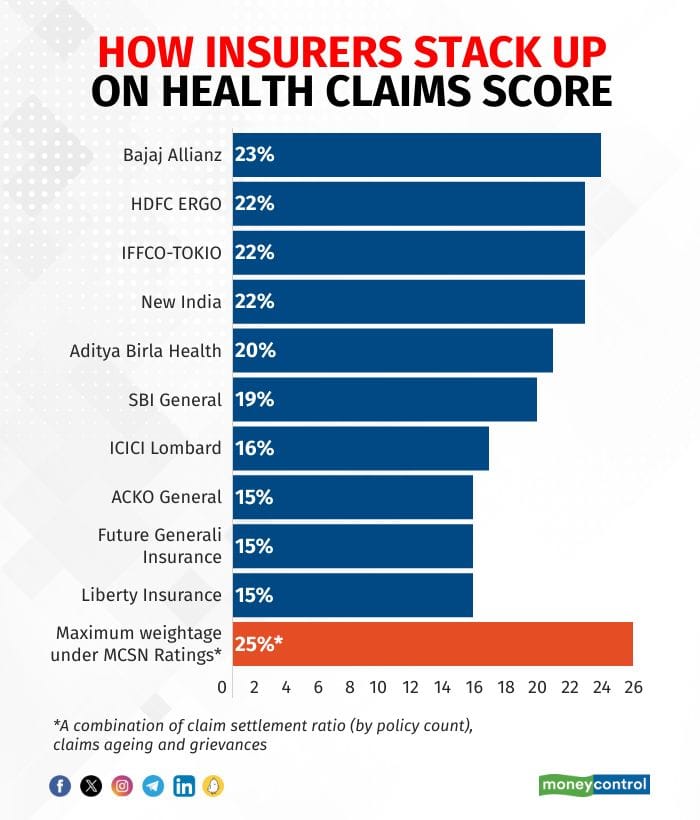

When we did our first ratings, the weightage given to claims was 20 percent. Since then, we have increased this to 25 percent. The more significant change has been that whereas previously we measured only claims settlement rate, now we also have claims aging and grievances. This makes the comprehensive claim scores more robust.

Also read: Moneycontrol-SecureNow Health Insurance Ratings: How to pick the right health insurance policy

Claim settlement needs a periodic assessment

At an overall level, combining all our parameters the leading five insurers are Bajaj Allianz, New India, HDFC Ergo, IFFCO-Tokio, and Aditya Birla Health. The overall scores are made of three sub-scores for claim settlement, claims aging and grievances.

We define claim settlement rate as the number of claims paid over the total claims decisions taken. Between 2013 and 2022, the number of claims has increased very significantly but the overall industry-wide claims settlement rate has been consistent. About 16 insurers had over 90 percent claim settlement rates in both 2013 and 2023.

The leaders in claims settlement rates in 2022 were Aditya Birla, Bajaj Allianz, HDFC Ergo, New India and SBI General Insurance. What we have seen though is that insurer performance on claims settlement has fluctuated over the years.

Also listen: Moneycontrol-SecureNow Health Insurance Ratings: Your one-stop guide to choosing the right policy | Simply Save

Many mid-performing insurers in 2013 are now in the top quartile, and vice versa. Because claims settlement performance is not static, you must reassess this periodically. This is where insurance portability is super helpful. It allows you to switch insurers without a loss in benefits.

How much of a claim is settled is not available publicly. However, from our own database of thousands of claims, we know that this is about 85 percent on average. So, 15 percent of claims, which is generally the cost for consumables or administrative charges, are not covered. Some insurers are now addressing this 15 percent gap by offering an add-on that comes at an additional cost but covers consumables as well.

Turnaround time for settling claims matters

Information on how long it takes to pay a claim is available and we have factored this in. In 2022, about 11 insurers settled over 95 percent of claims within 30 days. The leaders here were Care, Cholamandalam, ICICI Lombard, Magma HDI and Niva Bupa Health Insurance. What is not yet publicly available is the time from when a patient was ready for discharge to when she left the hospital. This is long, about 7 hours on average.

Much of the delay is caused by the hospital taking time to prepare the discharge summary and then sending the information to the insurer. Often insurers will make requests for additional information, and this also takes time.

Finally, we have grievance information available in the public disclosures. Claims grievances are normalised across insurers by the number of claims that each insurer gets. This year the grievances range from 3 to 49 per 10,000 claims. You should be reassured by the fact that this grievance rate is low which means that there is a large majority of claimants that are satisfied. However, there are large variances amongst insurers, and this is factored into the claims assessment of the ratings.

Standardised definitions help streamline the claim process

Over time we would like even more granular claims information. Specifically, product-wise settlement rates, grievances and aging are regularly required; the reasons for claims rejection should be known and the proportion of claims made that are paid must also be disclosed.

The claims process has been considerably streamlined over the years. One reason for this is that the regulator has identified allowed exclusions and also defined the often-used terms such as pre-existing conditions. This reduces the burden on insurance buyers of reading through detailed wordings of each insurer they evaluate.

Health insurance purchases have always been onerous. However, now with the regulatory minimum standards, information available and the synthesis that our ratings provide it is easier to pick the most appropriate insurance policies.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!