Highlights:

Utilisation rates continue to improve

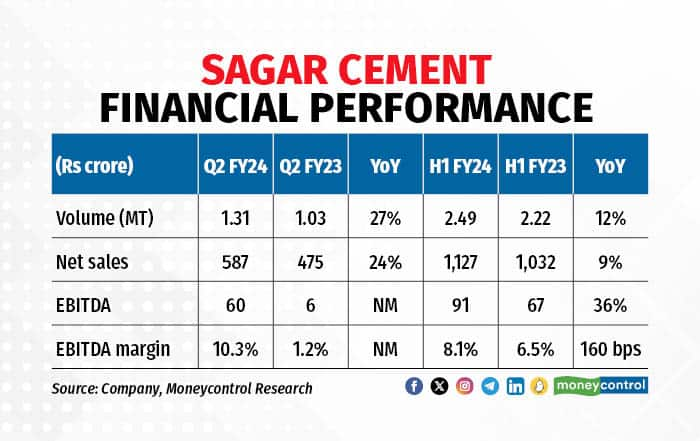

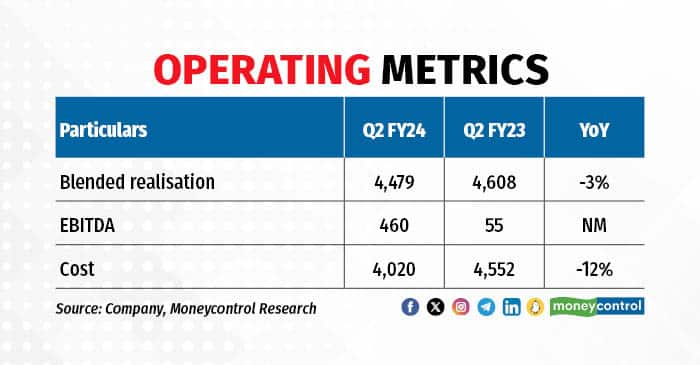

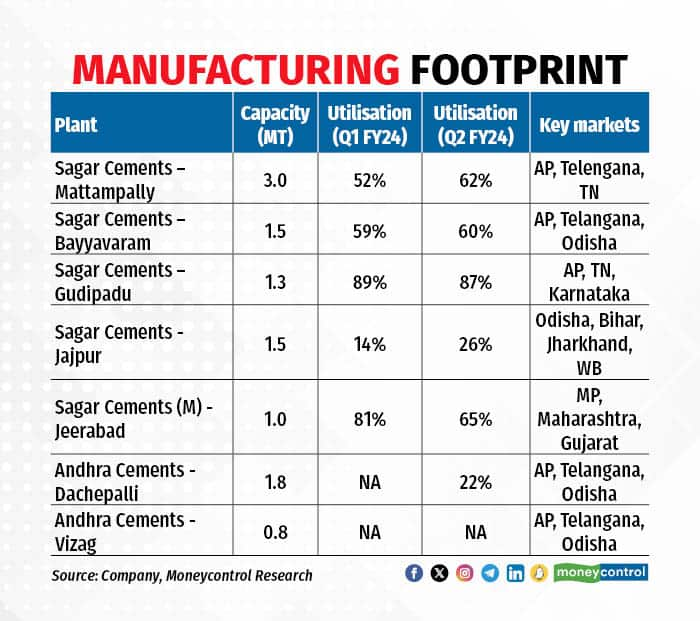

Sagar Cements revenues in Q2 rose from Rs 475 crore to Rs 587 crore, reflecting an increase of 24 percent year on year (YoY). Cement volumes were impressive at 1.31 million tonnes (MT), which indicates a growth of 27 percent over last year. Sagar's capacity utilisation at the group level stood at around 65 percent. The share of trade mix stood around 65 percent, which dragged the blended realisations lower by 3 percent YoY.

The company reported an EBITDA per tonne of Rs 460 in the quarter gone by. The expansion in operating margins was primarily attributed to benign power and fuel prices. While freight costs rose 7 percent YoY to Rs 850 per tonne, the power & fuel cost declined 17 percent YoY to Rs 1,823 per tonne. Employee expenses YoY stood nearly flat.

Despite a robust operating performance, Sagar suffered a net loss owing to higher depreciation and interest expense.

Margins to expand further

Fuel prices (pet-coke and imported coal) have corrected 50-60 percent in the last 12 months. The sector should seed better margin trends in Q3/ Q4 as the high-cost inventory gets exhausted. As per the management, a seasonal uptick in cement realisations coupled with receding cost pressures could drive the EBITDA per tonne to Rs 700-800 in the second half of fiscal year 2024.

Volume guidance retained

Sagar Cements has clocked a volume growth of 12 percent in the first half of this fiscal year. The management expects a further pick-up in capacity utilisation rates on account of a busy construction period and the company is targeting cement volumes of 6.0-6.2 MT for FY24. Of this, Dachepalli (Andhra Cements) and Jajpur plants are likely to contribute 0.75MT and 0.4 MT, respectively.

Debt near peak levels

Debt near peak levels

At the end of September this year, Sagar’s gross debt stood at Rs 1,533 crore, of which Rs 1,305 crore is long-term debt and the balance is for working capital requirements. This includes Rs 500 crore structured debt, which was raised earlier to fund the acquisition of Andhra Cements.

Sagar Cements now holds a 95 percent stake in Andhra Cement, which will be reduced to 75 percent over a 3-year period. Equity stake sale in Andhra Cement and the sale of Vizag land (which was part of Andhra Cement’s acquisition) should help deleverage Sagar’s balance sheet over the medium term.

In H1 FY24, Sagar Cements incurred a capex of Rs 130 crore. The maintenance capex for FY24 is pegged around Rs 50 crore.

Outlook and recommendation

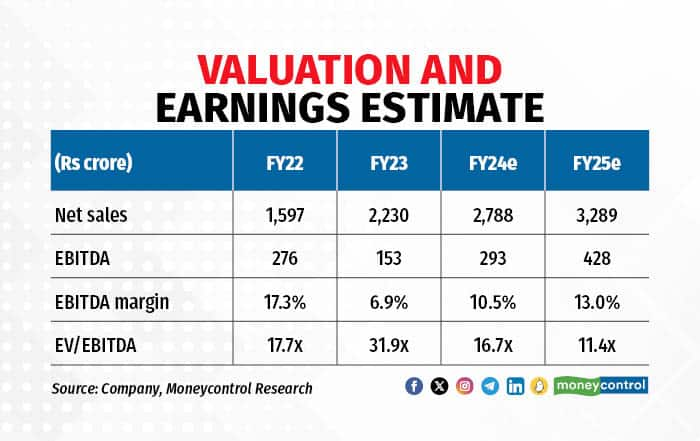

The growth outlook for the cement sector is robust and the company should continue to see healthy revenue growth in the near term owing to new capacities and strong end-market demand.

We believe Sagar Cements has a huge growth runway in the domestic cement sector but continue to see its stock valuation (11.4x FY25 EV/EBITDA) as challenging. The valuation has surged more than 30 percent in the last six months and investors should wait for a pullback before buying the stock.

We believe Sagar Cements has a huge growth runway in the domestic cement sector but continue to see its stock valuation (11.4x FY25 EV/EBITDA) as challenging. The valuation has surged more than 30 percent in the last six months and investors should wait for a pullback before buying the stock.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now