When interest rates fall—and experts predict the cuts will begin some time in 2024—debt funds will gain. Buried among 16 fixed income mutual fund (MF) categories is a tiny category of funds that stands to gain the most; Government Securities funds or G-sec funds or gilt funds.

But contrary to popular belief, G-sec funds don’t just benefit when interest rates fall. A Moneycontrol Personal Finance analysis shows that they can make just as much money for you if you hold them for long enough and can stomach a few ups and downs along the way.

Not just rate-cut companions

G-sec funds are the safest of all debt funds because the underlying instruments in which they invest in are securities issued by the Government of India. The default risk is zero. And that’s why they are also the most tradeable. This makes them—and therefore G-sec funds that invest in them—more volatile than any other fixed income security. This makes one of the most volatile debt funds.

Gilt funds are among the most volatile of debt funds because government securities are the most liquid and safest debt instruments. But a Moneycontrol Research shows that the volatility smoothens out as you stay invested for the long term.

Gilt funds are among the most volatile of debt funds because government securities are the most liquid and safest debt instruments. But a Moneycontrol Research shows that the volatility smoothens out as you stay invested for the long term.

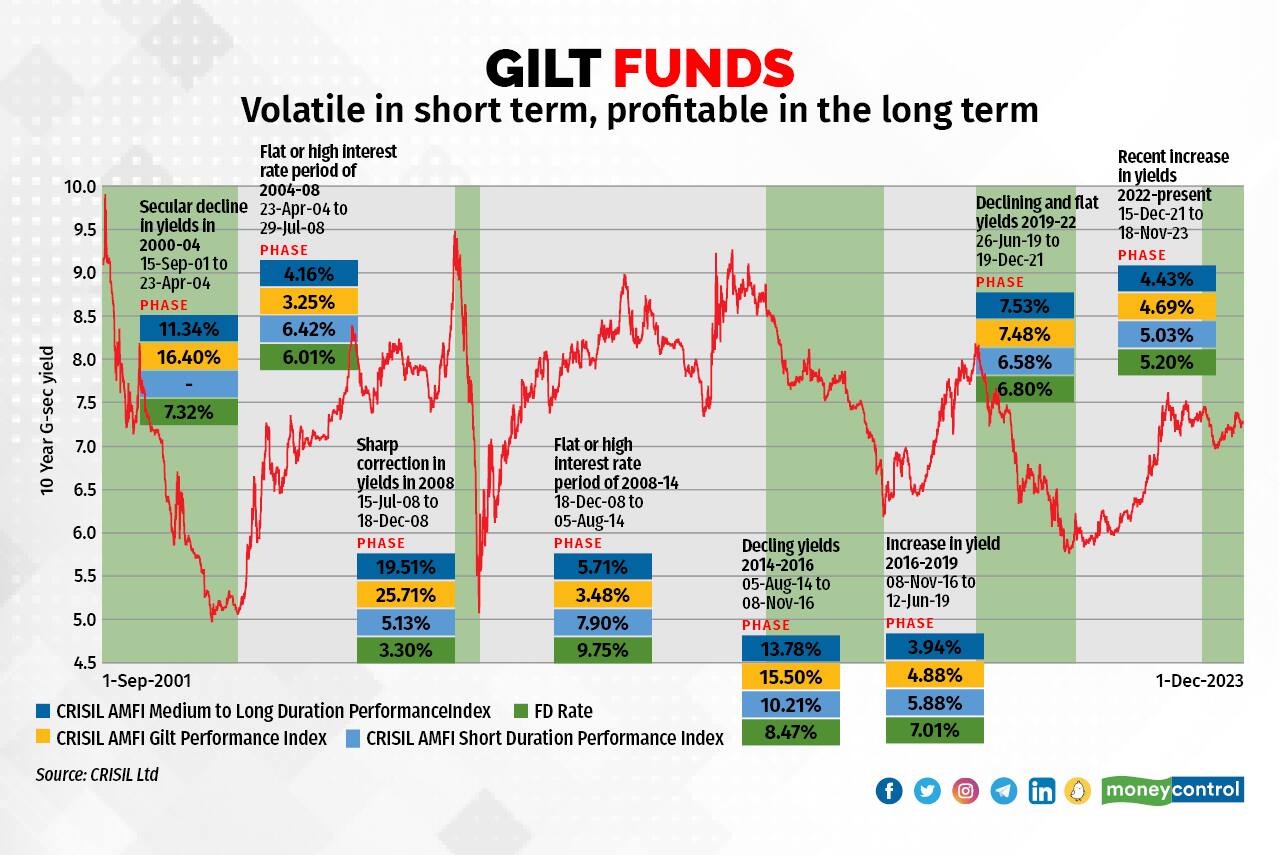

An analysis by CRISIL Ltd of how different bond funds worked across interest rate cycles between 2001 and till date shows that g-sec funds (as measured here by CRISIL AMFI Gilt Performance Index, outperforms most other fixed income categories when interest rates fell (2008, 2000-04, and so on). But when interest rates went up, the CRISIL AMFI Gilt Performance Index underperformed. What’s the way out?

