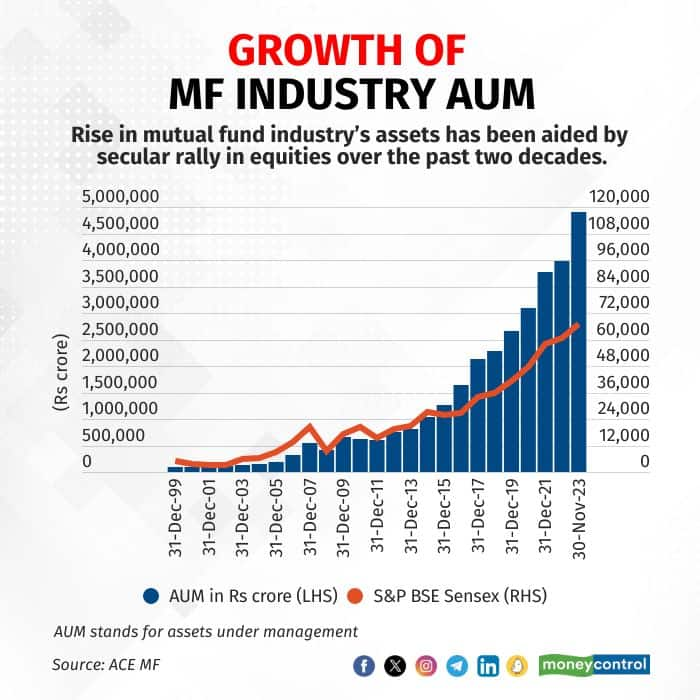

The Indian mutual fund industry’s total assets under management (AUM) have crossed the Rs 50 trillion mark in December 2023 in the 60th year of its existence, industry insiders say.

The official industry numbers on AUM will be released by the industry body Association of Mutual Funds in India in January. The MF industry’s AUM had reached Rs 49.04 trillion in November 2023, already. Experts say that the recent equity market rally has carried the MF industry past the landmark.

