B. Gopkumar, Managing Director and Chief Executive Officer, Axis Mutual Fund, feels there is room for further upside in the smallcap space, and they are comfortable with the valuations of the stocks they are holding.

The Axis Small Cap Fund, with assets of nearly Rs 18,000 crore, is the fourth-biggest scheme in the category. It is preceded by the Nippon India Small Cap Fund (Rs 41,019 crore), HDFC Small Cap (Rs 25,409 crore), and SBI Small Cap Fund (Rs 22,895 crore).

What has fuelled the rally in smallcaps?

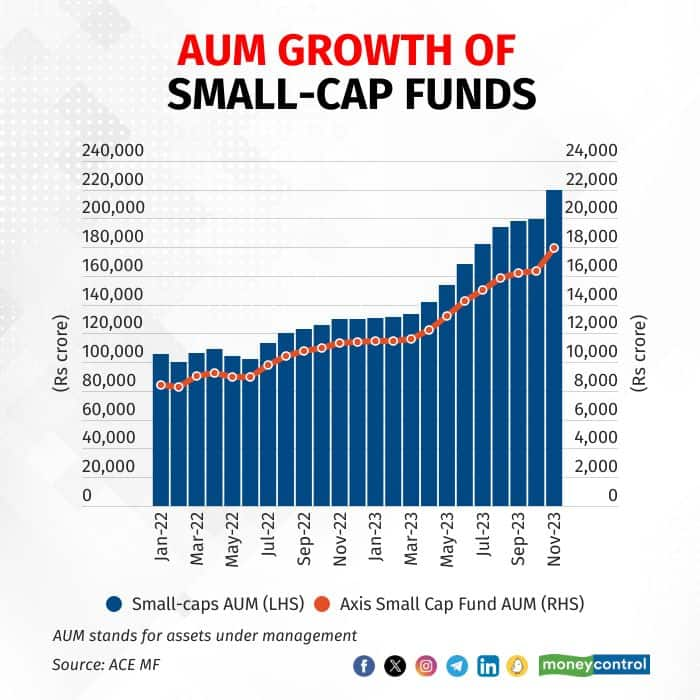

The assets under management (AUM) of smallcap funds have doubled in the last two years, from Rs 1.06 trillion at the end of January 2022, to Rs 2.20 trillion at the end of November 2023. The assets of Axis Small Cap Fund have more than doubled in this period, from Rs 8,411 crore to Rs 17,915.66 crore.

“In May-June 2023, smallcaps were undervalued compared to largecaps. That was when the money started flowing. If you look at our SIP book today, which is around Rs 17,000 crore, the smallcap fund is the number one recipient. Then come the mid and largecaps. Around three years ago, it was the other way around. Our smallcap earnings in the last quarter were up almost 30 percent. There is potential for further upside as there is some valuation comfort in the stocks we own,” Gopkumar told Moneycontrol.

Also read | Sebi should widen definitions to increase number of large and mid-cap stocks

Smallcap funds, as a category, have delivered average returns of 38 and 33 percent on a one-year and three-year basis, respectively. For Axis Small Cap Fund, the returns logged during this period are 31 and 30 percent, respectively.

What’s different about the current smallcap rally?

Smallcaps have been known for sharp rallies and deep drawdowns. In the past, in 2014, 2017, 2021, the smallcap pack was the best performing asset class. However, during 2018 and 2019, it witnessed sharp corrections.

The head of India’s eighth-biggest asset management company (AMC) believes the current rally is different from earlier ones.

“Earlier, smallcaps were mostly held by retail or proprietary investors, which probably made the past rallies slightly volatile. Smallcaps were rarely held by institutions or mutual funds. Whenever there is panic in the market, retail investors have a tendency to sell. Today, institutions are holding quality smallcaps. My belief is that we may not have so much selling this time around,” Gopkumar explained.

Will inflows into smallcap funds sustain?

Smallcap funds have received net inflows of Rs 37,178 crore since January 2023, while midcap funds saw net investments of Rs 21,520 crore. Largecap funds have logged net outflows of Rs 2,687 crore since the start of the year.

However, Gopkumar thinks that the flows may move to largecaps, going ahead.

Also read | “Strong buy” smallcap stocks by PMS in November

“Today, if you look at relative valuations, largecaps have largely corrected themselves. My view is that you will see a shift (of monies) to multicap and largecap schemes. We also believe that in relative terms, over the next one or two quarters, we may see largecaps performing better. We have already seen those stocks doing relatively well in the last 15 days or so,” he said.

Is Axis MF exploring new ideas?

