“One is never more on trial than in the moment of excessive good fortune.”

-- Lew Wallace

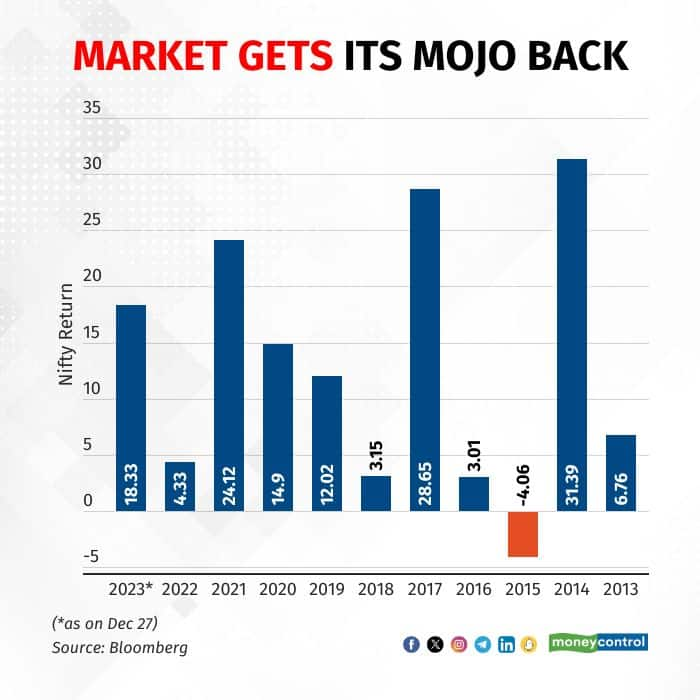

After a lackluster 2022, equity benchmarks roared back to life this year as robust domestic demand, revival of the capex cycle and rate cut hopes turbocharged investor sentiment and propelled indices to fresh lifetime highs, even as frenetic buying in some pockets has fanned fears of a pullback.

On the global front, to say that 2023 was a year of extremes would be to flirt wildly with understatement.

The deepest crisis to hit the US banking sector since the Great Depression. The biggest conflagration in the Middle East in over 50 years. Global interest rates at decadal highs. And consumer sentiment at decadal lows.

Yet nothing could derail the Indian market’s record run, thanks to Dalal Street’s pillar of strength -- the retail investor.

Also Read: Why India can likely outperform China for a fourth straight year in 2024

Mutual fund investments via systematic investment plans (SIPs) reached an all-time high of Rs 17,073 crore in November 2023 – the fifth straight month of record inflows.

With sustained SIP flows, domestic institutional investors’ (DII) net purchase of Indian equities at Rs 1.77 lakh crore in 2023 so far is higher than the Rs 1.62 lakh crore infused by FIIs. This was the third straight year when DIIs have eclipsed foreign institutional investors (FII) in equity purchases.

Slowly but surely, analysts say, the equity culture is getting entrenched in India.

“It was a great year as far as the equity market is concerned. We have seen a new high with broad-based participation. SIP inflow is at a new high, EPFO money is coming consistently, and PMS/AIFs too have become big. All of these combined have created strong traction in the equity market,” Mukesh Kochar, National Head of Wealth at AUM Capital, told Moneycontrol.

“Despite the occasional FII selling, market has created a new history with domestic liquidity. Retail participation has been a structural long-term change for Indian equity this year,” he added.

The domestic market started 2023 on an optimistic note, but faced its first test in the first month itself after US-based activist short seller Hindenburg Research published a scathing report against the Adani Group, triggering a widespread selloff.

While the growth-oriented General Budget offered some respite, the US banking crisis in March and collapse of Credit Suisse once again engulfed the market in serious self-doubt.

The Nifty touched its all-time high for the first time in June this year and the historic 20,000-mark in September. The Sensex scaled the 70,000-level in December.

The Nifty reached its fresh lifetime high of 21,600 in the previous session on December 27, while the Sensex hit the 72,000-mark for the first time.

This year saw another historic milestone after India’s market capitalization touched $4 trillion. The country maintained its fifth position on the global m-cap chart, after the US ($50 trillion), China ($10 trillion), Japan ($6 trillion) and Hong Kong ($4.5 trillion)

Macro Matters

Conventional wisdom suggests that markets can never run too far ahead of fundamentals. On this count, at least, investors have no cause for complaints.

India posted a Gross Domestic Product (GDP) growth rate of 7.6 percent for July-September, beating all estimates and cementing its status as the world’s fastest growing major economy.