Mutual Funds Sahi Hai

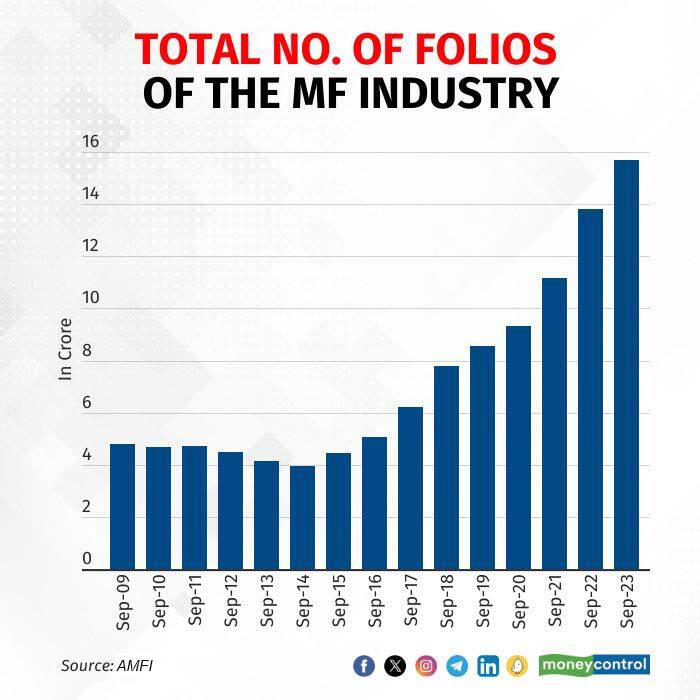

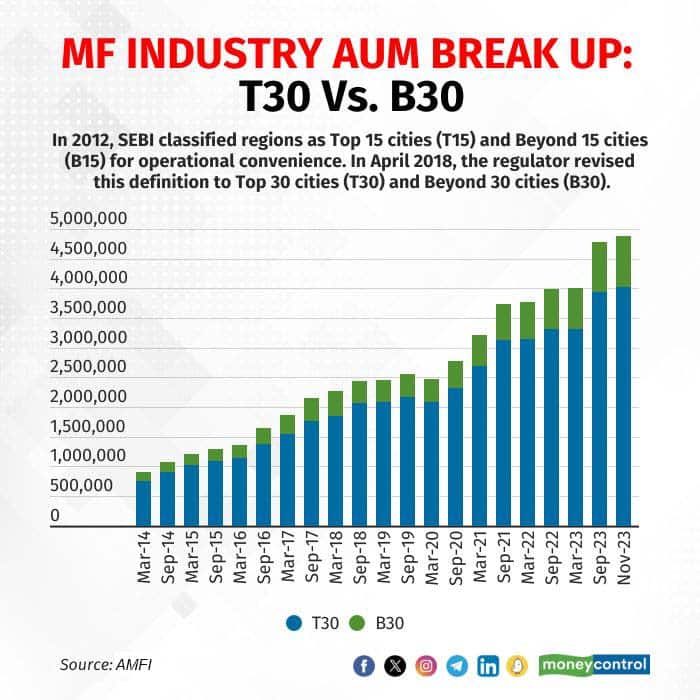

Industry leaders are unanimous in accepting that the ‘Mutual Funds Sahi Hai’ campaign has single-handedly taken mutual funds to each and every nook of the country. The investor education and awareness initiative was started in March 2017.

“The differentiating or the key moment for the industry was the ‘Mutual Funds Sahi Hai’ campaign,” says Swarup Mohanty, Vice-Chairman and CEO, Mirae Asset Investment Managers.

Also read | When Edelweiss MF’s Radhika Gupta helped start SIPs on the sets of Shark Tank India 3

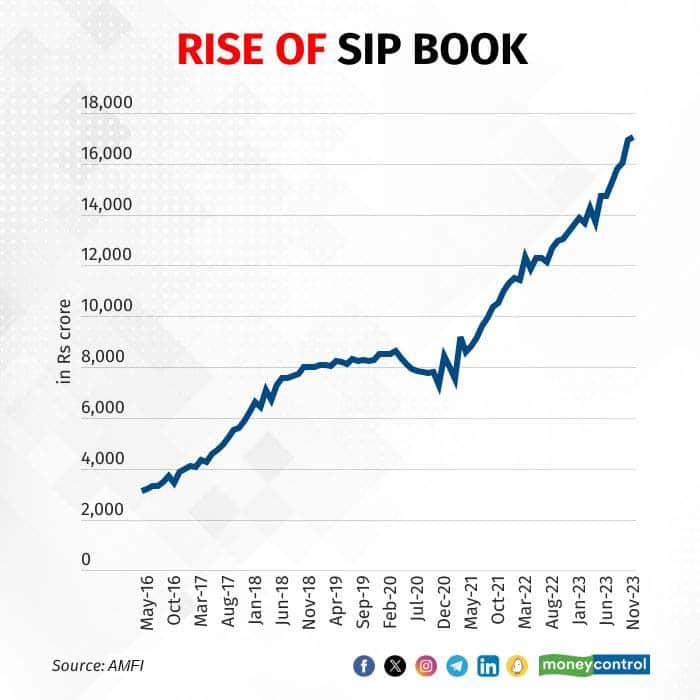

Meanwhile, Radhika Gupta, MD and CEO, Edelweiss Mutual Fund, believes that the campaign has made SIP (systematic investment plan) and mutual funds popular words in the country.

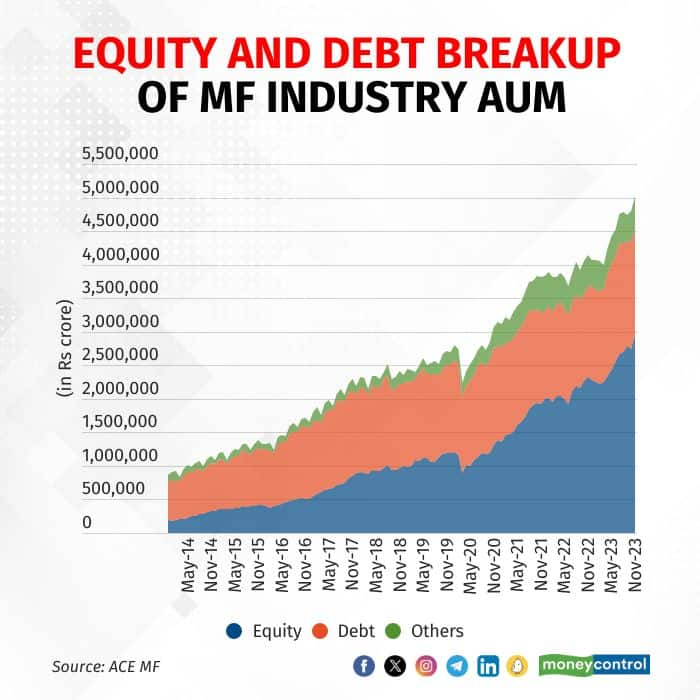

Data shows that since the end of 2017, the AUM of the industry grew 135 percent from Rs 21.26 trillion to more than Rs 50 trillion during December 2023. During the same period, the BSE Sensex rose 100 percent from 34,057 to more than 70,000 levels.

