Soon, you will be able to withdraw money from your National Pension System’s (NPS) lump-sum corpus once you turn 60, in a systematic manner.

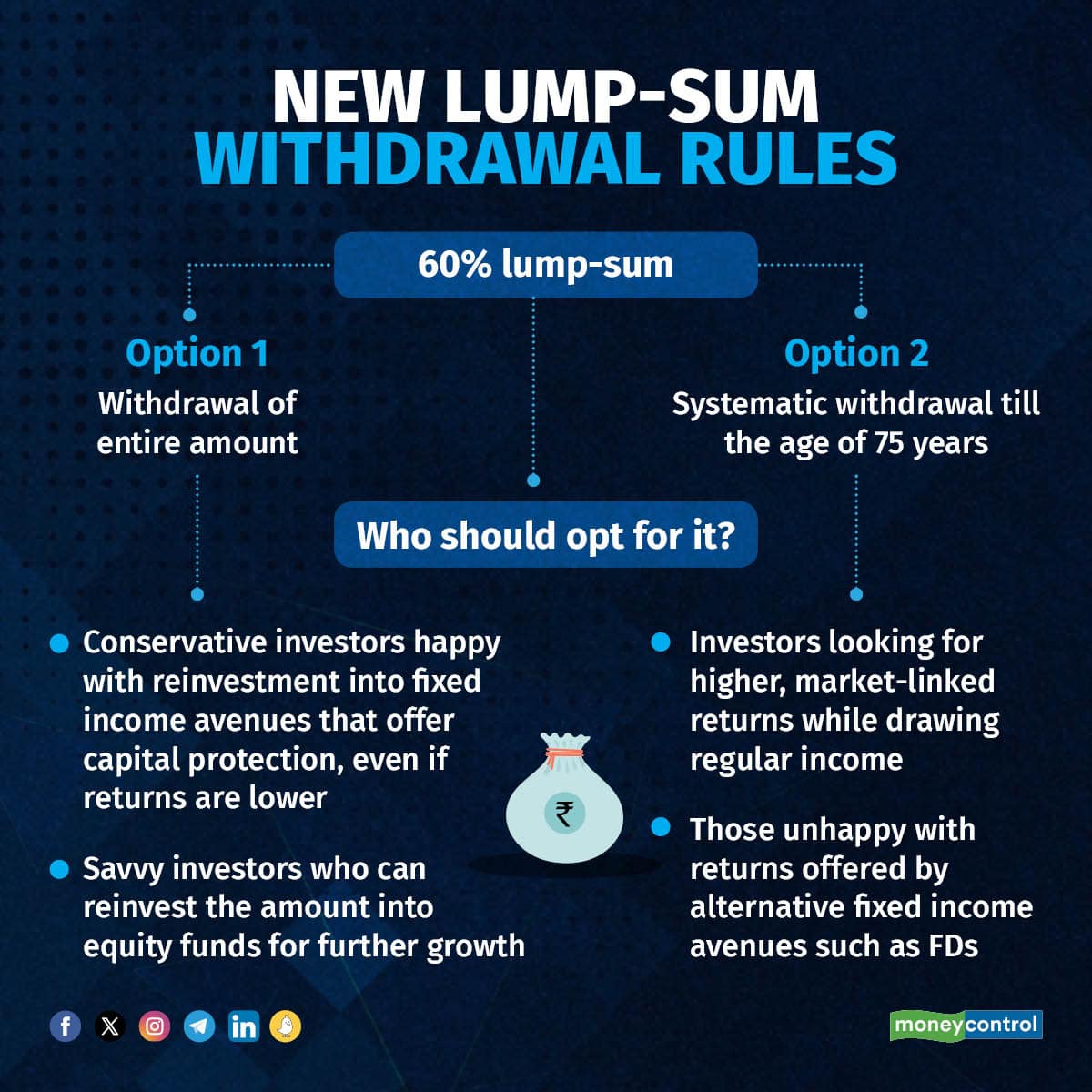

The Pension Fund Regulatory and Development Authority (PFRDA) recently decided to provide the option of 60 percent lump-sum withdrawal in a staggered manner through the systematic lump-sum withdrawal (SLW) facility. You can choose to receive the proceeds in monthly, quarterly, half-yearly and annual modes until you turn 75.

