Only a small fraction of beneficiaries of accident insurance cover under the Pradhan Mantri Jan-Dhan Yojana (PMJDY) have made claims since the plan was launched a decade ago, data showed.

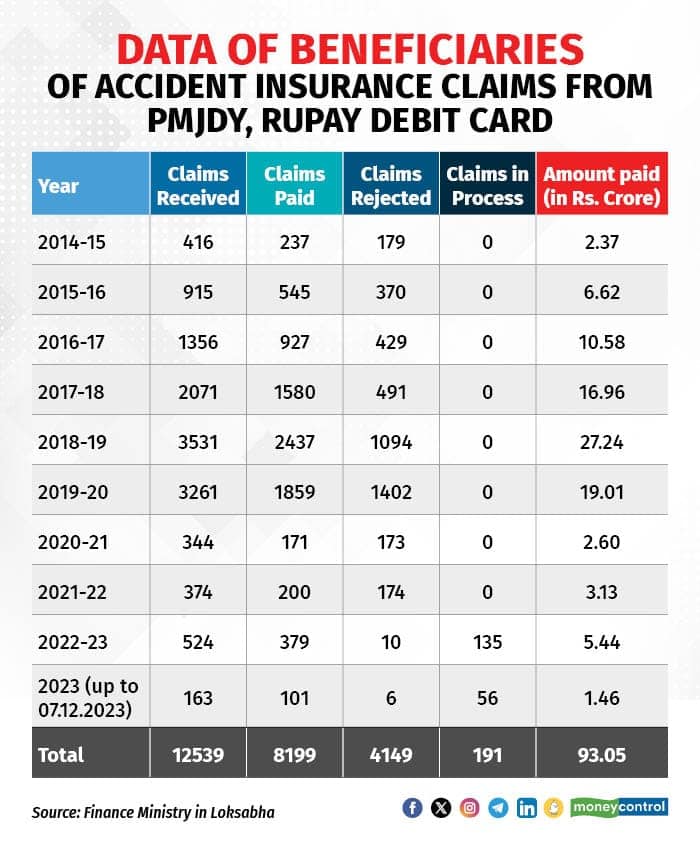

According to Finance Ministry data, only 12,539 claims were received since April 1, 2014. Notably, the total number of number of RuPay debit cards issued to beneficiaries as of December 6, 2023, is 34.71 crore.

As per the data, a total amount of Rs 93.5 crore has been paid under PMJDY, which provides a RuPay debit card with inbuilt accident insurance cover of Rs 2 lakh to account holders.

"The benefits of insurance will be available to the cardholders who have performed a minimum of one successful financial or non-financial transaction using RuPay debit card at any Channel (ATM / Micro ATM / e-commerce / POS and so on.) within 90 days prior to the date of accident including the accident date, "said Finance Minister Nirmala Sitharaman in a written reply to the Lok Sabha on December 18.

The Minister further added that out of 12,539, a total of 8,199 claims have been paid between April 1, 2014, to December 7, 2023.

Why the small number of claims?

According to experts, the small number of claims is due to a lack of awareness and the long process involved in making the claim.

Subhash Chandra Khuntia, Former chairperson of the Insurance Regulatory and Development Authority of India (IRDAI) told Moneycontrol that this is mainly due to people not being aware that they have insurance coverage.

"There is lack of awareness of the PMJDY RuPay debit card, which needs to be improved. Also, since it is an accident cover, one needs to prove it as an accident, so the definition of accident needs to be proved. So, there is a little rigorous process in claiming," he said.

This data is relevant in the context of the rising number of road accidents in India during this period. According to data of the Ministry of Road Transport and Highways (MoRTH) report during 2022, a total of 4,61,312 accidents were recorded in the country, of which, 1,51,997 (32.9 percent) took place on the National Highways including Expressways, 1,06,682 (23.1 percent) on State Highways and the remaining 2,02,633 (43.9 percent) on other roads.

"If we compare the total number of accidents happening in India every year; in comparison to that this number of claims is quite low mainly due to the lack of awareness, "he said.

India has witnessed 4,12,432 road accidents in 2021, and 3,72,181 in 2020, according to government data presented in Parliament. "I will also say that this is very good scheme and can help the account holders in many ways; so, banks should take the initiative to create more awareness on it, "added Khuntia.

In a written reply to the Lok Sabha, Union Minister of Road Transport and Highways Nitin Gadkari said that India reported as many as 1,68,491 road accident deaths last year. The number of road accident deaths in 2021 stood at 1,53,972, while it was 1,38,383 in Covid-hit 2020.

"People are not aware so claims are not filed. Once you are using a debit card; you just think that it's a debit card. There is a need to advertise more about it, and the process should be told to the people in simpler languages. There is need for more financial and digital literacy about it," said Chandan Sinha, former Executive Director of RBI.

The government should advertise the benefits in a more aggressive manner, said Rupam Roy General Secretary, All India Bank Officers’ Confederation (AIBOC).

R Gandhi, former Deputy Governor of RBI agreed that poor awareness about insurance could be one of the major factors.

The Pradhan Mantri Jan Dhan Yojana (PMJDY) was launched in August 2014, with the aim to provide universal banking services for every unbanked household. More than 51.09 crore accounts have been opened under the PM Jan Dhan Yojana in the last nine years and the deposit balance swelled to over Rs 2.03 lakh crore, the Finance Ministry said on August 28 via a release as the scheme completed nine years of successful implementation.

On August 28, 2023, Finance Minister Nirmala Sitharaman said, “The nine years of PMJDY-led interventions and digital transformation have revolutionised financial inclusion in India. It is heartening to note that more than 50 crore people have been brought into the formal banking system through the opening of Jan Dhan Accounts."

"Among these accounts, approximately 55.5 percent belong to women, and 67 percent have been opened in rural / semi-urban areas. The cumulative deposits in these accounts surpass Rs 2 lakh crore. Furthermore, about 34 crore RuPay cards have been issued to these accounts without charge, which also provides for a Rs 2 lakh accident insurance cover, "she said.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!