At the same time, mutual fund folios gained more than 150 percent to 15.71 crore, showing the impact of the ‘Mutual Funds Sahi Hai’ campaign.

Returns, delivered!

Thanks to the secular rally in equities over the past decade, mutual funds have been able to deliver constant returns to investors.

Ravi Kumar T V, Founder of Gaining Ground Investment Services, says, “There is structural growth in markets. We didn't have any three-four-year kind of underperformance and markets have made new highs like every three years. Given the kind of returns delivered by markets, more and more people have become motivated to invest in mutual funds.”

Also read | Year-end special 2023: Budget shocker, IRDAI expense regulations defined 2023 for insurance industry

As per Kumar, the removal of entry load on mutual funds in 2009 was also one of the major masterstrokes that helped the industry. An entry load was a charge levied by an MF when an investor steps in, to meet their marketing costs and distribution commissions.

Nilesh Shah, MD and CEO of Kotak Mahindra Asset Management Company, said, “By and large, we have delivered inflation-beating returns to investors, our NPAs (non-performing assets) are lower than banking or insurance systems and our performance is better from a real return point of view. This has again helped in getting investors' trust and confidence.”

Distribution push

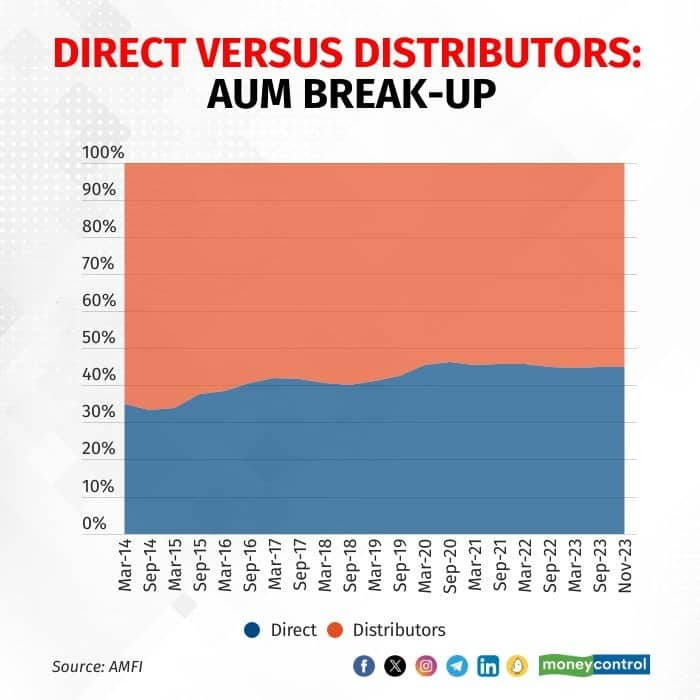

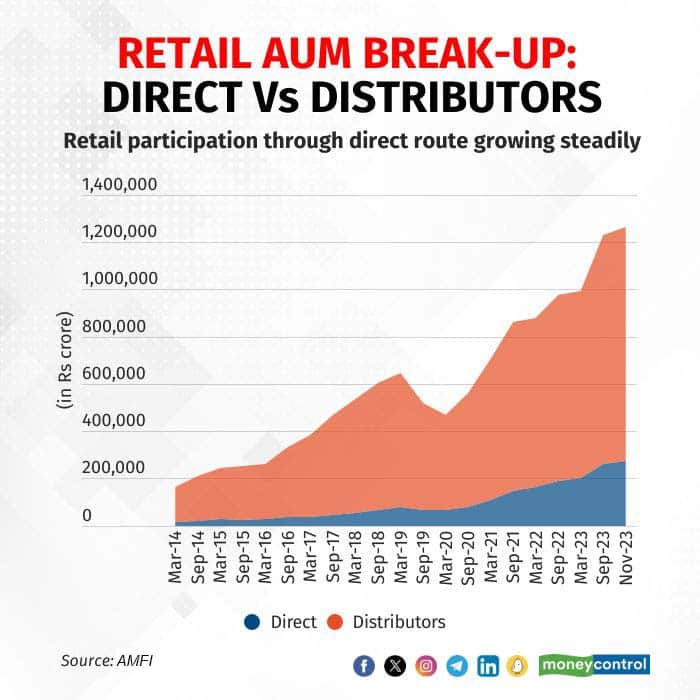

Data shows that retail participation in mutual funds through direct route has grown steadily over the years, while distribution route has seen manifold growth on a much bigger base.