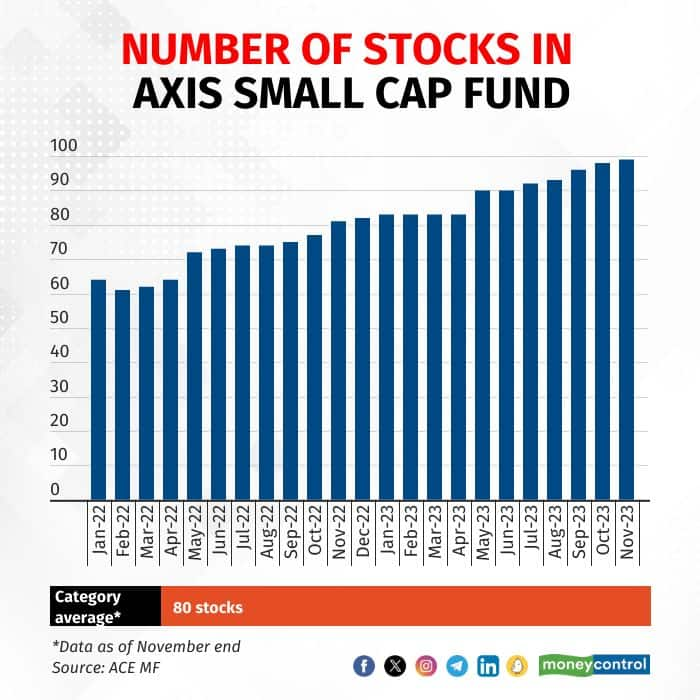

With the rise in inflows over the last couple of years, fund holdings have expanded in the smallcap space. For example, the number of stocks held by the biggest smallcap fund, Nippon India Small Cap, has increased from around 140 stocks in January 2022, to 197 today. Likewise with the Axis Small Cap Fund, where the number of stocks has risen from 64 to around 100 during the same period.

But with the unabated rise in net inflows, are AMCs able to find fresh opportunities?

“We do have a lot of ideas. If you look at the number of smallcap firms coming to the IPO market, it paints an interesting picture. The quality of issues is fairly good, along with the quality of promoters,” said Gopkumar.

Would Axis MF place restrictions on inflows?

The continuous inflows into smallcap funds have become a worry for some fund houses. Earlier, Nippon India Life Asset Management had announced that it will not accept lump sum investments in Nippon India Small Cap Fund. Tata Small Cap and SBI Small Cap Fund had also restricted lump sum investments.

Also read | Five sectors that Mahesh Patil of Aditya Birla Sun Life Mutual Fund likes

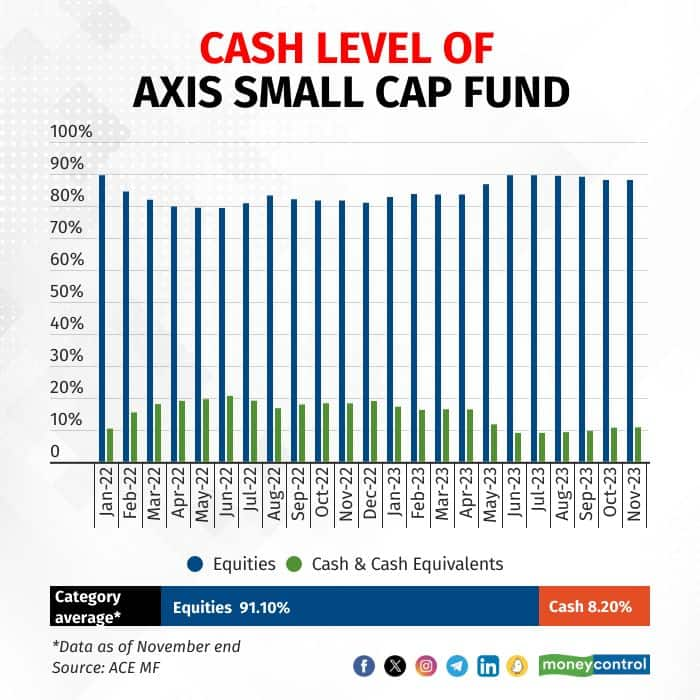

However, Axis Small Cap Fund is continuing to accept large investments.

“We have figured out that we can handle inflows, because we have sufficient liquidity in our stocks, hence we believe we can buy and we can sell. Till the time we are convinced about that, we'll keep taking money,” he said.

However, Gopkumar admitted that if the inflows continue at this pace, they may have to take a call on accepting fresh investments in the future.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!

Moneycontrol Pro Panorama | Rising passive investment

Dec 27, 2023 / 05:15 PM IST

In this edition of Moneycontrol Pro Panorama: High food inflation can play spoilsport, services pull up current account in latest ...

Read Now

Moneycontrol Pro Weekender: Jerome Powell and the Wizard of Oz

Dec 16, 2023 / 12:47 PM IST

If Powell succeeds in steering the US economy to a soft landing, it will be a remarkable achievement, and history will know him as...

Read Now