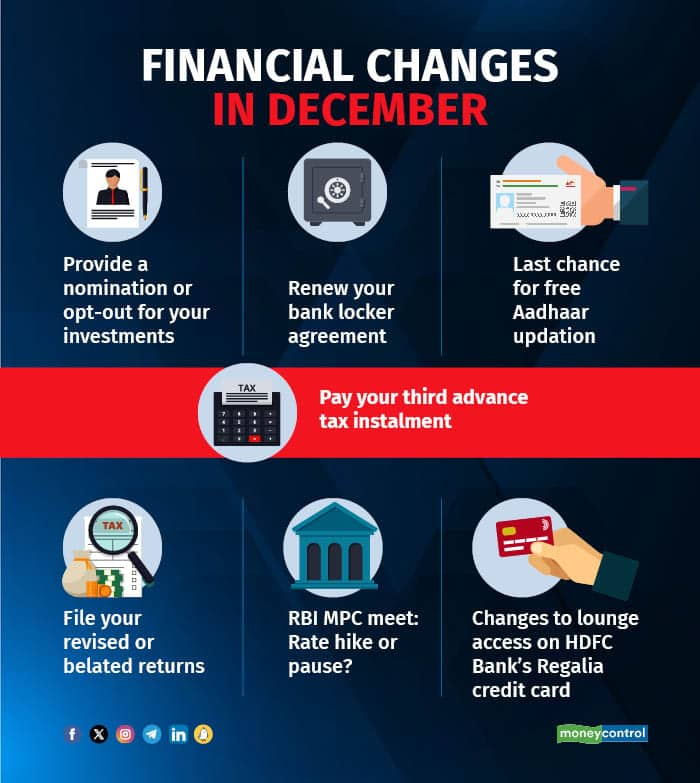

This December mutual fund holders, equity investors, and individuals may have to attend to several crucial deadlines and changes on the financial front.

Mutual fund holders and equity investors need to provide nominations or opt-out before December 31, while those having bank lockers need to sign and submit a revised locker agreement to their bank before the last date. There are changes to lounge access on HDFC Bank’s Regalia credit card within India. Also, December is the last month for users who have not updated their Aadhaar for 10 years to complete the process. During the month, you need to pay the third advance tax instalment and file your revised or belated returns.

Let's look a little closer at the changes in December 2023 that could impact you.

Nomination for existing individual investors by December 31

Providing nomination or opting-out confirmation has already been mandated in the case of new mutual fund (MF) investors for folios created from January 1, 2024. Nominations in the case of investors where folios were created prior to January 1, 2024, must be complied with on or before December 31 by either submitting nominee details or by providing opt-out declaration.

It’s important to note that if the required details are not registered within the stipulated timelines, transactions like redemptions, systematic withdrawal plan (SWP), switch and systematic transfer plan (STP) will not be permitted in such folios from January 1, 2024.

Investors in stocks through demat accounts also need to make nominations or opt out on or before December 31. The failure to do so would result in the freezing of the trading and demat accounts.

Also read | Why putting down nominations is important… and why it still doesn’t work

Sign the revised locker agreement

In January 2023, the Reserve Bank of India (RBI) extended the deadline for banks to complete the process of renewal of locker agreements in a phased manner by December 31, 2023. You will have to sign a revised locker agreement and submit it to the bank branch if you have submitted a bank locker agreement on or before December 31, 2022.

You need to bear several important points in mind while renewing the locker agreement, as explained here.

Simply save podcast | Want your bank locker to be safer? Don’t ignore the new locker agreement

Update your Aadhaar card

Aadhaar card is one of the most important identity documents for Indians. It’s required to be furnished in many government schemes. If you want to update some information in your Aadhaar card, you can do it for free till December 14. After this date, updating will attract cost. Aadhaar users who have not updated their Aadhaar for 10 years should get it done before the last date. A user who does not update her Aadhaar card may face difficulties in availing government facilities in future. This free updating service is available only on myAadhaar portal. If the update is done physically through the Aadhaar centres, then people will have to pay the necessary fees.

December 15 is the deadline for the third advance tax instalment

If you’re a salaried individual and think the “Advance Tax” provision is not applicable to you, you’re wrong. Advance tax liability may arise for a person having salary as the primary source of income but also having earnings from other sources such as interest from deposits, rental income, capital gains and so on. So, you need to assess your advance tax liability.

According to section 208 of the Income Tax Act 1961, every person whose estimated tax liability for the financial year is Rs 10,000 or more, after taking into consideration tax deducted and collected at source (TDS and TCS), is required to pay advance tax.

Taxpayers are required to pay their annual estimated advance tax liability in four instalments. On or before 15 December, a taxpayer needs to pay 75 percent of the advance tax.

If you miss advance tax payments or delay them, there is penal interest on the taxes due, under section 234C, at the rate of 1 percent per month / part of the month.

File your revised or belated returns

December 31, 2023, is the last day to file revised returns or belated returns if you haven't yet filed them by the original deadline of July 31, 2023.

You would, however, have to bear a penalty of Rs 5,000 if you file your return now. This amount is lower at Rs 1,000 for those with income of less than Rs 5 lakh.

If you have not paid the tax for the money earned in the financial year 2022-23, you need to pay the tax along with the applicable interest.

If you cannot file the return by December 31, 2023, due to genuine reasons, you can send an application to the Income Tax Commissioner for condonation of delay in filing returns.

Will RBI maintain the status quo on repo rate?

In a relief to home loan borrowers, the RBI did not raise the repo rate in its April, June, August and October monetary policy announcements, holding it at 6.5 percent.

It remains to be seen whether the RBI will maintain the status quo on the policy repo rate or hikes it in December to control inflation. If the RBI hikes interest rates, banks will once again increase interest rates on home loans and other loans linked to the repo rate as an external benchmark, as per the terms of loan agreements.

Also read | Seeking home loan freedom? Slash years and save lakhs with this prepayment strategy

Changes to lounge access on HDFC Bank’s Regalia credit card

HDFC Bank has announced changes to lounge access within India for credit cardholders. The changes will be applicable to Regalia credit cards from December 1. The lounge access programme will be based on credit card spends. The bank has set a spending criterion of Rs 1 lakh or more in a calendar year. Such users can access the lounge facility by visiting the Regalia Smart Buy page. Additionally, credit card users can avail two complimentary lounge access vouchers as part of a quarterly milestone.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!