Highlights

So, why then look at the stock?

The coming quarter will see an inventory build-up before the peak season in the K-12 segment (Kindergarten to class 12). The March quarter accounts for 70-80 percent of annual revenues in the segment, offering the first-mover advantage to S. Chand on the back of syllabus changes under the National Curriculum Framework (NCF).

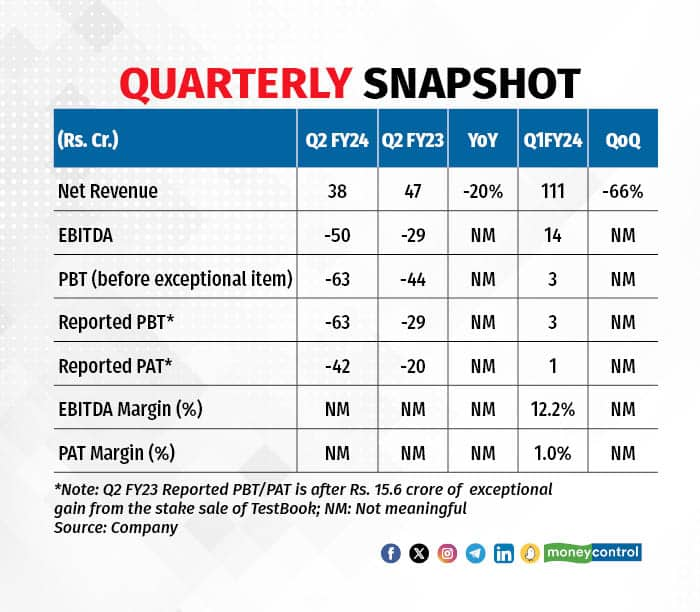

Q2 FY24 Update

Q2 saw pressure in HE segment sales

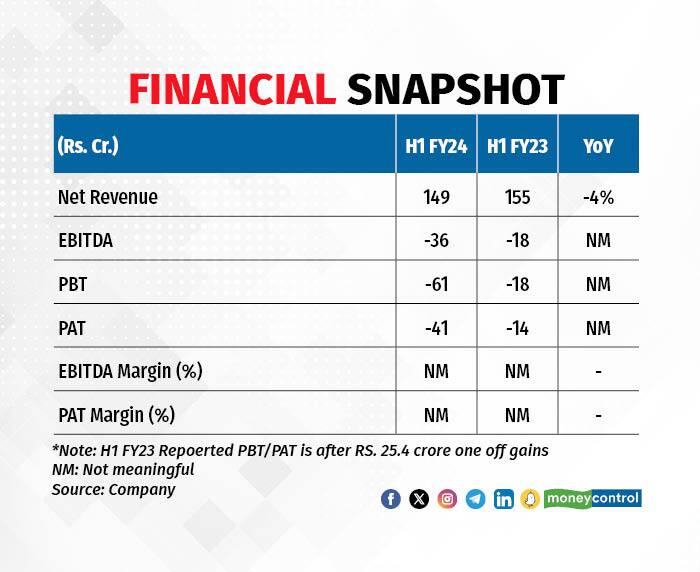

The 4 percent YoY decline in revenue in the first half of the current fiscal (H1 FY24) was primarily attributed to the softness in the HE and competitive exams segment due to the lower-than-expected job vacancy announcements in the period.

This, coupled with higher employee and marketing expenses, and the absence of one-off gains (exceptional income of Rs 25.4 crore in H1 FY23) led to higher net losses in H1 FY24.

That said, more job announcements by the government before the general election next year will boost the HE segment’s performance over the next two quarters. Also, S. Chand is poised to deliver strong volume growth in the publishing division with the phased implementation of the new education policy (NEP).

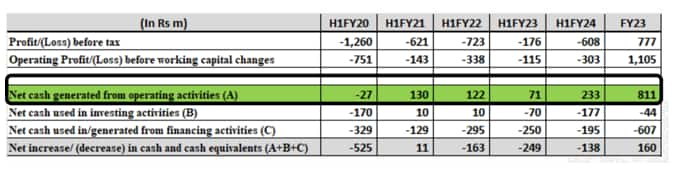

Strategic focus on improving cash flow

The company remains net debt free, backed by higher cash flows in the September quarter. The first half of FY24 saw the strongest operating cash flow in the company’s history (Rs 23.3 crore against Rs 7.1 crore in H1 FY23).

Source: Company Presentation

Source: Company Presentation

Tech products will be a big valuation driver on the back of rising digitisation

Mylestone (K-8 curriculum solution) is expected to grow exponentially with the focus on bigger schools aiding profitable growth. Moreover, the recently-launched YouTube channel had also recorded strong growth in H1 FY24.

Outlook

After a long gap of 18 years, the NCF implementation will fuel the next leg of growth in the medium term. The management expects around 30-40 percent of schools to adopt the new curriculum in the current academic year.

S. Chand had already launched books with new content that is in line with the new NCF (increase in number of subjects/domains) and is ready for the upcoming sales season in December 2023.

The margin trajectory will depend on the movement in paper prices during the year. However, the company plans to take a single-digit price hike across the product portfolio in H2 FY24.

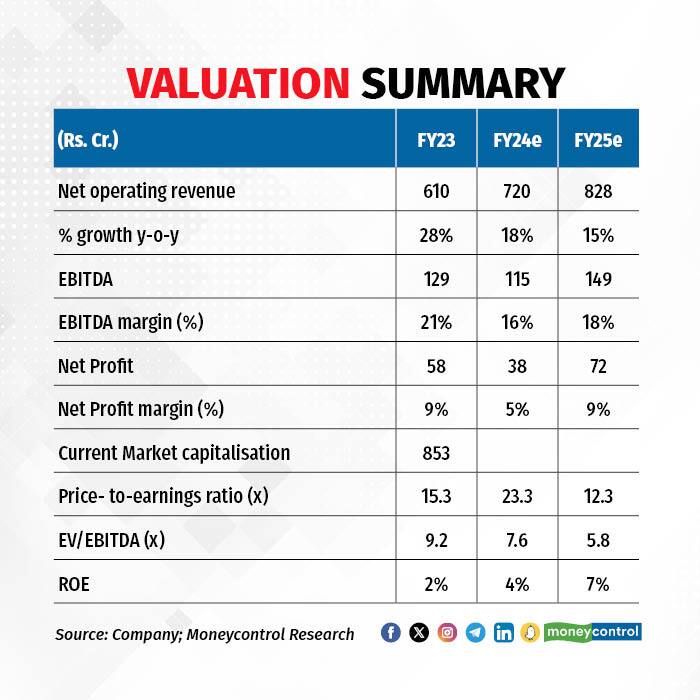

Operating revenue is guided in the range of Rs 720-750 crore (Rs 610 crore in FY23) and the target EBITDA margin (21 percent in FY23) is expected to be range bound between 16 percent and 18 percent in FY24.

The stock is now trading at 11.9x FY25e P/E and 5.8x FY25e EV/EBITDA. The stock appears to be reasonably priced, given the robust business model and the improved financial position.

For more research articles, visit our Moneycontrol Research page

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now