In the last seven weeks, global equity benchmarks had bounced back sharply, partly reflecting the dovish stance of key central banks.

Some of the leading equity markets are up 11-15 percent in this short duration. However, dark clouds have emerged in the background in the form of deterioration in the economic growth indicators of the US and European economies.

New supply-chain worries have surfaced as Houthi militants are creating trouble in the Red Sea due to which some of the big cargo shipping companies have suspended their services across Suez Canal.

Moreover, there is the threat of the new COVID variant JN.1. While it is still early days, equity markets are likely to be volatile in the coming days due to the new set of risks and businesses, with defensive profiles likely to outperform.

In this context, our tactical pick is the leading CDMO (contract development and manufacturing organisation) and API company Divi’s Lab (CMP: Rs 3,633; Market cap: Rs 96,491 crore; Nifty: 21,255).

Also read: Equity strategy: Is a spoiler in the making for the Santa Claus rally?

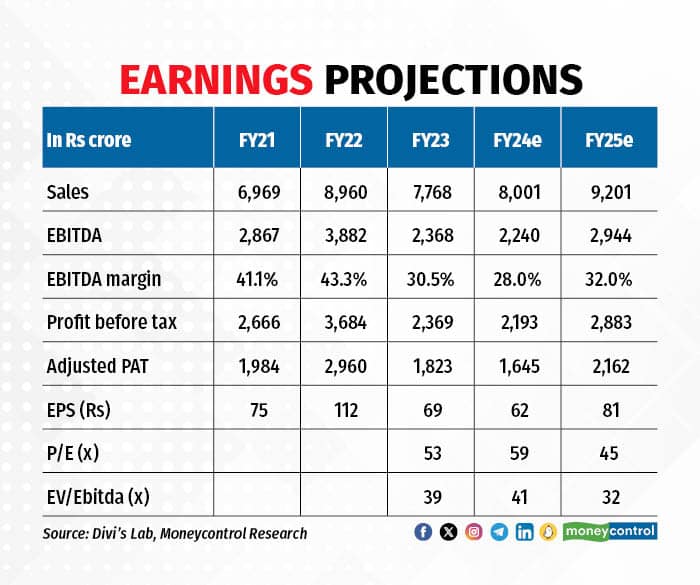

While FY24 thus far has been a year of consolidation for Divi’s Lab, in FY25, the company is likely to push the pedal on growth.

The company expects material improvement in growth profile from FY25 onwards with the commencement of the Kakinada unit by the end of Q1FY25. While this unit will manufacture KSMs (key starting materials), nutraceuticals and intermediates, it will free up capacity in existing units for new opportunities for custom synthesis and generic API business.

In addition, the company is targeting MRI-based contrast media or Gadolinium compounds by the end of the current fiscal. After that, it would take about a year for filings and commercialisation.

The other medium- to long-term opportunity to watch out for is the company’s interest in peptide building blocks. This interest is partly driven by some of the new drugs in obesity and anti-glycemic compounds categories, such as Semaglutide.

Meanwhile, the company is hopeful of growing its market share for old molecules such as Naproxen, Gabapentin, and Dexamethrophan. Here, the company has been working towards new technologies (photochemistry, atom-efficient chemistry), which help in large-scale production at lower cost, allowing to optimise green chemistry, in terms of lower wastage and reduced effluents.

On margins, we retain that a gradual improvement is expected in the coming quarters, though reaching the earlier range of 35-40 percent can take time.

That said, the balance sheet remains strong, with more than Rs 3,600 crore cash, which can help it to tap inorganic opportunities

Finally, the stock has had a significant time correction of about three years and now trades at 32x FY25e EBITDA. While this is still at a premium to the sector, we believe Divi’s is among the best positioned to ride the emerging opportunities in off-patented API molecules, nutraceuticals and contrast media

Risk to the scenario: Execution risk related to the commissioning of new plant.

For more research articles, visit our Moneycontrol Research page.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now