As per data available with ACE MF, retail AUM via direct route has grown from Rs 15,491 crore in March 2014 to Rs 2.74 trillion in November 2023, a jump of 1,671 percent.

Distributor AUM has grown from Rs 1.47 trillion to Rs 9.89 trillion, a jump of 573 percent during this period.

Also read | Mutual Funds Year-end Special 2023: 5 things that impacted how you invested in 2023

“Distributors have played a very important role. They took mutual funds to every pin code in India. They ensured that investors were handheld during all the ups and downs,” said Shah.

Shah of Kotak AMC credits “Triveni Sangam” of regulator, manufacturer and distributor for doing their job in serving mutual fund customers.

“Without regulations, this industry would not have reached here. Because of these guardrails, we have survived. All of us get inconvenienced by the regulator sometimes, but there's no doubt that without SEBI (Securities and Exchange Board of India), the mutual fund industry would not have reached where it is today,” said Shah.

In 1993, SEBI introduced the first of mutual fund regulations. SEBI has constantly updated its regulations.

“We return money to consumers and it's easy to exit an investment. Tight regulations are welcome in a largely financially illiterate market,” said Gupta.

This has led to trust. “People invest in banks because there is an implicit and explicit guarantee of government, in insurance there is LIC (Life Insurance Corporation of India) and the government itself is behind EPFO (Employees' Provident Fund Organisation). Mutual funds is an arena where the private sector has played a bigger role than the public sector,” said Shah.

What held back growth?

As per estimates, mutual funds continue to form a modest slice of the total pie of household savings, as they contribute less than 10 percent to the total financial savings as of March 2022. Bank deposits continue to have a humungous share, followed by life insurance.

So, what has held back this growth?

Also read | How India’s health insurance preferences have changed over the last three years

Kumar believes that the lack of simplification in mutual funds has hampered growth. “People are now confused between categories such as flexi-cap and multi-cap. If there were fewer categories since the beginning, we would have achieved the Rs 50 trillion mark much earlier,” he said.

Lack of financial literacy, too, should be blamed, says Mohanty. “The need for investing is not yet there in India. People think that buying a car is more important than investing,” he said.

Meanwhile, Gupta noted that there is a need for greater push for distribution in India. “There is a need to make distribution a serious profession because it will also contribute not just to financialisation, but also help in employment and entrepreneurship,” she said.

Lack of level-playing field

Shah rues that the only thing that would have helped mutual funds grow more than what they achieved is the level playing field with other financial services industries.

“In the insurance industry, commission structures are fairly high and transparency is fairly low, and they have a tax advantage. In NPS (National Pension System), if you're a salaried employee, you get 10 percent of your salary income tax-free, that's about 3.9 percent tax exemption given. We are more transparent, we pay less commission, we balance the interest of manufacturer, distributor and investor and yes, we have to fight this non-level playing field,” said Shah.

Meanwhile, Shah is confident that when the level playing field is achieved in mutual funds, it will accelerate the industry's growth in a big way. “Otherwise, we'll achieve it with our performance,” he said.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

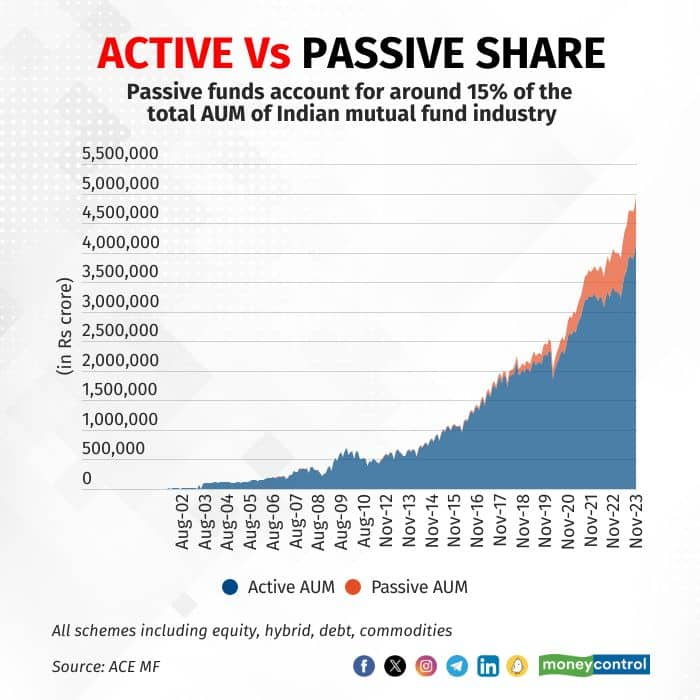

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now