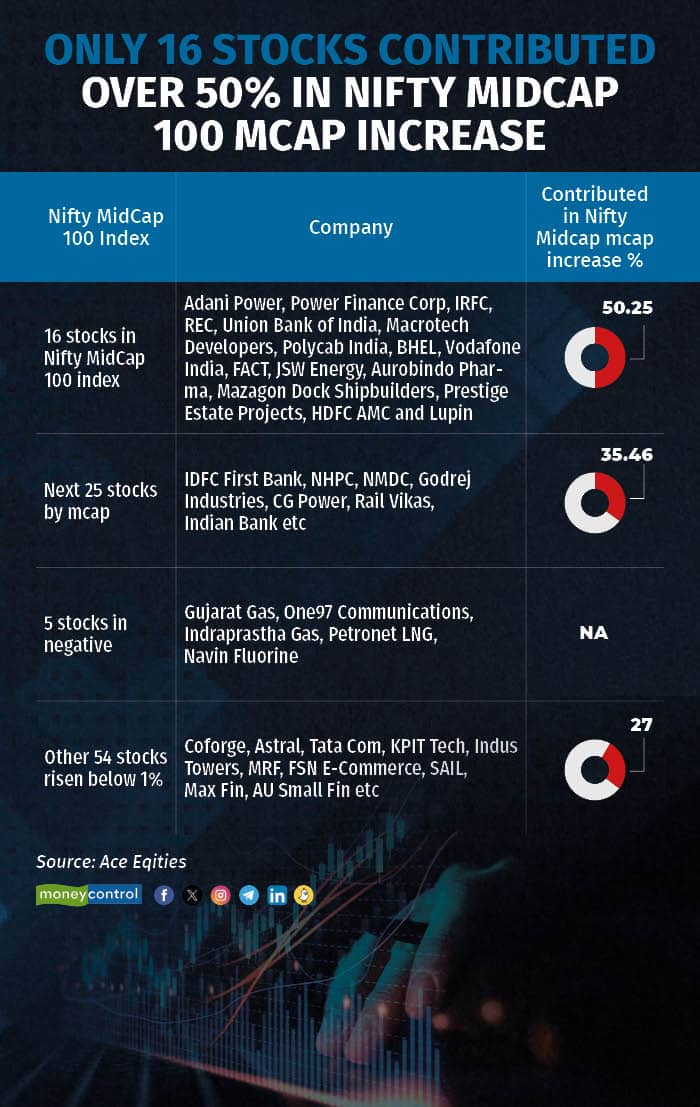

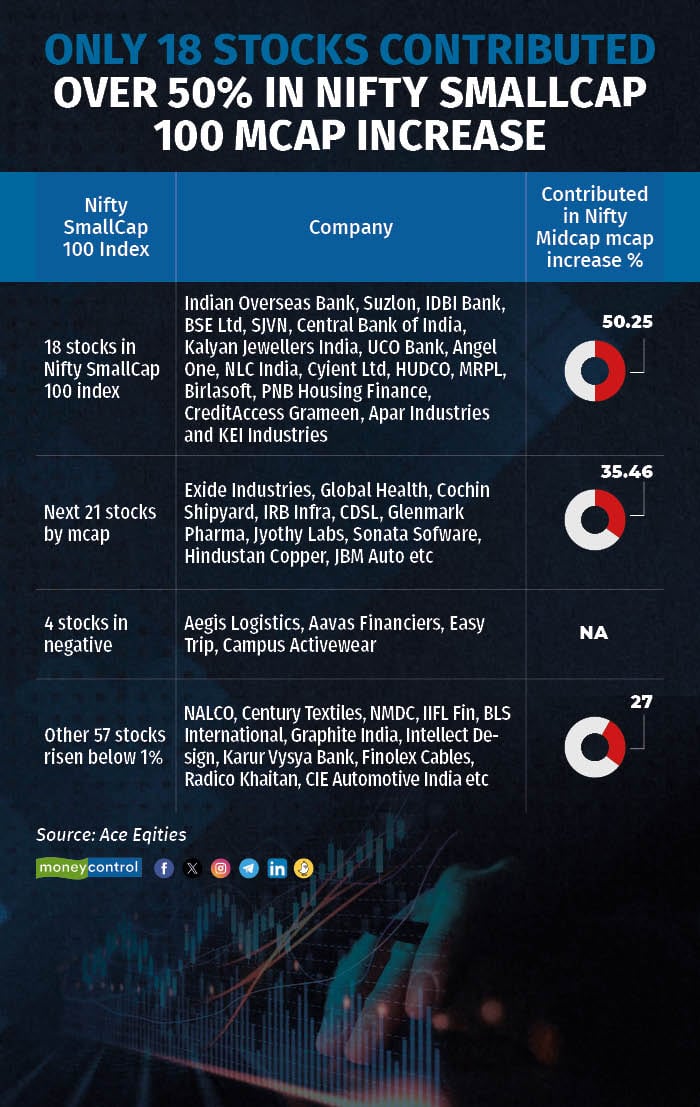

Only 16 stocks drove over 50 percent surge in the Nifty Midcap 100 Index valuation since April, while there are 18 responsible for over 50 percent surge in the value of the Nifty SmallCap 100. Interestingly, seven out of the midcap 16 and eight out of the smallcap 18 were public sector companies, according to data shared by Ace Equities.

The market capitalisation (MCap) for the Nifty Midcap 100 index surged from Rs 32.29 lakh crore to around Rs 49 lakh crore between April 1 and December 19, while it zoomed from Rs 10.9 lakh crore to Rs 18.10 lakh crore for the Nifty Smallcap 100 index in this period.

In the Nifty Midcap 100, stocks like Adani Power, Power Finance Corp, IRFC, REC, Union Bank of India, Macrotech Developers, Polycab India, BHEL, Vodafone India, FACT, JSW Energy, Aurobindo Pharma, Mazagon Dock Shipbuilders, Prestige Estate Projects, HDFC AMC and Lupin contributed over 50 percent to the index's market cap gains.

For the Nifty SmallCap 100, companies such as Indian Overseas Bank, Suzlon Energy, IDBI Bank, BSE Ltd, SJVN, Central Bank of India, Kalyan Jewellers India, UCO Bank, Angel One, NLC India, Cyient Ltd, HUDCO, MRPL, Birlasoft, PNB Housing Finance, CreditAccess Grameen, Apar Industries and KEI Industries accounted for over 50 percent of the index's market cap increase.

Both the indices jumped around 66 percent and 51 percent since April, while the benchmark Sensex and Nifty surged over 20 percent each since April.

Amid broader market surges, analysts warn of high valuations. While some foresee midcap and smallcap stocks outperforming due to better earnings prospects.

The local equity market rally that started from April stemmed from multiple factors such as improved macroeconomic conditions, raised targets for Sensex and Nifty by various brokerages, recent victories in three states, renewed foreign investor interest, and anticipated US Fed rate cuts next year. Analysts predict a potential return for the BJP in power in the upcoming general elections next year to further boost the market sentiment.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!