When the RBI left the repo rate unchanged in its latest monetary policy review on December 8, it dashed hopes of any relief for home loan borrowers.

Since October 2019, all floating rate loans issued by banks have been linked to an external benchmark-based lending rate (EBLR) which is the repo rate in the case of retail loans. Any tweaks in the repo rate – whether a hike or a cut – are passed on to borrowers. As the RBI upped the repo rate by 250 basis points between May 2022 and February 2023 to 6.5 percent, home loan rates shot up, adding to the burden of borrowers.

Currently, many banks are offering home loans within a range of 8.4 – 11.0 percent, or even higher.

If you want some relief, approach your bank for a reduction in interest rate. “Home loan borrowers can request their existing lender to reprice their loan rates if there exists a significant difference between their existing rate and the interest rates being offered to fresh home loan borrowers,” says Ratan Chaudhary, Head of Home Loans, Paisabazaar.

What to do

You have to send an email request and pay a repricing / conversion fee to the bank. The fee could range from 0.25 percent to 0.50 percent of the outstanding loan amount, according to BankBazaar.

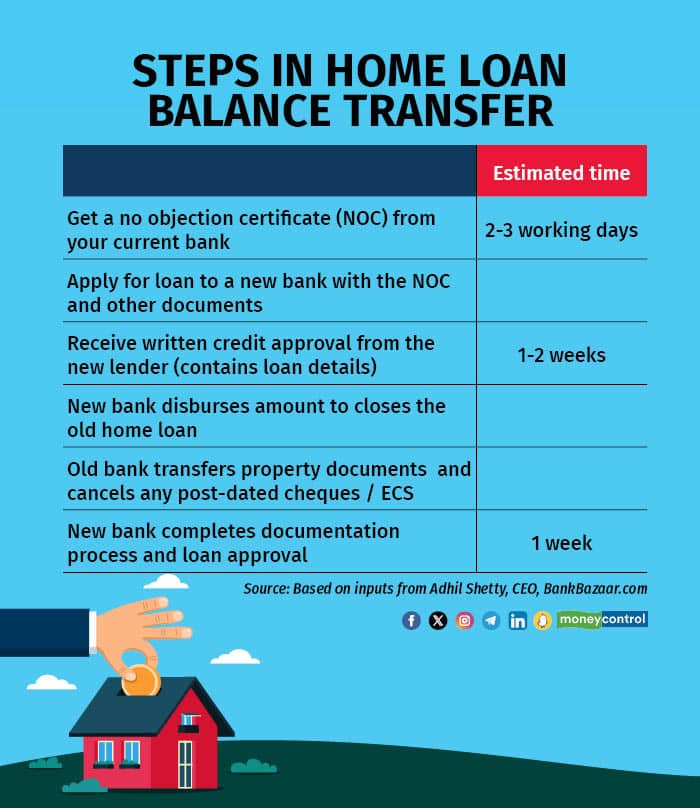

While you can alternatively consider shifting your loan to another bank (home loan balance transfer), that can involve more paperwork, time and cost (see graphic for details).

According to Raj Khosla, Founder and MD, MyMoneyMantra.com, a borrower could expect to pay roughly 0.25 percent to 2 percent of the outstanding loan amount as total charges to the new lender, subject to a minimum of Rs 12,000. This estimate includes processing fee, legal and valuation fee and any incidental charges for document verification.

“Apart from that, some lenders (your existing bank) charge a prepayment penalty if you switch loans before the lock-in period ends. This could be 0.4-4 percent of the loan amount,” says Khosla.

Also read: RBI MPC: Das calls for greater transparency in floating-rate loans

Also, if your existing lender refuses to reprice your loan, then what are the chances of another bank agreeing to do that?

Chaudhary says that many home loan borrowers get charged a higher spread due to their credit profile (that is, if it is not good). According to him, any significant improvements in a borrower’s credit score, monthly income, job profile or other facets of his / her credit profile subsequent to taking the loan may make the person eligible for a home loan at a lower rate from other lenders. “If the existing lenders refuse to reprice their loan, they can avail of the home loan balance transfer option.”

Calculate your net savings

So, how do you calculate how much difference a rate cut will make? You can use any online home loan refinance or balance transfer calculator for this purpose. You have to key in all the loan details – principal outstanding, loan tenure and existing and new interest rate. The principal outstanding is, however, one detail that you may not find in your online home loan account. You will have to contact your current bank for that.

A typical calculator will show you your total savings and also the savings per EMI (the latter, if you want to keep the loan tenure unchanged).

Alternatively, you can keep your EMI unchanged and see how your tenure goes down because of the lower rate. Compare this with the one-time outgo on fees and other charges for the home loan repricing to arrive at a decision.

Adhil Shetty, CEO, BankBazaar.com Shetty says, “Account for processing fees and other expenses and calculate your exact savings over the life of your loan. Switch only if you have at least a 50 basis points lower rate.”

Also read: Increase home loan EMIs or tenure: What should borrowers do?

Base rate and MCLR to repo-linked loans

Note that, before repo rate-linked home loans were introduced in October 2019, there were loans linked to the MCLR (marginal cost of funds-based lending rate). Those loans in turn were preceded by the base rate-linked loans.

So, if you are an old home loan borrower with a loan linked to the MCLR or the base rate, your loan repricing request can also help you shift to the more transparent repo rate-linked system. Commenting on the extent to which home loan borrowers can benefit from such a shift, Shetty says, “The rates on the base rate-linked loans are much higher than the EBLR loans, and it would definitely bring down the burden of the borrowers by as much as 2-3 percent if they switch to a repo-linked loan.

His advice for those with MCLR-linked loans is, however, different. He says, “Loan rates based on the MCLR are very close to those linked to the EBLR. The MCLR borrowers may also have been protected during the high interest cycles last year. So, they must calculate their savings before making a shift.”

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!