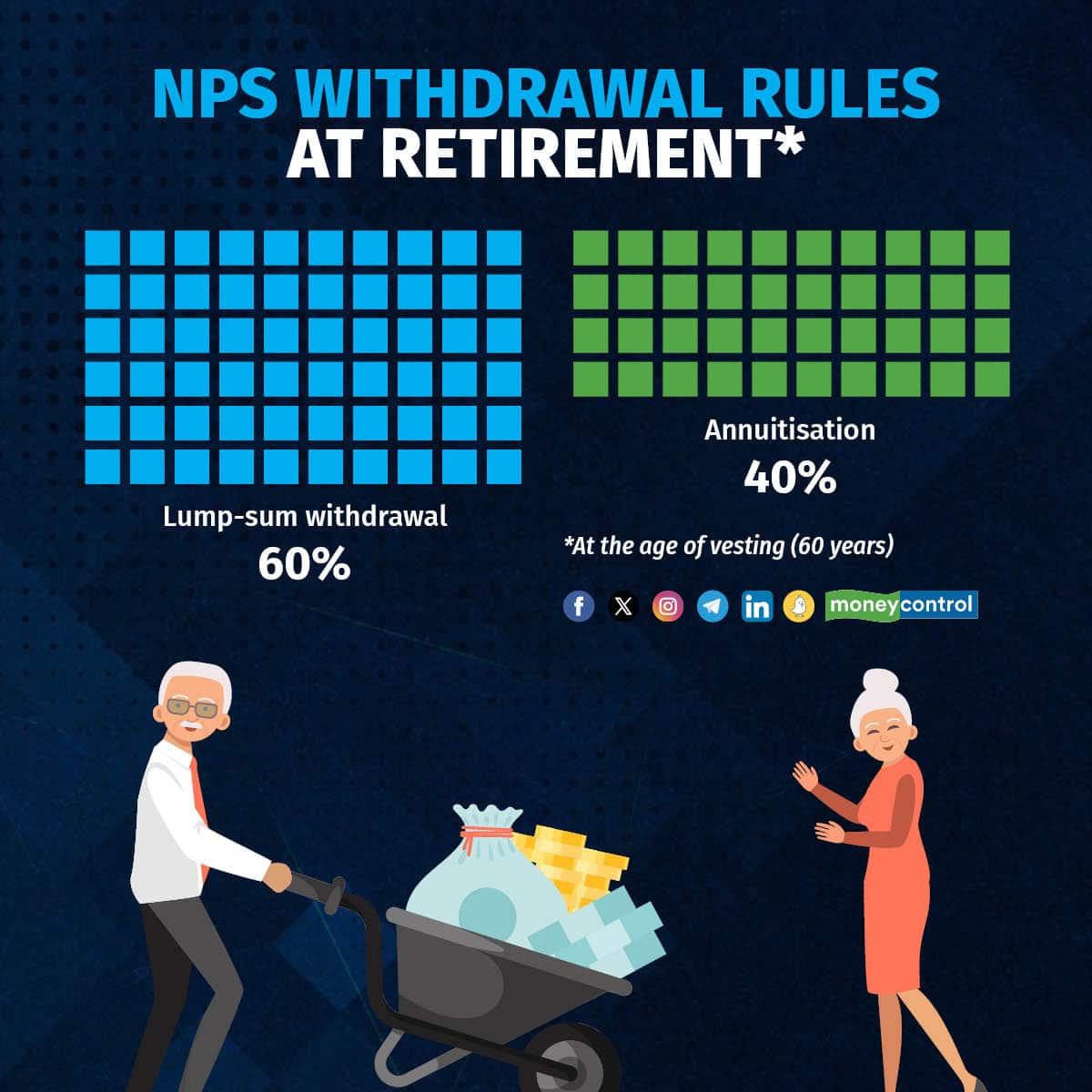

Under NPS, you can make a tax-free, lump-sum withdrawal of up to 60 percent from your kitty at the age of vesting (that is, when you turn 60), with the balance (at least 40 percent) being mandatorily converted into annuities. This remains unchanged.