Stick with them for longer periods and they pay off.

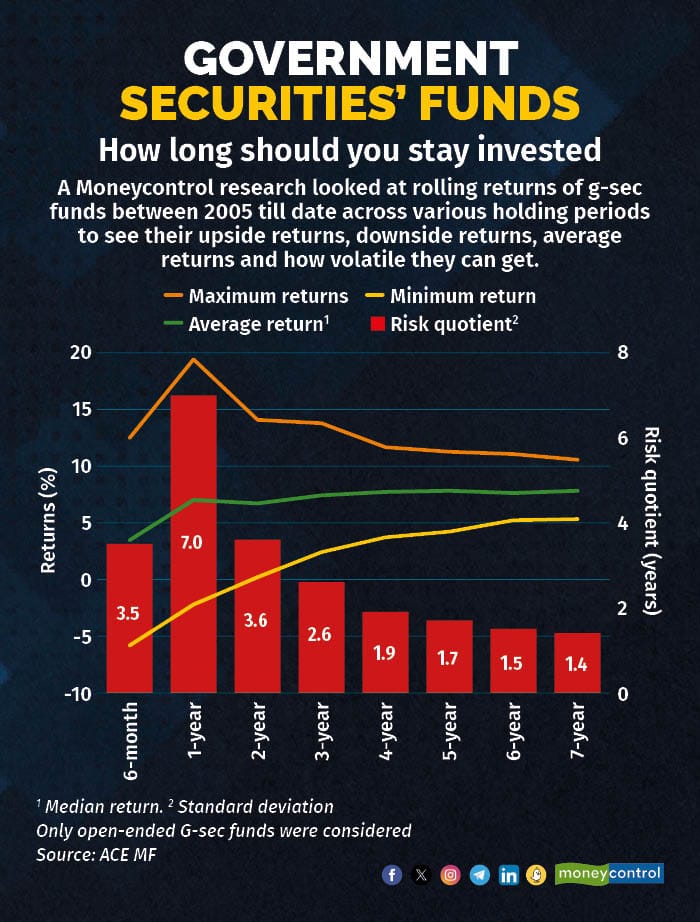

We looked at returns given by G-sec funds from 2005 till date. And checked out a series of 6-month returns, 1-year returns, 2-year returns, and so on till 7-year returns. In MF parlance, these are rolling returns. This method calculates a series of period returns at regular intervals, to catch how funds performed across periods if you had invested in them at various points in time. The aim was to check how much G-sec funds can earn on their way up, how bad their returns could get when interest rates rise, what average return you could expect from them, and how volatile they can get.

An analysis of 6-month returns shows that G-sec funds are capable of giving very high returns, but you could also make a loss. Over a year, G-sec funds have been known to give nearly 20 percent returns in the past, but there have been many 1-year periods where G-sec funds have lost money <see table>. But things start to stabilise as you hold them for longer. Even the worst performance by a G-sec fund improves as you increase the holding period. In other words, your chances of making a loss go down as you hold on to G-sec funds for longer.

A Moneycontrol Personal Finance research reveals that G-sec funds are less volatile and more profitable as investment horizon goes up

A Moneycontrol Personal Finance research reveals that G-sec funds are less volatile and more profitable as investment horizon goes up

Another interesting observation is how G-sec funds become less volatile (as measured by a statistic called ‘Standard Deviation’) as the holding period goes up.

Why aren’t they popular?