The Finance Ministry is on track to complete the country’s highest-ever budgeted capital expenditure of Rs 10 lakh crore in 2023-24, providing further boost to the economic momentum.

More hearteningly, this capex cycle is not a single-player game.

Over the past twelve months, capex by listed corporates and states has reached unprecedented levels of Rs 8.1 lakh crore (YoY growth of 17 percent) and Rs 7.1 lakh crore (up 34 percent) respectively, ICICI Securities said in a recent report.

Which means all the engines of the capex cycle have now started to fire.

Not surprisingly, infrastructure, railway, defence and real estate stocks have been the superstars of 2023.

“In all bull runs we always have a new set of performers and this time PSU, defense, and railway emerged as the greatest performers. Corporate earnings have been good along with new capacity addition across sectors. This time we have seen capex from both government and the private sector. PLI schemes in various sectors have created tremendous benefits for small companies and have been the game changers,” AUM Capital’s Kochar added.

With a 75 percent jump, the Nifty Realty index emerged as the top sectoral performer this year, followed by PSU, Auto and PSU Bank indices.

Crystal Ball Gazing

A lot of financial history, as best-selling financial author Morgan Housel once remarked, is people saying "No one could have seen this coming" about things that have occurred regularly for the last 500 years.

While no one enjoys being the bearer of bad tidings, a cursory look at the data would not do anyone harm.

The benchmarks have gained around 18 percent this year, but the smallcap and midcap indices have vaulted over 40 percent.

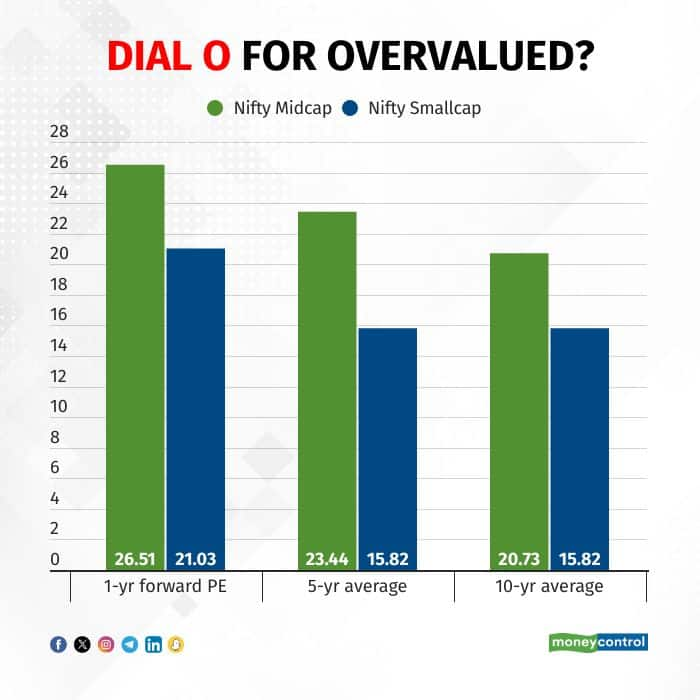

At 1-year forward price-to-earnings (PE) ratio of around 20x, the Nifty trades near its 5-year average of 19.5x, which means it is fairly valued. The same cannot be said about the midcap stocks.

Some stocks in the mid- and small-cap space are trading so far beyond their fundamentals that even Dogecoin looks like a respectable asset in comparison.

The new year is going to be a stock-picker’s market, analysts say, adding that investors would do well to temper their expectations.

Also Read: This investment head expects valuations to ease out in small, midcaps next year

"There are areas of concern which investors have to be careful about. Several IPOs getting heavily oversubscribed is an indication of exuberance. There is frenzy in the mid and small cap segments where valuations are excessive. The rally in the PSU space, in some segments like ship building, are being driven by hope based on order inflows. The market is ignoring the execution challenges here,” said V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

“Investors should give priority to high quality bluechips which are doing well and have good earnings visibility. A correction in the broader market is inevitable," he added.

But the good news, at least for long-term investors, is that India continues to be in a macroeconomic sweet spot.

“In 2024, the Indian economy will continue to stand out, especially against the challenging backdrop of other emerging economies. We firmly believe that India will continue its growth momentum in the year ahead and remain the land of stability against the backdrop of a volatile global economy,” said Pranav Haridasan, MD and CEO, Axis Securities.

The bolstered balance sheet strength of corporate India and the significantly enhanced health of the Indian banking system are positive factors, he added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Check Free Credit Score on Moneycontrol: Easily track your loans, get insights, and enjoy a ₹100 cashback on your first check!