PFRDA’s latest move does not mean that the long-standing demand to allow systematic withdrawal of the entire NPS corpus at the age of vesting (60 years) has been accepted. The regulator is yet to permit systematic withdrawal instead of annuitisation—40 percent of the amount will still have to mandatorily be converted into annuities, that is, pension income.

The recent decision only pertains to the 60 percent lump-sum component of your NPS retirement kitty.

Also read: How NPS' staggered lump-sum withdrawal plan can help retirees earn regular income

Automated withdrawals from the lump-sum component allowed

To be sure, NPS subscribers can make staggered withdrawals even today. However, the process is not automated currently.

You can also choose to defer receiving the entire or part lump-sum component until the age of 75 and opt for annual withdrawals. However, if you want to make phased, annual withdrawals, you have to make the request every year, which then needs to be authorised.

In contrast, the new feature will facilitate automated systematic withdrawal, on the lines of the facility that mutual funds currently offer.

Now, every NPS subscriber will have to make this choice at retirement—lump-sum proceeds or systematic withdrawal?

Seeking higher income? Market-linked SLW can help

The decision is particularly relevant for those who have equity exposure through NPS’ scheme E. “The benefit of opting for systematic withdrawal is that you can continue to stay invested if your NPS portfolio has exposure to equities. This will leave the door open for capturing the upmoves in equity markets, thus boosting your overall income through NPS,” says Vidya Bala, co-founder, Primeinvestor.in, an investment research and advisory firm. Just like systematic investments into equity mutual funds can counter volatility in the markets, systematic withdrawal, too, helps in averaging out the highs and the lows.

“Unless you can invest the lump-sum in alternatives that yield superior returns of over, say, 8 percent, systematic withdrawal makes sense, particularly if you have exposure to equities that can ensure higher returns, and thus, higher income,” says Bala.

She does not recommend withdrawing the lump-sum to park the funds in guaranteed fixed income instruments. “Fixed deposits and bonds have yielded lower returns over the past two decades and these continue to gradually decline. Market-linked instruments such as NPS systematic withdrawal will help you net superior returns for longer,” she adds. The key here, however, if your overall retirement planning strategy.

Also read: NPS: Which is the best annuity option?

Conservative investors: choose systematic withdrawal, shift to fixed income

Financial advisory firm Fisdom’s research head Nirav Karkera believes that if the retiree is conservative, keen on better predictability, seeks greater control over the proceeds and wants to preserve the capital, then lump-sum withdrawal would work better. “If she is highly dependent on the NPS corpus to meet retirement needs and it happens to be the largest retirement kitty that she has, she should ideally choose the lump-sum option and move the money into fixed-income instruments,” he says.

This will ensure stable returns, eliminating the risk of market fluctuations. "Conservative investors will have the comfort of better control and easier access to funds should any medical or financial emergency arise," he says.

Savvy investors can manage lump-sum better

The approach will be different for someone who is financially savvy and has managed to amass an adequate retirement kitty, even without factoring in the NPS corpus. In that case, Bala recommends withdrawing the lump-sum and investing the proceeds in an index equity fund.

“So, it boils down to your individual set of circumstances—if you are seeking growth, opt for lump-sum withdrawal that will be deployed into equities. If you need regular income with higher returns by way of equity exposure, opt for systematic withdrawal plan,” she says.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now