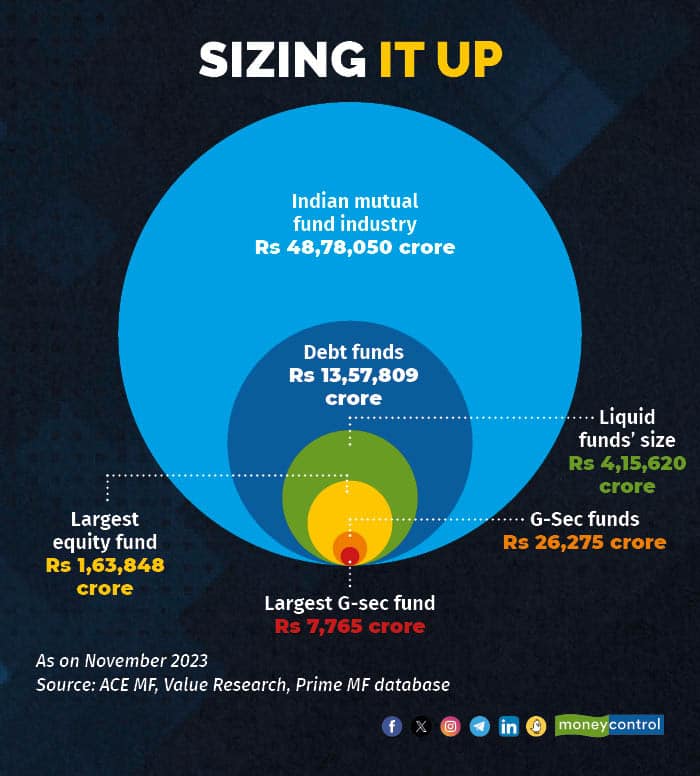

There are 21 open-ended G-sec funds (excluding exchange-traded funds and target maturity funds) in the Indian MF industry. The combined assets under management (AUM) of G-sec funds is Rs 26,275 crore, or just 0.54 percent of the overall industry’s assets. Of the 16 debt fund categories, they are the fifth smallest. The largest G-sec fund is merely Rs 7,765 crore, as on November 2023-end. Thirteen of these schemes are worth less than Rs 1,000 crore. Just four G-sec funds are in excess of Rs 2,000 crore, each. All this despite the G-sec category of funds being one of the oldest; the earliest G-sec fund (Kotak Gilt Fund) was launched in 1998.

With combined assets of around Rs 26,275 crore (November 2023-end), G-sec funds are a drop in the ocean

With combined assets of around Rs 26,275 crore (November 2023-end), G-sec funds are a drop in the ocean

Fund managers and experts say that G-sec funds are often seen as speculative products. “Instead, they should be seen as asset allocation products,” says Suyash Choudhary, Head – Fixed Income, Bandhan Mutual Fund, formerly IDFC Mutual Fund. Choudhary says that you must stay invested in G-sec funds for around 3-5 years. He also says that it is tough for investors to quantify expected returns in duration oriented products. “It is easier to visualize an accrual strategy; the strategy that schemes like credit risk funds and corporate funds follow. This often leads to under-estimating credit risk and over-estimating duration risk, especially over longer investment horizons” he adds.

While the accrual strategy focuses on the running income that a bond fund earns out of the interest income from its underlying assets, a duration strategy aims to make capital gains when prices of debt securities move, depending on where interest rates are headed.

That’s not the only problem. “Investors understand equity volatility. But when debt funds, especially G-sec funds, get volatile in the short-run, people don’t fathom it because they associate debt funds with fixed deposits,” says Joydeep Sen, Corporate Trainer-Debt.

What should investors do?

Experts say that G-sec funds should form part of your portfolio. For starters, interest rates in the US and in India are poised to fall in 2024. Marzban Irani, Chief Investment Officer, Fixed Income, LIC Mutual Fund, says that this is a “good time to invest in fixed income schemes, including G-sec schemes. The government is increasingly spending on healthcare, infrastructure and is therefore spending money for which it needs to borrow. Hence the yields are high in sovereign instruments.” Irani says that you could either buy G-secs directly on the RBI’s Retail Direct platform if you know which G-sec to buy or buy a G-sec mutual fund. But invest for at least 3-5 years to get the benefit of one or two interest rate cycles.

Sen has a strategy. He says that investors must look at the modified duration; a measure of a debt fund’s sensitivity to interest rates. “Match the duration with your own investment duration. In other words, stay invested for the portfolio’s duration. If the duration if 5 years, then stay for around 4-5 years, if the duration is 6, then stay invested for around 5-6 years,” he says.

Kirtan Shah, founder of Credence Wealth Advisors LLP, says that if you want to invest strategically in G-sec funds—to take advantage of interest rate movements—then G-sec funds are ideal for moderate risk-taking investors, as G-sec funds typically have a duration of around 5-6 years. “But for someone who understands risk better, a long-tenured bond fund works better,” he says.

But all experts agree that long-term investors must hold G-sec funds in their portfolio, preferably over 5-7 years, as part of their asset allocation. If you look at G-sec funds beyond strategic investments, there is merit in holding on to them, as the Moneycontrol Personal Finance analysis shows.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now